[ad_1]

Following the turmoil in financial markets last week, traders are only paying attention to how central banks in each country and region react to sharp increases in bond yields.

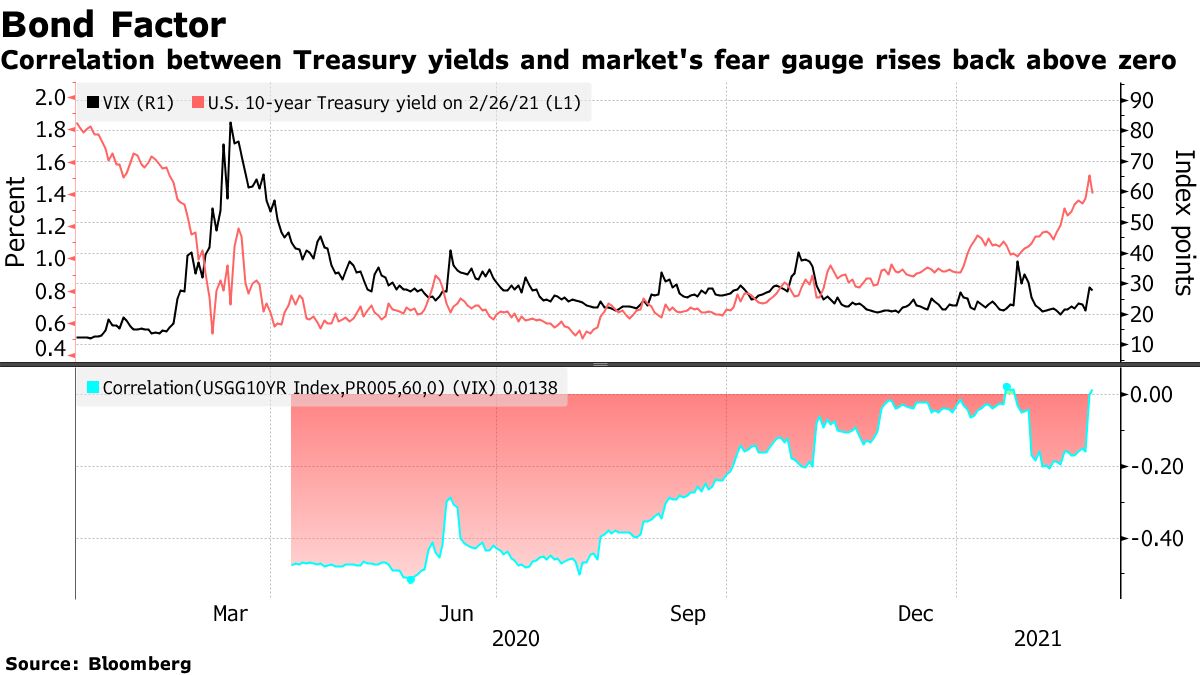

An important factor in determining the risk appetite in the market on the first day of the week is how the market anticipates the policy responses that the central bank may take. Last week, 10-year US Treasury yields soared to almost three times the level of August last year.

The move has highlighted a situation where investors are beginning to worry about accelerating inflation.In response to accelerating prices, the US financial authorities and the central banks of each country / regionThis is because the policy may tighten up earlier than expected. The S&P 500 Index has fallen weekly for the second week in a row since October last year, and the implied volatility (IV, expected volatility) of the seven major currencies (G7) has risen sharply since June last year.

“The market is moving into a situation that is not suitable for the weak,” said Naider Naemi, dynamic market manager at AMP Capital Investors, adding that he will continue to bet on falling Treasuries. “The current focus is on the central banks of countries and regions, including the financial authorities of the United States. If the central bank warns of recent increases in bond yields, the yield curve will begin to flatten,” he said.

Despite the bond market turmoil, last weekend there was some lull in buying at the end of the month and attempts by the authorities to calm the market. European Central Bank (ECB) Director Schnabel said that further monetary easing measures may be necessary if higher government bond yields hurt growth.Observation. The Chairman of the Federal Reserve Board of Governors (FRB), Powell, said that the increase in yields was a “sign of confidence” in the economic outlook.He pointed.

Yields on 10-year US Treasuries sometimes topped 1.60% on February 25, but ended up closing at 1.40% last week.

Still, investors are likely to keep an eye on official statements over the next few days, hoping for more peace of mind. Powell will speak on the US economy on the 4th and is likely to be the last chance for public comment before the Federal Open Market Committee (FOMC) on the 16th and 17th. Other officials will also speak one after another.

Original title:Performance Watch Traders in Bond Markets ‘Not for the Faint of Heart’ (抜)