[ad_1]

Investors shrugged when electric carmaker Tesla was selected as a constituent of the S&P 500, the world’s largest stock index so far.Is it okay to incorporate stocks that fluctuate rapidly? However, it turned out that it was not.

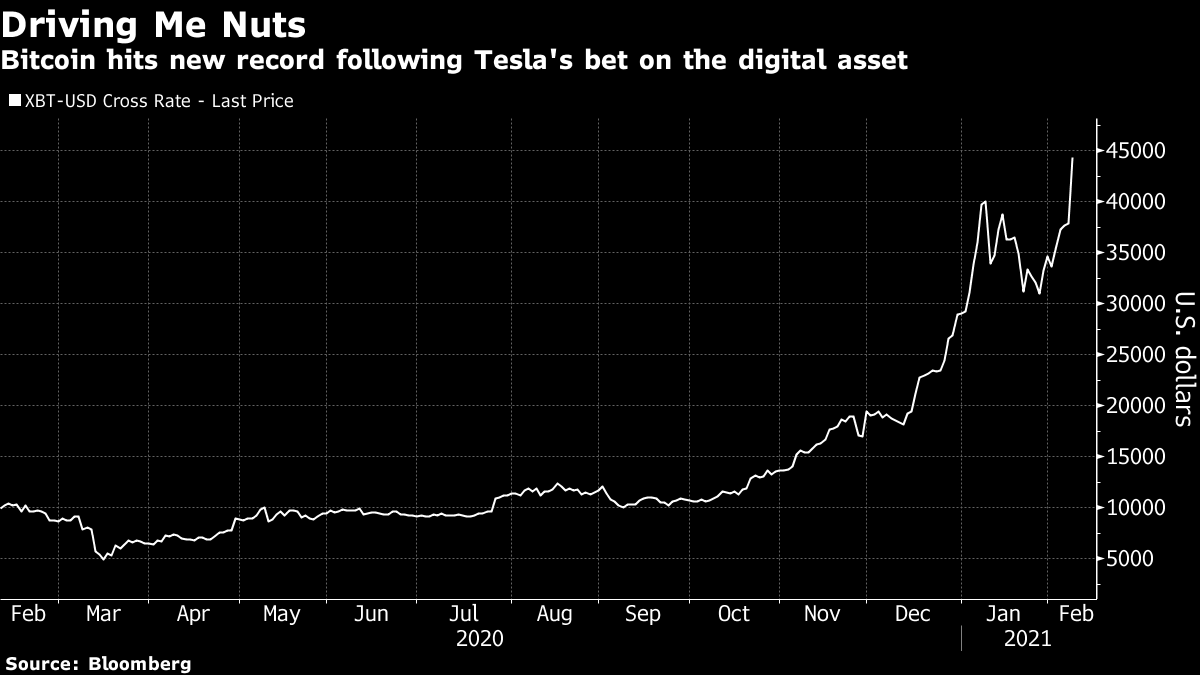

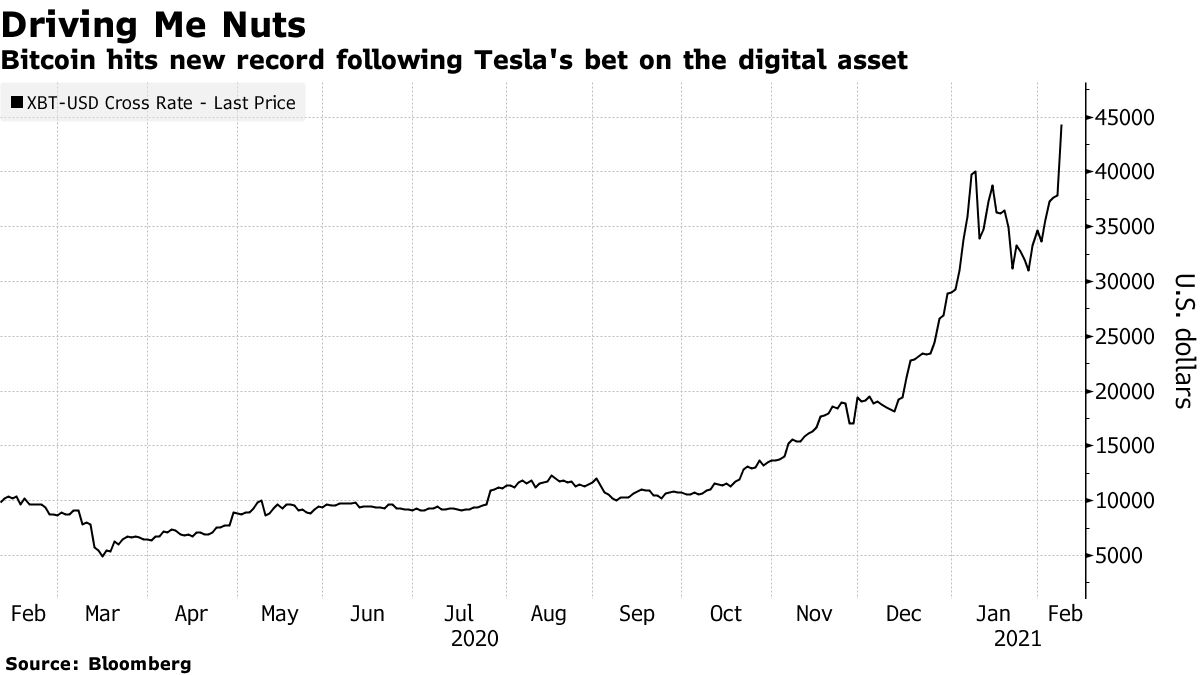

Tesla founder Elon Musk revealed on the 8th that the company is investing $ 1.5 billion (about 158 billion yen) in virtual currency Bitcoin and accepting payments with Bitcoin.Expressed the policy, the company becomes part of the S&P 500Less than two months have passed since he was hired.

For those who are concerned that Tesla’s overvalued levels and volatile price movements will be a problem for passive investors, there is more to think about. Tesla is one of the largest components of the S&P 500 and accounts for about 2% of the weight. This means that at least a portion of the roughly $ 11.2 trillion in funds invested in commodities linked to the index is now affected by the movement of cryptocurrencies, known for their volatile fluctuations.

“It’s really interesting to think that S&P 500 investors are now Bitcoin investors, which is shocking,” said Phil Taves, CEO of asset management firm Taves.

Tesla is not the first company to enter the cryptocurrency market and other companies are making similar investments. Software company MicroStrategy has invested around $ 3 billion in Bitcoin, and Square, led by Jack Dorsey, who has long supported cryptocurrencies, will have assets of around $ 50 million in April-June 2020 (second quarter ). changed to Bitcoin. However, both companies are not S&P 500 companies, and the number of general investors affected by Bitcoin through both companies is limited.

Shares of Tesla have risen 460% over the past year, more than double since the S&P Dow Jones Index announced the adoption of the S&P 500 in November of last year. In response to the announcement, there were a number of warnings about the impact of the addition of Tesla stocks to the index. Reference traders tend to “buy high and sell low,” said Robert Arnot, founder of Research Affiliates.He showed a sense of caution.

Tesla’s Bitcoin purchase has indirectly affected investors in the cryptocurrency S&P 500, but at least one seasoned market participant has said that this is why Tesla is not in the index. I think it is doubtful.

David Blitzer, who oversaw the Index Committee on the S&P Dow Jones Index through 2019, said: “The S&P 500 is designed to measure trends in the US stock market and make management decisions regarding fund management and strategy. Not to evaluate or criticize later. “

Ray McConville, a spokesman for S&P Dow Jones, declined to comment on Musk’s move.

Original title:

Crypto hits the S&P 500 via Musk’s $ 1.5 billion Bitcoin Flier (抜 粋 抜