[ad_1]

Why did the United States Treasury crash on the 25th? If you search for the reason for this, you will find a wealth of evidence to suggest that it was triggered by technical rather than fundamental reasons.

The indigestion of government bond auctions, the possibility that the $ 50 billion holdings have been resolved and the loss of liquidity have amplified the movement. Traders have significantly revised their prospects for an interest rate hike in the United States, despite no major changes in economic trends or statements by policy makers.

“It is not an orderly sale and does not appear to have been driven by a clear fundamental pattern of continuation or an extension of reflationary deals,” NatWest Markets strategist Blake Gwin said in a client report. He said many more “technical” factors were intertwined in a typical no-buyer environment.

Some of the factors are as follows.

5-year bond yield and 7-year bond auction

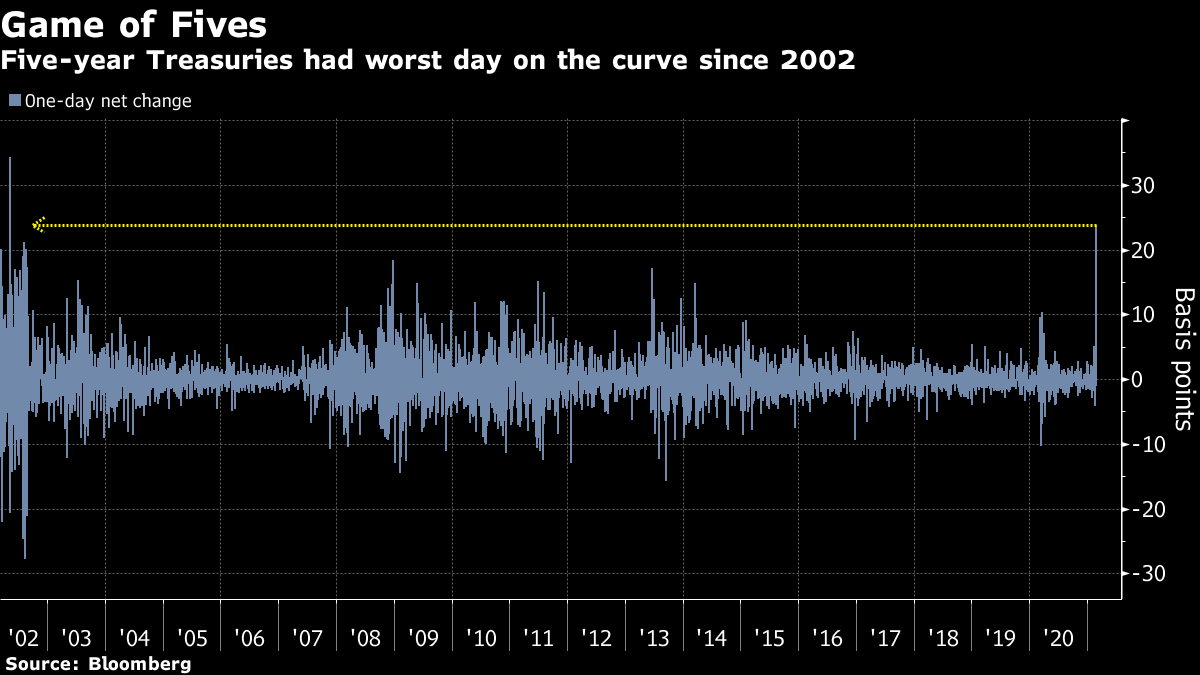

The focus in the bond market was the five-year US Treasury, which is often tied to the long-term outlook for the policy rate. Yields on 5-year bonds rose 22 basis points (bps, 1bp = 0.01%) to close at 25. The Butterfly Spread Index, which shows the performance of 5-year bonds versus 2 and 10 bonds years, it rose 24bps to the worst daily performance since 2002.

The reason for the sale was that demand was record weak in the 7-year bond auction. The supply-to-hedge ratio was 2.04 times, well below the recent average of 2.35 times, and the yield on the 5-year bonds rose to more than 0.75%.

Height adjustment

With yields surging, traders were quick to adjust their holdings. Short-term government bonds fell sharply and the yield curve flattened, especially hitting the popular steep position in reflationary trading.

According to preliminary data, the open interest balance of all US Treasury futures has decreased by $ 50 billion in terms of 10-year indexed bonds. There may be some inaccuracies in the data due to possible rollovers, but it still suggests that a large position has been rewound.

| Maturity |

Change in the number of contracts (net of rolls) |

$ m value of 1 base point movement |

|---|---|---|

| TU (2-year) | 591 | 0.27 |

| FV (5 years) | -124,152 | -6.89 |

| YOU (10 years) | -174,423 | -14.98 |

| UX (Ultra 10 years) | -50,986 | -6.99 |

| USA (Long bond) | -24,158 | -4.72 |

| WN (Ultra link) | -44,792 | -15.76 |

| Total | -417,920 | -49.61 |

Furthermore, when the index’s 10-year US bond yield reached 1.5%, it rose immediately after a 10bp rise and then fell immediately, suggesting that some traders had a long stop loss.

Source: Bloomberg

Separation of the fundamentals

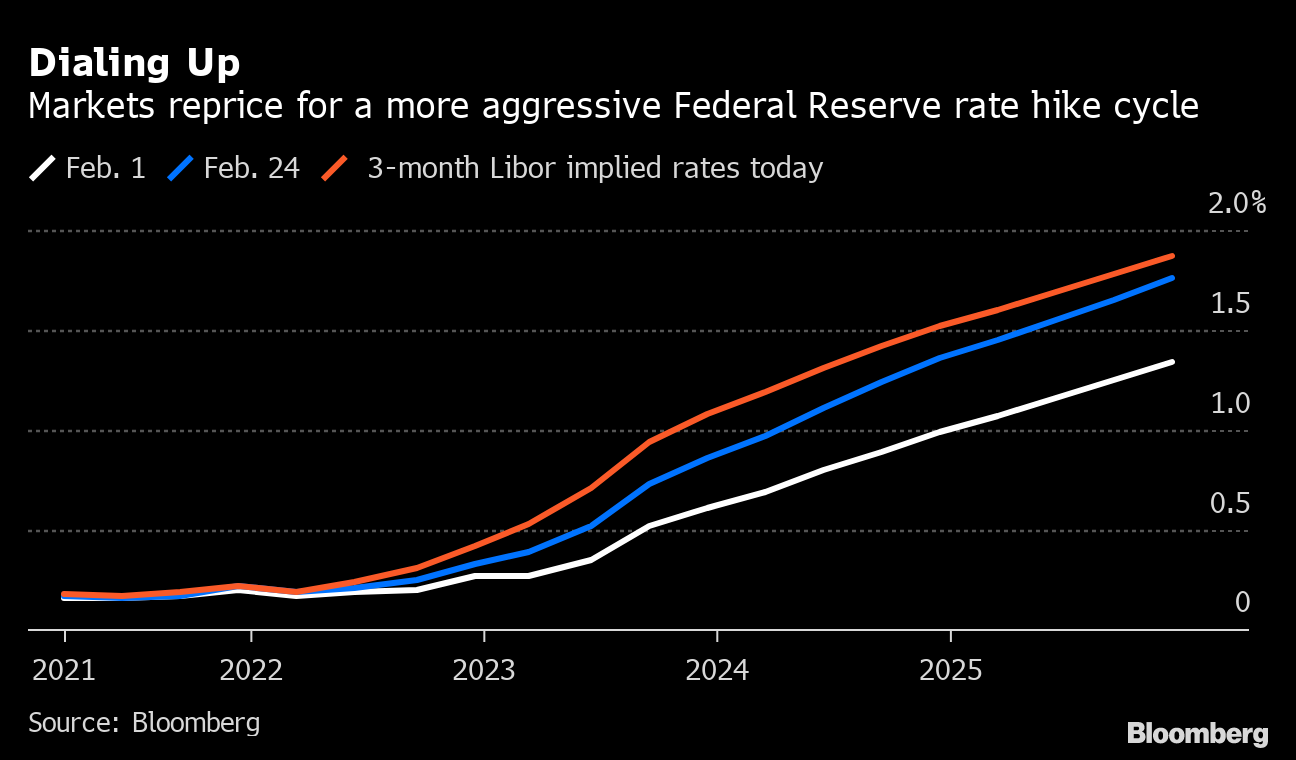

The gap between the bond market and fundamentals is most evident in short-term bonds. Despite the lack of clear material, the market outlook for the US policy rate trajectory has been revised and Eurodollar futures have fallen with record volumes.

The start of the US interest rate hike, which the market is taking into account, is now March 2023, ahead of the previous half year. A total rate hike of more than 50 bp is expected in the same year.

Marking

Markets Shift Prices for a More Aggressive Federal Reserve Rate Hike Cycle

Source: Bloomberg

Loss of liquidity

The dryness of the bond market when traders needed it most could also be a factor.

“Excessive fluctuations in performance on the 25th may have been contributed by the strong market contraction,” Jay Barry, strategist at JPMorgan Chase, said in a client report. He also noted that HF traders tend to withdraw quickly from the bond market when volatility increases rapidly.

Original title:

Chaotic Treasury sell-off driven by $ 50 billion in decommissioning (1) (抜 粋 粋