[ad_1]

Pedestrians cross an intersection at dusk in the Shibuya district of Tokyo, Japan, on Wednesday, February 17, 2021. Bank of Japan Governor Haruhiko Kuroda says it will be difficult for the bank to reach its price target even in 2023, hinting that he needs to maintain monetary easing long after his current term ends.

Photographer: Kiyoshi Ota / Bloomberg

Photographer: Kiyoshi Ota / Bloomberg

Every morning we deliver global news that you want to follow up on before you start your day. Click here to subscribe to the Bloomberg newsletter

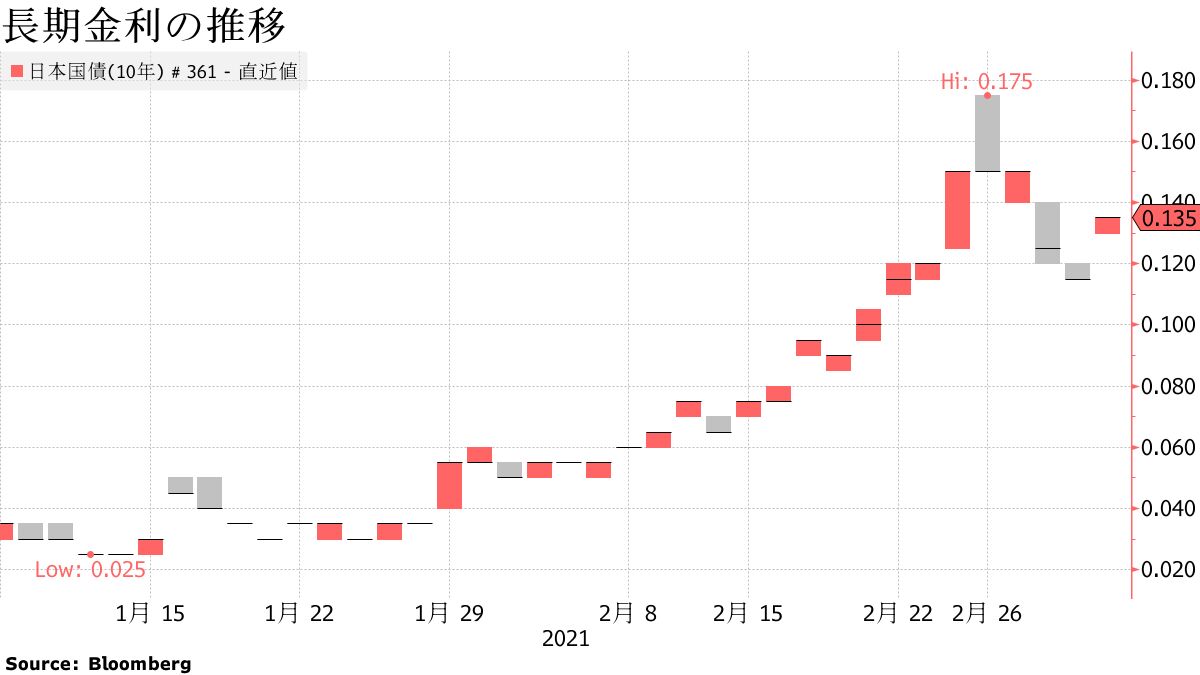

Japan’s long-term interest rates have risen. In addition to the sharp rise in long-term interest rates in Europe and the United States, the 30-year government bond auction held that day was slow, spurring sales.

The long-term interest rate was 0.135%, 2 basis points (bp) higher than the previous day. Yields on 10-year US government bonds rose to almost 1.5% in foreign markets on the 3rd, and yields on German 10-year government bonds also rose sharply. After hitting a high of 0.175% for the first time in five years last weekend, it began to decline, but sold again in response to rising interest rates abroad.

Okumura, a strategist at SMBC Nikko Securities, said: “The US bond market was once reassured by the warning from the head of the US Federal Reserve Board (FRB) that interest rates they would go up, but interest rates are rising again. The bond market is still volatile. ” The policy inspection carried out by the Bank of Japan is also said to be “anxiety towards the end of the fiscal year.”

|

|

|

In response to rising long-term interest rates at home and abroad, the market continued to pay close attention to the attitude of central banks in each country. Fed Director Brainard raises interest rates long-term US In a speech on the 2ndWhile the restraint has caused interest rates to fall, officials at the European Central Bank (ECB) say they don’t see dramatic action needed to curb bond yields on the 3rd.The sight showed. In these circumstances, the focus is on Fed Chairman Powell’s conference on the 4th.

At the meeting on the 3rd, Bank of Japan deliberative committee member Goshi Kataoka analyzed that the increase in long-term interest rates in Japan was based on the increase in interest rates in the United States and the government’s economic measures, and if it suddenly increases significantly, it is possible to take restraining measures. He said he had sex, but said he “hasn’t gotten that far” at this point.

Mizuho Securities market analyst Ryosuke Matsuzaki said that the content of the policy inspection conducted by the Bank of Japan remains uncertain, but “the level of the interest rate itself has risen considerably compared to December of the year. passed when the inspection was announced, and also not “I think it will encourage the increase,” he said.

30-year bond auction

The 30-year government bond auction conducted by the Finance Ministry had a minimum winning bid of 100.00 yen, which was 15 yen below the mid-market forecast compiled by Bloomberg. The bid-to-cover ratio was 2.77 times, the lowest level since July 2016, and the queue (difference between the lowest and average winning bids) was 22 yen, an increase from the previous 9 yen.

SMBC Nikko Securities’ Mr. Okumura noted that “this is a weak result. Yields were declining due to anticipated purchases as of yesterday, and the still volatile US Treasury market performed negatively.”

- Observations: previous auction results for JGB at 30 years

Yield on newly issued government bonds (as of 3:00 p.m.)

| 2 year voucher | 5 year voucher | 10 year bond | 20-year bond | 30-year bond | 40 year bond | |

| -0.125 % | -0.070 % | 0.135 % | 0.515 % | 0.710 % | 0.750 % | |

| The day before yesterday | -0.5 bp | + 0.5 bp | + 2.0 bp | + 3.0 bp | + 3.5 bp | + 3.0 bp |