[ad_1]

Stock market information is displayed on the Nasdaq MarketSite in the Times Square neighborhood of New York, USA, on Monday, September 14, 2020. US stocks hit a high of more than a week amid a flurry of deal activity and signs of progress toward a coronavirus vaccine. The dollar weakened and Treasuries changed little.

Photographer: Michael Nagle / Bloomberg

Photographer: Michael Nagle / Bloomberg

Every morning we deliver world news that you want to follow up on before you start your day. Click here to subscribe to the Bloomberg newsletter.

The United States stock market fell back on the 29th. The whereabouts of discussions on additional economic measures in the United States and the trend of the new coronavirus infection have been identified, and the stream of recovery of the global stock market has been weakened. Crude oil fell below $ 40 a barrel.

|

On the S&P 500 stock index, more than 2 stocks fell for every rising share.By Peroshi and Munewsin on Democratic Party Economic MeasuresThe talks ended that day after agreeing to renegotiate the following day. Regarding the new crown, the positive rate in New York City is the first in several months.It exceeded 3%.

The S&P 500 species are 3355.47, 0.5% less than the previous day. The 30-share average of Dow Industrial is down $ 131.40 (0.5%) to $ 27,452.66. The Nasdaq comprehensive index fell 0.3%. At 4:59 pm New York time, the yield on US 10-year bonds fell less than 1 basis point (bp, 1 bp = 0.01%) to 0.65%.

Brent Shut, chief investment strategist at Northwestern Mutual Wealth Management, said the near-term financial stimulus situation is driving the market. “There is concern that the new corona infection will spread again in the fall, and some people have withdrawn their funds and decided to wait and see,” he said.

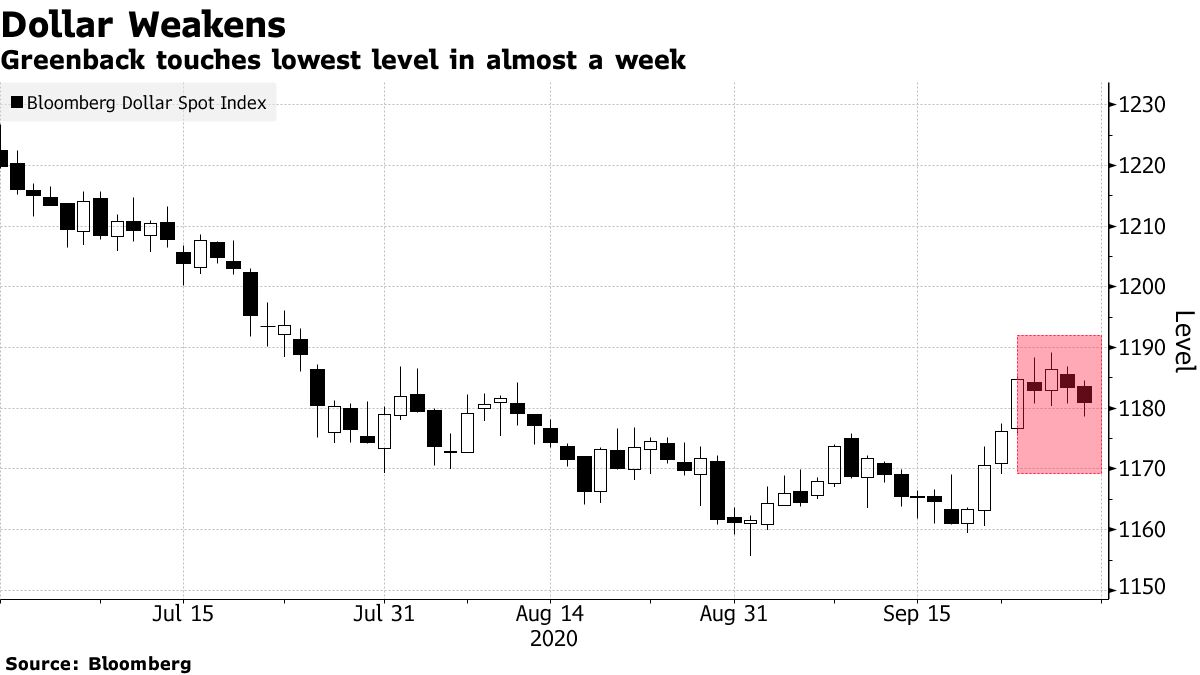

The euro is significantly higher in the currency market. A short hedge was introduced due to the portfolio adjustment flow and the rate of increase against the dollar reached the highest since the beginning of the month. The dollar is weak as traders pay attention to the first candidate debate in the US presidential election. The Bloomberg Dollar Spot Index, which shows the dollar’s movement against the top 10 currencies, fell 0.2%.

The dollar is up 0.2% against the yen to $ 1 = 105.66 yen. The euro rose 0.7% against the dollar to 1 euro = $ 1.1744, the highest level since Aug. 28.

The New York crude oil futures market is down. It was the lowest price in two weeks. There was growing concern that a sustainable recovery in demand was still some way off. The November contract for West Texas Intermediate (WTI) futures on the New York Stock Exchange (NYMEX) ends at $ 39.29 per barrel, down $ 1.31 (3.2%). London ICE’s North Sea Brent’s November contract was down $ 1.40 to $ 41.03.

The New York gold futures market continues to grow. As the number of new corona infections increases, there is widespread speculation that more economic stimulus measures will be taken in the United States and Europe. The December contract for gold futures on the New York Commodity Exchange (COMEX) ended at $ 1903.20, an ounce, to $ 20.90 (1.1%).

Original title:Stocks tumble as traders weigh stimulus prospects: markets close

EUR rose the most this month in short hedging; USD Slips: Inside G-10 (抜 粋)

Oil falls amid growing chorus of demand recovery warnings (抜 粋)

PRECIOUS: Gold face for second consecutive win in stimulus betting (抜 粋)

(Add a market comment to the fourth paragraph and update the market price)