[ad_1]

Tech stocks rallied slightly in the US equity market on the 26th. 10-year US Treasury yields fell below 1.5% as bond sales they were liquidated globally.

|

Supported by the rise of Microsoft and Amazon.com, the Nasdaq 100 index is up about 0.6%. Meanwhile, energy and bank-related stocks sold significantly, weighing 30 Dow Jones industrial averages.

The S&P 500 stock index was 3811.15, 0.5% less than the previous day. The Dow Jones Industrial Average is $ 469.64 (1.5%) cheaper at $ 30,932.37. The Nasdaq Composite Index rose 0.6%.

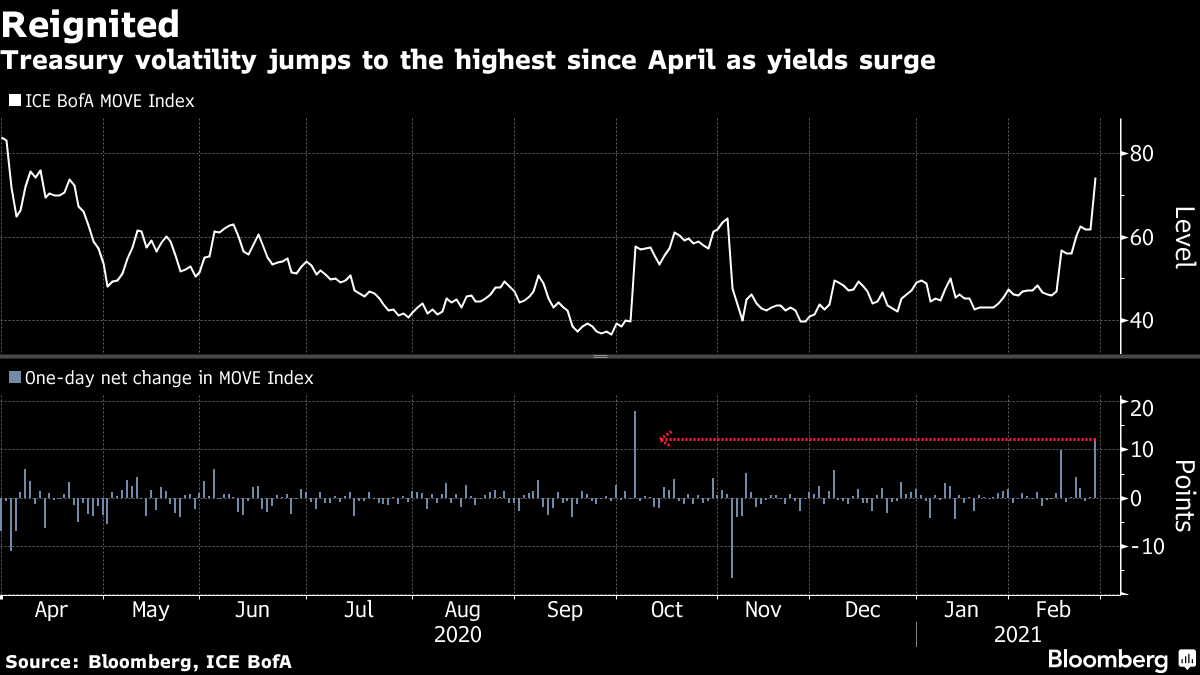

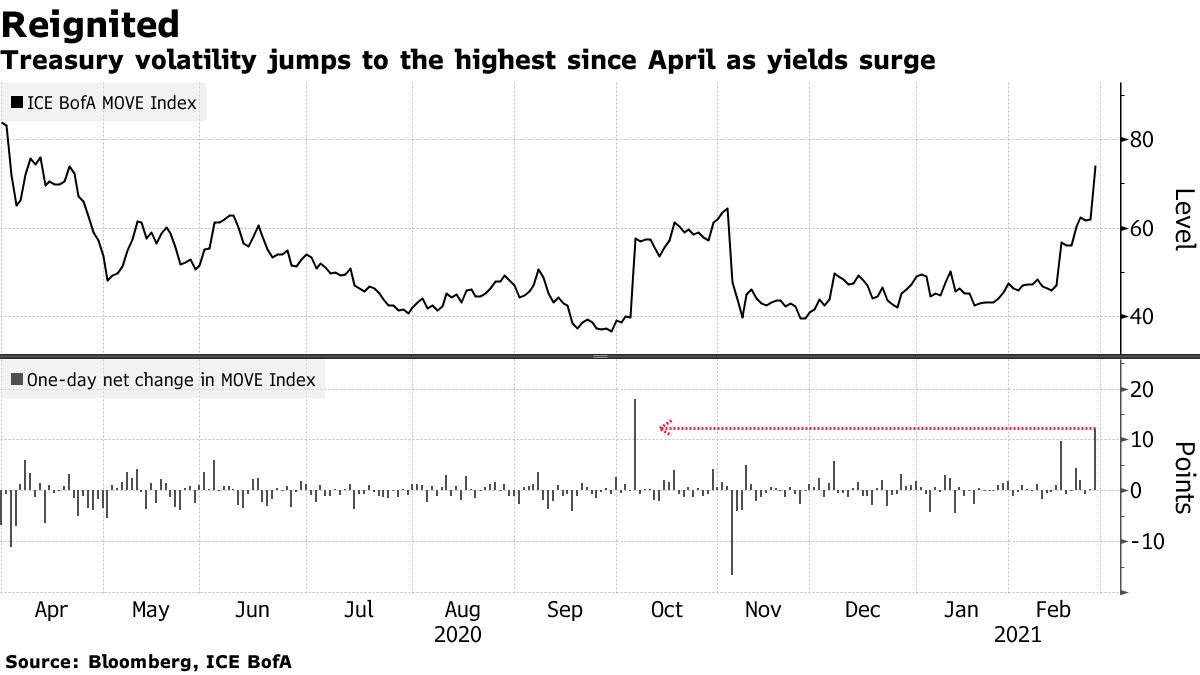

At 4:38 pm New York time, the yield on US Treasuries fell 11 basis points (bp, 1 bp = 0.01%) to 1.41%. Asian and European central banks in market crisisBond prices have regained global stability as they move toward sedation.

Presidents of the Federal Reserve Board of Governors (FRB) this weekParliamentary testimony acknowledged that rising US Treasury yields are a sign of optimism about growth prospects. US monetary officials have emphasized that there are no plans to tighten policies given the continued weakness in the labor market.

“High interest rates create a situation where investors will not tolerate the high valuations they have been willing to accept for the past few years,” said Matt Mayley, chief market strategist at Miller Tabak. “President Powell’s comments this week were bullish on the economy, but not particularly bullish on the stock market,” he said.

In the currency market, the dollar is totally stronger than the top 10 currencies. The dollar index has risen sharply since October last year on a weekly basis. The background is that US Treasury yields have been around the highest level for the first time in a year. The fleeing currency was bought, and the Swiss franc and yen also rose against the currencies of resource-rich countries.

The Bloomberg Dollar Spot Index, which shows the movement of the dollar against the top 10 currencies, rose 0.7%. At 4:39 pm New York time, the dollar is 0.3% higher than the yen at $ 1 = 106.55 yen. The euro was down 0.9% against the dollar at $ 1.2069.

New York crude oil futures prices have fallen dramatically. The dollar has risen and the investment attractiveness of dollar-denominated commodities has declined. If the recent acceleration in inflation triggers accommodative monetary policy, there is growing concern that it will spread to commodity markets.

The April New York Mercantile Exchange (NYMEX) West Texas Intermediate (WTI) futures contract ends at $ 61.50 a barrel, down $ 2.03 (3.2%). However, on a monthly basis, it increased 18% in the context of declining global inventory and progress in recovering demand. The April contract for Brent North Sea in London ICE is down 75 cents to $ 66.13.

The spot market for gold continued to decline and, at 3:44 pm New York time, was 2.2% lower than the day before. It also fell on a monthly basis, the steepest drop since November 2016. This month’s market was hit by the rise in the dollar and the slump in exhaust demand following the prospects for economic improvement. January rice announced on 26Personal income increased 10% month over month.

The April contract for gold futures on the New York Stock Exchange (COMEX) ends at $ 1,728.80, down 2.6% at 1 ounce.

Original title:US Tech Stocks Rebound as Bond Slump Softens: Markets Close

The dollar is set for the best week since October with a peak performance: within the G-10 (抜 粋)

Oil falls with a stronger dollar, the best start to the year (抜 粋)

The gold route deepens with the metal set for the worst month in four years (抜))