[ad_1]

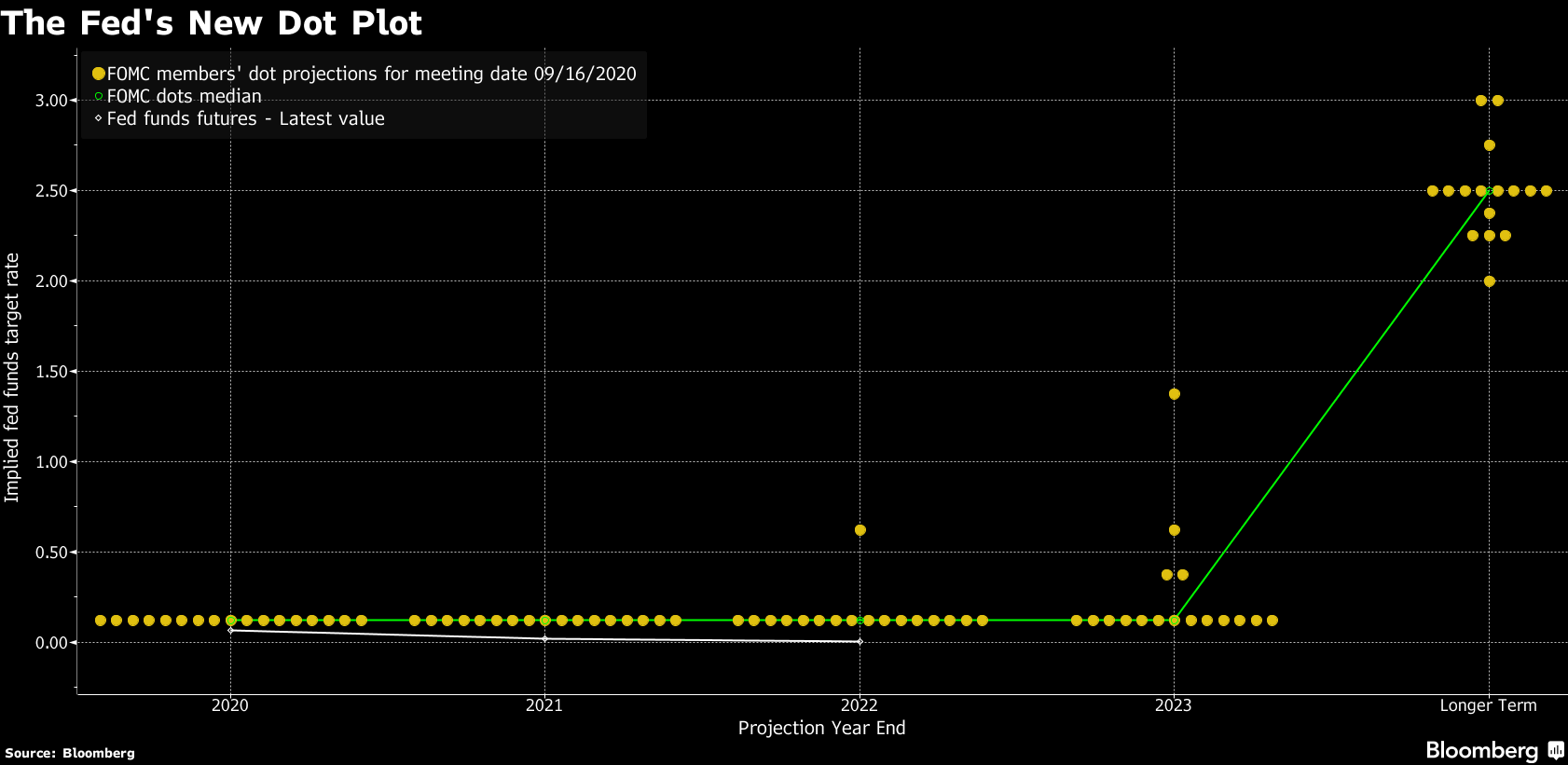

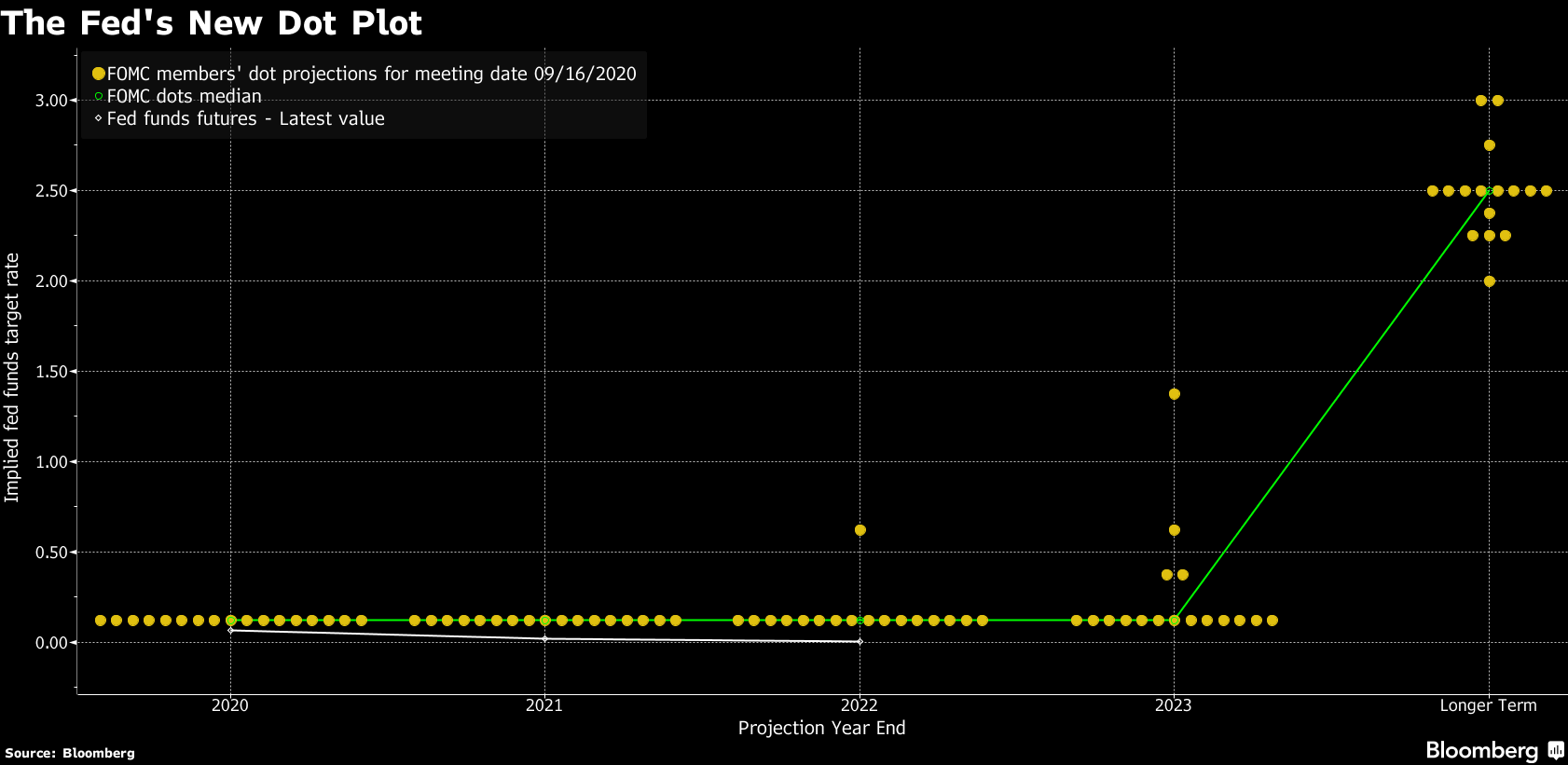

In a regular meeting held on the 15th and 16th, the Federal Public Market Commission of the United States (FOMC) decided to keep the target range for the federal fund (FF) interest rate at 0-0.25%. He also suggested that interest rates near zero would remain for at least 2023 to support the recovery of the US economy from the new coronavirus infection pandemic.

In a statement issued after the meeting, the FOMC said it will “maintain an accommodative monetary policy stance” until an average period of 2% inflation is achieved, and medium to long-term inflation expectations remain firm at 2%. Voiced.

The statement reflects the new long-term policy framework established by the financial authorities. The new framework will allow the target to be exceeded given the long-term failure to reach the 2% target for inflation. This strategic shift was made by Powell, Chairman of the Federal Reserve Board (FRB), in August.Revealed.

“These changes underscore the strong commitment of the financial authorities in the medium and long term,” Powell said at a press conference after the release of the statement.

The policy decisions were 8 in favor and 2 against. The negative votes were cast by Kaplan, the governor of the Dallas Federated Bank, and Kashkari, the governor of the Minneapolis Federated Bank. Kaplan argued that it was desirable to maintain “greater flexibility in policy rates.” Governor Kashkari said he should wait for a rate hike until “core inflation reaches 2% sustainably.” This FOMC meeting was the last meeting before the November 3 presidential election.

Financial officials, including President Powell, have emphasized in recent weeks that America’s economic recovery will depend largely on the ability to control the new Crown. It also notes that additional financial stimulus is likely to be needed to support employment and income.

The FOMC has now taken all steps to support the economic recovery. The FOMC reiterated that it will continue to buy US bonds and mortgage-backed securities “at least at the current rate to keep the market running smoothly.” A separate statement states that US bonds will be purchased for $ 80 billion a month and mortgage-backed securities will be purchased for $ 40 billion.

The quarterly economic forecast released at the same time predicts that the median policy interest rate will remain at an ultra-low level during 2023. However, all four said they would have at least one rate hike in 2011.

Furthermore, the degree of economic contraction this year is expected to be less than previously expected, but the pace of recovery in the coming years is expected to be slower than expected.

“The recovery is progressing faster than expected,” Powell said. “The future path remains extremely uncertain.”

See the table for details of the economic forecasts of the FOMC participants.

Original title:The Fed notes that rates will stay close to zero for at least three years (2) (抜 粋)

(Add and update economic forecasts, etc.)