[ad_1]

Plant stacks at night in the Keihin Industrial Area in Kawasaki, Kanagawa Prefecture, Japan, Thursday, February 11, 2021. Japan’s economy is estimated to have ended the pandemic year of 2020 with growth topping Double digits, a show of resilience that suggests the country could emerge from a damaging state of emergency this quarter on a less unstable footing.

Photographer: Soichiro Koriyama / Bloomberg

Photographer: Soichiro Koriyama / Bloomberg

Every morning we deliver global news that you want to follow up on before starting your day. Click here to subscribe to the Bloomberg newsletter

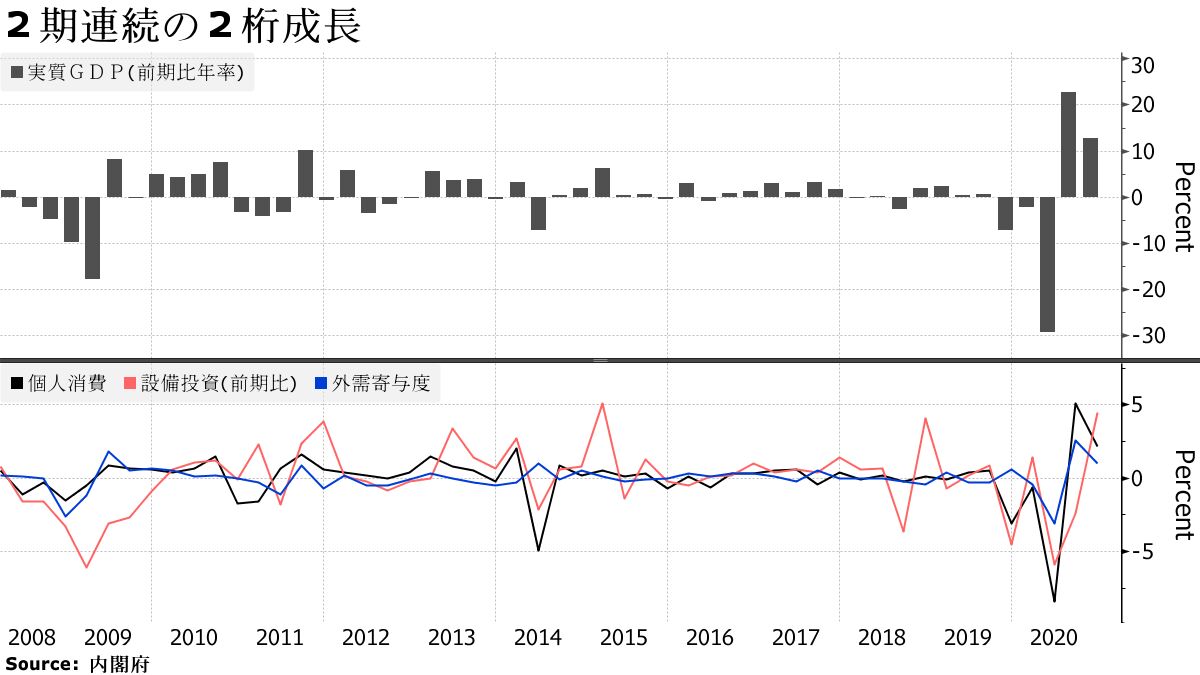

Preliminary figures for real gross domestic product (GDP) for the October-December 2020 period increased 12.7% from the previous quarter, marking the second consecutive quarter of double-digit growth. The growth rate exceeded the market forecast (up to 10.1%), which is the second highest level after the July-September 2008 period since 1994, which is comparable. Consumption remained strong due to the policy effect of the response to the new coronavirus, and the recovery of exports contributed due to the recovery of overseas economies. The Cabinet Office announced on the 15th.

Exports increased for the second consecutive quarter, driven by the recovery of the Chinese economy, and capital investment turned positive for the first time in three quarters due to the contribution of spending on production machinery such as semiconductor manufacturing equipment. Private consumption increased for the second consecutive quarter, in part due to support from policies such as the “GoTo Campaign” that continued through December.

Yasutoshi Nishimura, the minister in charge of economic revitalization, assessed the content as “feeling the potential resilience of the Japanese economy.” “It is still below pre-Corona levels and the recovery is halfway there,” he said. “We must be careful with the downside risks to the economy.”

In the market, GDP in the January-March quarter is expected to grow negatively again. Due to the outbreak of mutant strains of the new crown, Western countries have again tightened behavioral regulations such as the blockade (city blockade). In Japan, due to the reissue of the state of emergency, measures are being taken such as reducing business hours focused on restaurants and refraining from going out unnecessarily, and personal consumption is expected to decline again.

| Main point |

|---|

|

The economist’s perspective

Mitsubishi UFJ Morgan Stanley Securities Business Cycle Research Institute Hiroshi Miyazaki Senior Economist:

- Capital investment was strong. It appears that export-led output recovery in manufacturing is more likely to lead to increased capital investment.

- It is possible that heavy consumption of durable goods led to an increase in personal consumption. Many durable goods are expensive items, like cars and appliances, and they are easily affected by the wealth effect – I think there are places where stocks were strong even in crown disease and supported household consumption.

- Most people see negative growth in the January-March quarter. With the slowdown in the number of people infected with corona, the end of the state of emergency is also in sight and personal consumption will rebound in the April quarter. -June.

Hiroaki Muto, Economist, Investment Planning Department, Sumitomo Life Insurance Company:

- Although it was a bit late, it appears that equity investment has finally come out cyclically in a way that is driven by exports.The rebound was stronger than I expected

- In capital investment, some home appliance companies in the manufacturing industry and non-contact manufacturing industries are emerging as new players.

- As for the macroeconomy as a whole, it will weaken again in January-March, but it is on a recovery trend.

Yoshimasa Maruyama, Chief Market Economist, SMBC Nikko Securities:

- This GDP was mainly driven by consumption, exports and capital investment. Contents to confirm that the economy can recover without corona

- However, it can be said that the number of infected people increased considerably because the economy was oriented in the direction of boosting the economy, leading to the issuance of a partial state of emergency. The content is not optimistic about the future.

- For the BOJ, it may not be something that requires additional relaxation.

Cabinet office explanation

- The annual increase in real GDP by 12.7% is the highest level after the July-September 2008 period since 1994, which is comparable.

- Cars, eating out, and mobile phones contribute positively to private consumer spending

- Private equity investment is the largest since the 5.1% increase in January-March 2015, due to the contribution of spending on production machinery, such as semiconductor manufacturing equipment.

- Exports contributed by automobiles and production machinery, the highest since 1994 when they are comparable

- 20-year real GDP declined 4.8%, the first negative growth in 11 years since 2009, the second negative range in the past

- Private consumption is the biggest negative since 1994, and housing, equipment, and exports are all negative since 2009.

(Updated by adding Rev. Nishimura’s speech in the third paragraph)