[ad_1]

Lagard, governor of the European Central Bank (ECB), said yesterday that the euro exchange rate should be monitored in light of its impact on prices, but did not suggest the need for imminent policy adjustments.

The ECB has decided to keep the size of the Pandemic Emergency Purchase Program (PEPP) at 1.35 billion euros (about 170 trillion yen) and keep the interest rate on central bank deposits at minus 0.5%.

At a post-policy press conference, Lagard said the ECB “will carefully examine incoming information, including exchange rate trends, in terms of their impact on the medium-term inflation outlook.”

Bloomberg News reported shortly before the governor’s comment that the Policy Board had agreed to take a weaker tone for the appreciation of the euro than last time.

The ECB Policy Committee agrees that there is no need to overreact to stakeholder appreciation of the euro

The euro has risen, rising 0.8% at 3:25 pm Frankfurt time to 1 euro = $ 1.1901. Last week, it temporarily topped $ 1.20 and hit a high for the first time in two years.

The euro has risen more than 10% against the dollar since March, pushing down import prices and putting downward pressure on prices. Eurozone inflation fell for the first time in four years in August.

“Of course, whenever the appreciation of the euro puts downward pressure on prices, we need to closely monitor those issues, which were discussed extensively,” he said. On the other hand, the ECB repeatedly emphasized that it would not target a specific level of change.

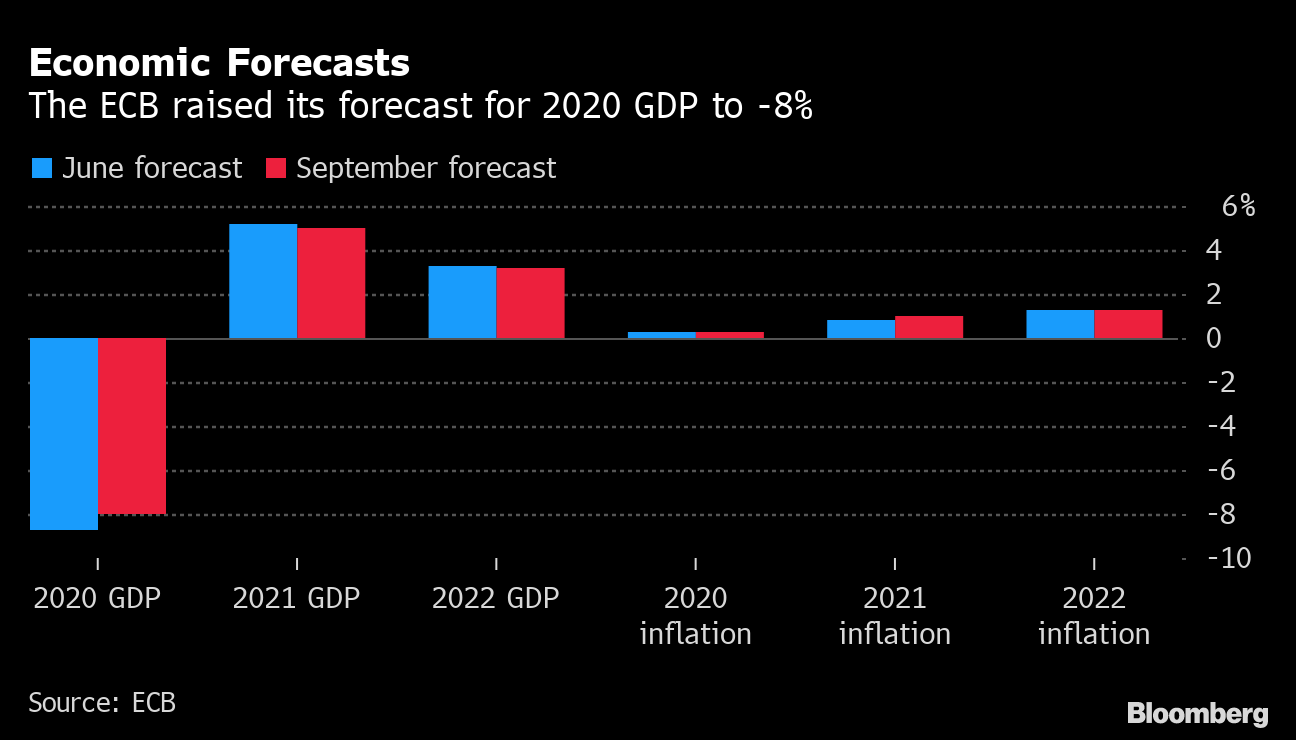

The ECB publishes the latest economic forecast. This year’s growth forecast is -8%, slightly better than the June forecast. It is expected to grow by 5% in 2021. The pace of recovery in the inflation rate is slow and is expected to be 1.3% in 2010, well below the ECB’s target of just under 2%.

Economic forecasts

The ECB raised its 2020 GDP forecast to -8%

Source: ECB

In a poll leading up to Wednesday’s policy announcement, economists expected the ECB to expand the PEPP by € 350 billion and extend it for six months by the end of December. At the moment, it is supposed to continue until the end of June 2009. The governor said that PEPP’s current purchase quota of 1.35 billion euros is “very likely” to be exhausted. At the same time, it revealed that the expansion was not discussed.

It will take some coordination within the Policy Board to propose additional measures, but Lagard reiterated today that the Commission is willing to coordinate all policy measures to ensure inflation is close to its target. did.

“Recovery remains largely dependent on the development of the novel coronavirus pandemic and the success or failure of its containment, and there is still great uncertainty,” he said.

Original title:Lagarde says the ECB is monitoring the euro without signaling the alarm (抜 粋)