[ad_1]

The disturbing noises heard in recent weeks in the world’s largest bond market resonated loud and clear on the 25th. The message that economic growth and inflation are on the rise has wreaked havoc on a wide range of risk assets.

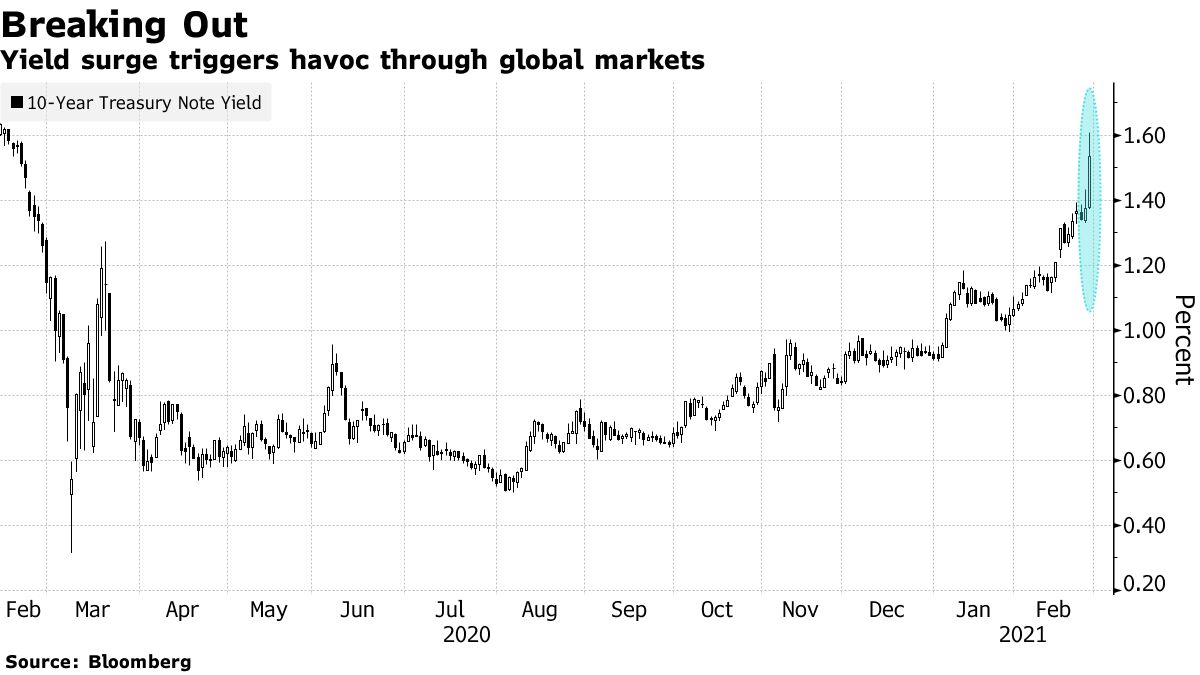

10-year US government bond yields soared to the 1.6% range, hitting the highest level in just over a year. Anticipated discussions have emerged among traders during a time when the US Federal Reserve is under pressure to tighten monetary policy. Stock prices have fallen dramatically. There was downward pressure on valuations with rising interest rates. The bidding demand for the government bond auctions was the lowest in history, and even affected Treasury Secretary Janet Yellen.

Yields on Australian and Japanese government bonds rose in the Asian market on the 26th. The Reserve Bank of Australia (Central Bank) has announced the purchase of three-year bonds worth A $ 3 billion (about A $ 250 billion). yen) as a measure to curb yields. The yield on the 3-year bond exceeded the 0.1% target. The 10-year yield on Japanese government bonds also hit the highest level in five years.

Not only have America’s one-year emergency economic measures been successful, but there is growing speculation that some parts of the economy could eventually overheat. It seems that the process of reviewing market levels has finally begun in a market that has been stuck in the same pattern for months due to the new coronavirus crisis. In addition to the fiscal mobilization of trillions of dollars by the federal governmentThe good results of the vaccine have increased the probability that developed economies will recover earlier than expected by central banks.

“The economy is already recovering and many believe the proposed economic measures are much larger than necessary,” said John Calley, portfolio manager at Amundi Asset Management. “We put too much coal on the fire and the firepower becomes very strong. You are beginning to think that the US financial authorities will not be able to maintain interest rates at current levels,” he added.

Rising U.S. Treasury yields, which have been at historically lows since April last year, must be a daunting sight for traders, even if it speaks to the economic health and positions in multiple markets. We are pushing for a review. Big tech stocks, which were popular in the bull market, led the decline on the 25th. The Nasdaq 100 index fell nearly 4%. Valuations, which have been at the highest level since the era of the internet stock bubble, have become difficult to justify due to rising interest rates.

Sectors likely to benefit from high bond yields in the equity market have also been sold. The KBW Bank stock index, which had risen to its highest level since 2007 on the 24th, fell 2.7% that day. Energy stocks and public interest stocks using the S&P 500 stock index are also down more than 1%.

The forex market was also surprised. The Bloomberg Dollar Index rose 0.7% on the 25th, the highest rate since September last year. Meanwhile, historically volatile emerging market currencies have fallen. South African rands, Turkish liras and Mexican pesos have fallen dramatically, more than 2%.

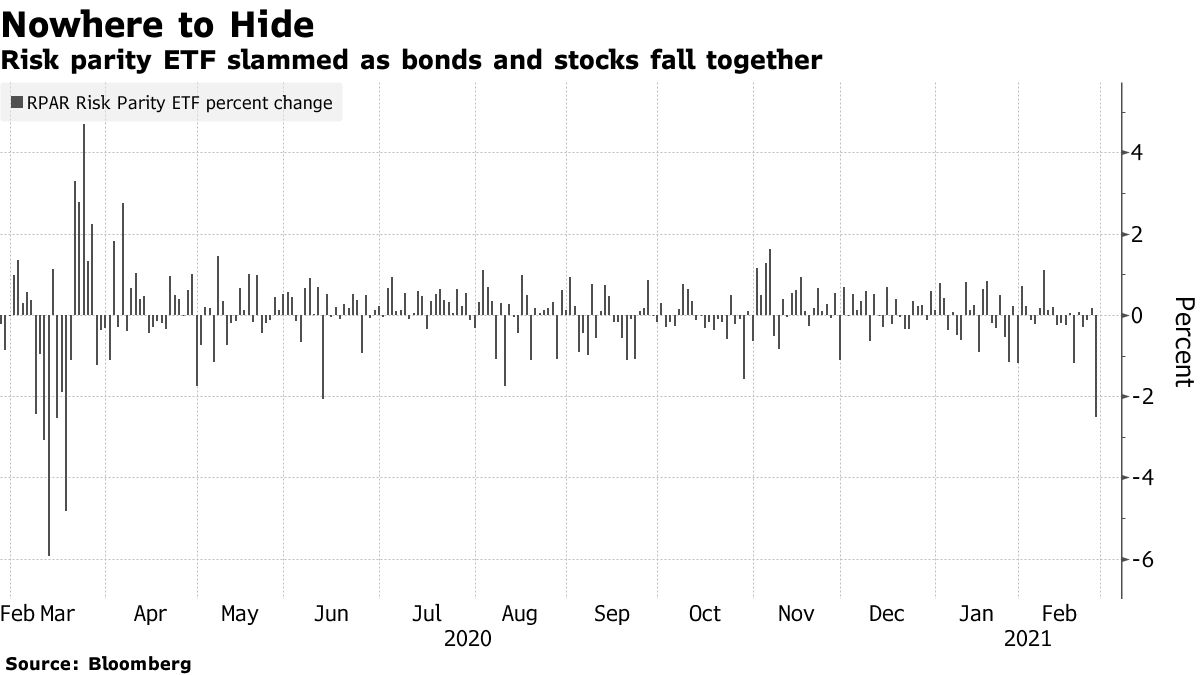

“These interest rates are currently rising at a rate that could disrupt strategies like risk parity, and bond volatility is on the rise,” said Samia Samana, senior global market strategist at the Wells Fargo Investment Institute. It has also spread to assets. “” Until interest rates slow down, we may need to be mentally prepared for more days like this, “he said.

Original title:Global Bond Path Extends into Asia, Testing Yield Curve Control (抜 抜)

Original title:

In a flash, US yields hit 1.6%, wreaking havoc on all markets (抜 粋)