[ad_1]

The Chairman of the Federal Reserve Board of Governors (FRB), Powell, has indicated that financial authorities are far from weakening support for the US economy. He also expressed his hope that economic activity will normalize and improve by the end of the year.

The president testified in the Senate Banking Committee on the 23rd. “The economy is far from meeting the employment and price targets of the financial authorities, and it will be some time before we can make any more significant progress,” he said.

Fed Chairman Powell

He also said he was less serious about concerns about inflation as additional large-scale economic measures from the government emerged and the growing number of Americans receiving the new coronavirus vaccine and pent-up demand. He also noted that the recent rise in bond yields, which has caused turmoil in the stock market, is a “sign of confidence” in the strong economic outlook.

Currently, financial authorities are buying bonds at a monthly rate of $ 120 billion, at the same rate until there are “more significant strides” towards maximum employment and price stability. You have stated that you will continue shopping.

Powell noted that it is important to determine the reason for the increase in bond yields. “In a way, it’s a sign of the market’s confidence that we will get a strong and full recovery,” he said.

Regarding the economic outlook, he said, “We should not underestimate the current difficult situation, but it also suggests an improvement in the outlook within the year.” “Especially the ongoing progress in vaccination will help accelerate the normalization of activity,” he said.

In a question-and-answer session after the opening testimony, he said that this year’s rice growth rate could reach 6%. Last year it was less than 2.5%.

“High unemployment is especially serious among low-wage workers, as well as among minorities such as African Americans and Hispanics,” he said. “The economic turmoil has changed the lives of many and it is very uncertain about the future.” It created a feeling. “

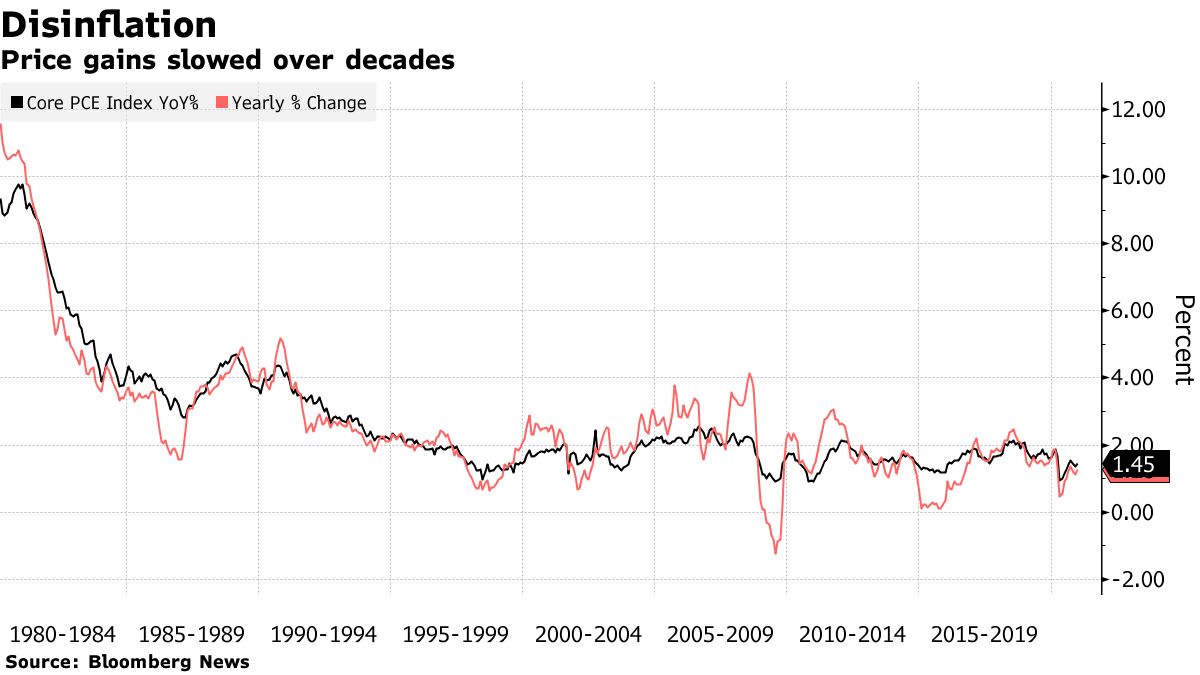

In addition to achieving maximum employment, the president reiterated that the policy rate will remain close to zero until inflation rises to 2% and is on its way to reaching a slightly higher level.

“We don’t think inflation will rise to uncomfortable levels,” Powell said.

Powell said inflation is expected to accelerate in the coming months, but the impact will be temporary, compared to a year ago, when economic activity practically came to a halt and inflation slowed.

In addition, he noted that pent-up demand may become apparent as vaccination progresses, which may drive prices up later in the year. However, he said inflation is unlikely to rise significantly or last for long.

Original title:Powell tells the Fed to keep buying bonds even as the outlook improves (抜 粋)

(Update with comments on inflation and bond yields)