[ad_1]

The Bank of England (Bank of England) has asked commercial banks to start preparing for negative interest rates. He stressed that the adoption of the policy should not be taken as a sign that it is near, and concluded that it is appropriate to start preparations for its introduction when necessary.

“My message to the market is that we don’t want you to read what the Monetary Policy Committee (MPC) is doing about the central bank’s toolbox,” Bailey said at an online press conference.

The central bank also announced that it would start investigating a tiered system with a negative policy rate.

Officials have been considering negative interest rates for almost a year as an option to save the UK economy from recession. After listening to commercial banks, it became clear that introduction within 6 months would increase operational risk.

At the MPC meeting held until day 3, opinions were divided on whether to ask the banks to begin preparations. Some have pointed to the risk of being misinterpreted as a suggestion that the introduction of negative interest rates is near.

Some officials argued that the message to banks about negative interest rates should be retained at a later date, as “it is not necessary in light of the current situation and outlook,” according to the minutes.

MPC has left the policy rate unchanged at 0.1% and kept the bond purchase limit at £ 895 billion (about 129 trillion yen). The 0.1% is the lowest ever recorded by the Bank of England and has never adopted a negative interest rate.

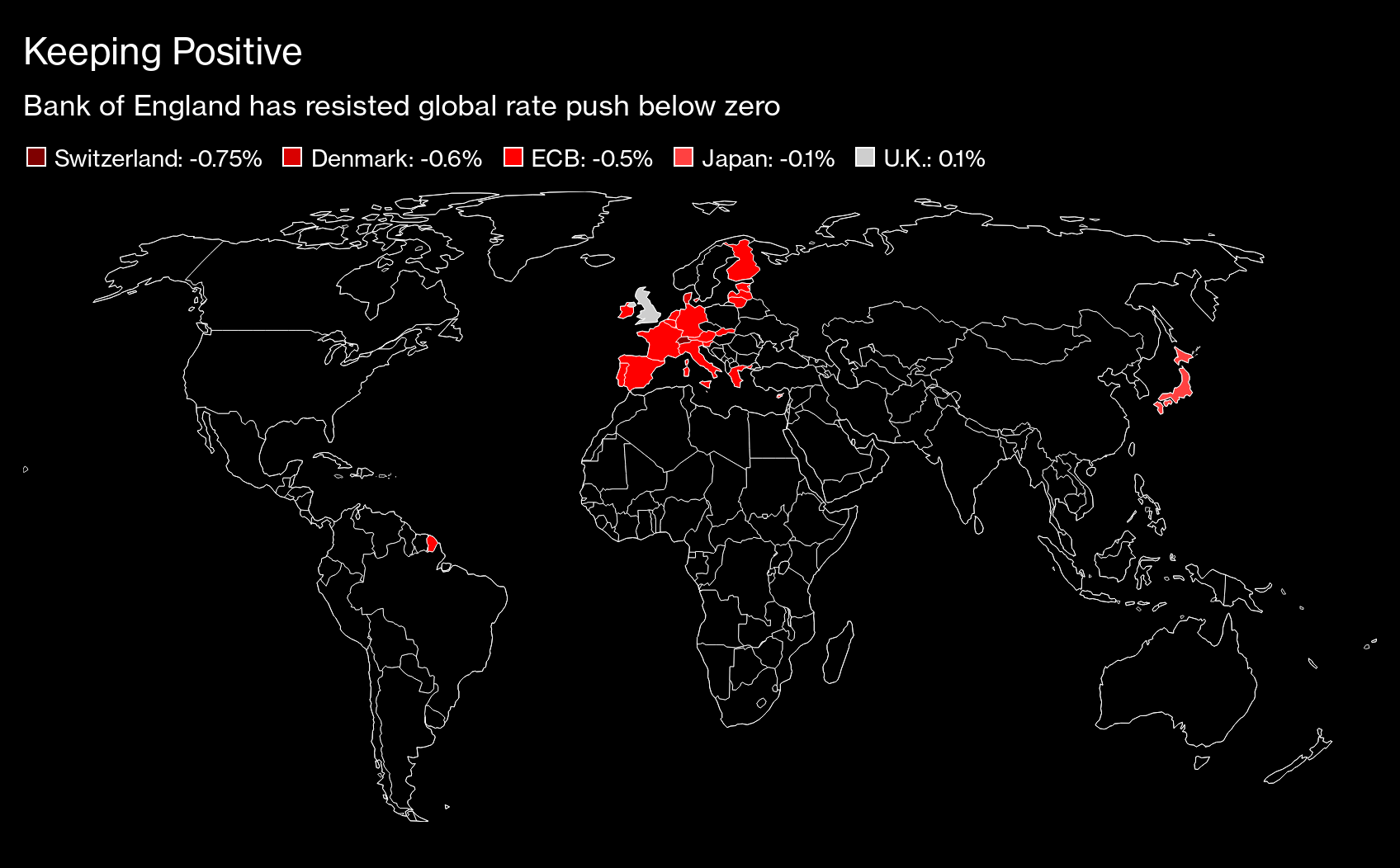

The European Central Bank (ECB) and the Swiss National Bank (Central Bank) have adopted negative interest rates, but have introduced a stratification system that exempts some of the reserve requirements of commercial banks from negative interest rates.

The Bank of England’s MPC should interpret the “future supervisory actions of the request and soundness body (PRA) as a sign that negative interest rates and stratification schemes will be introduced soon or at some point. No.”

Keep a positive attitude

The Bank of England has resisted the push in the global rate below zero

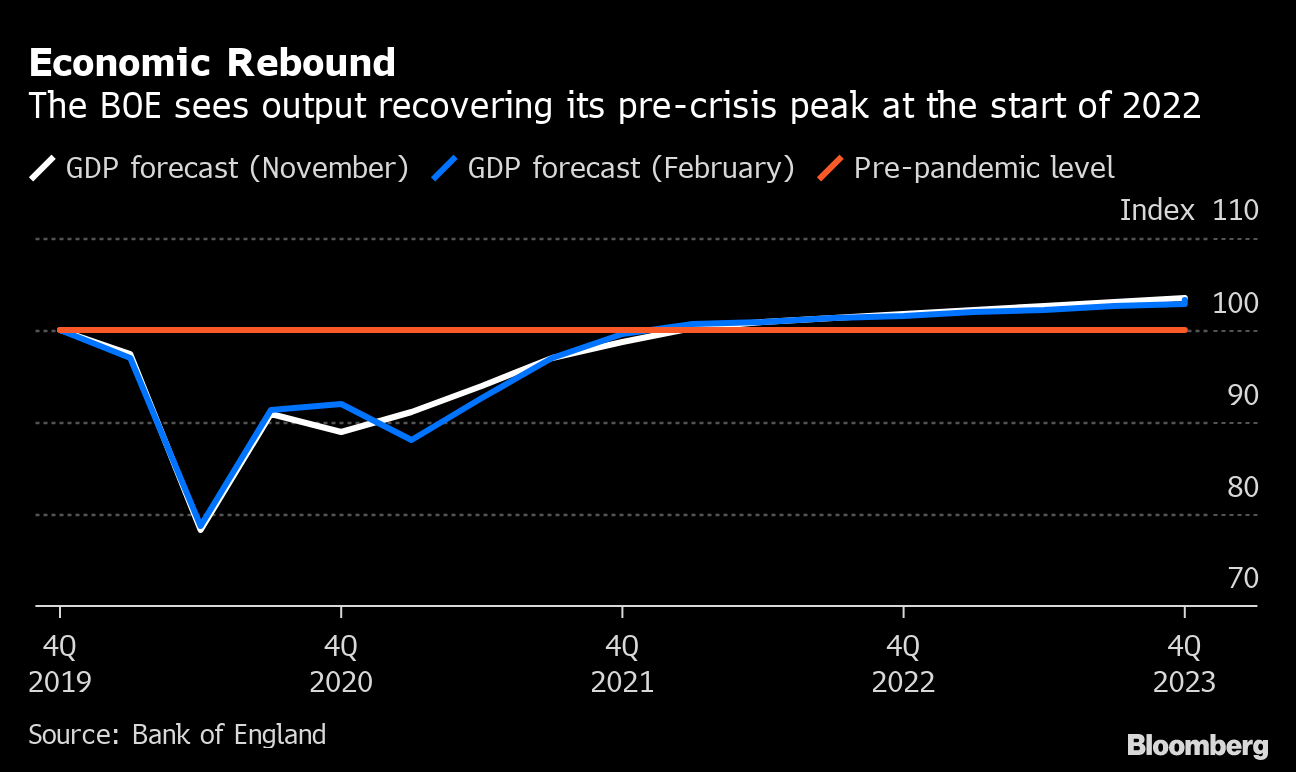

As for the economy, the economy is expected to contract in January-March (first quarter), and the growth rate for the full year has dropped to 5%, compared to the 7.25% forecast in November last year .

On the other hand, he also expressed optimism that the economy will recover quickly due to aggressive efforts to vaccinate against the new coronavirus.

United Kingdom, new corona vaccination exceeds 10 million, which is equivalent to approximately 15% of the population

“Gross domestic product (GDP) is expected to quickly recover to pre-new krone levels by the end of 2021,” he said. “The vaccine program is expected to ease restrictions related to the new crown and alleviate public health concerns.” I’m doing it. “” The announced large-scale fiscal and monetary policy actions will also support the economic recovery, “he added.

In an online press conference, Governor Bailey said the vaccine “The program started in many countries, including the UK, which has improved the economic outlook. MPC’s core forecasts are new crown-related restrictions and concerns. health of the people at the moment. weight of the activity, but we hope that the vaccine program will help to alleviate them. “

Economic rebound

The BOE forecasts that production will return to its pre-crisis peak in early 2022

Source: Bank of England.

Original title:BOE tells banks to prepare for negative rates if necessary (1) 、BOE tells banks to start preparing for negative rates if necessary 、BOE sees rapid rebound in UK with Johnson’s vaccine push (1) 、BOE sees rapid rebound in UK after Johnson’s vaccine push 、BOE sees UK’s second contraction in a year in Covid lockdown (抜 粋)