[ad_1]

It is not true that the amnesty of the old folders up to 5,000 euros dated 2000-2010 expected of Sostegni Decree now it’s just old credits unchargable debts. The vulgar one with which the political forces in favor of the removal of pending taxes justified the operation – resized with the mediation of the prime minister. Mario draghi – is denied by the technical report of the expected provision in Official diary after the signature of the head of state. There it is explained that the cancellation will cost the State coffers 666.3 million of which 451 linked to the fact that taxpayers’ debts will also go to the pulp they are already paying in installments (after having entered the Scrapping ter or the balance and extract of the yellow-green government) or in which, in any case, “there is still acollection expectation“. The message this sends to those who pay on time is clear. Not only that: the direct consequence is that the measure does not scratch the mountain of truly impossible to collect folders that flood the warehouse of theRevenue collection agency. Now the real game is there reform that, by modifying the unclaimed credit discharge mechanism, it should, as Draghi announced, do “more efficient”The fight against tax evasion.

What changes compared to drafts: the income ceiling is of little use – Compared to the initial version, folders are automatically deleted drop from 61 to 16 million mainly due to the reduction of the time horizon, which in the pre-council of ministers reached the drafts until 2015, also canceling relatively recent roles. Thus, the cost of public coffers falls compared to the previous 930 million. On the other hand, the impact of the other fixed pole on Friday, the roof of 30 thousand euros of income tax: will cut only the 17% of taxpayers with tax arrears that fall within the other parameters. To the level communicative having put a limit on the role that excludes the richest from the “favor” makes the amnesty palatable, but in reality it changes very little. The reason is obvious: according to the latest data from the Department of Finance, the average reported income to the tax authorities by natural persons slightly higher than i 33 thousand euros. In the country where according to the latest Report on tax evasion freelancers and companies do not pay the tax authorities on average two-thirds of the amount owed, 78% of taxpayers “disclose” to the tax authorities less than 30 thousand euros a year. Therefore, you have access to the amnesty that cancels the capital owed, interest and penalties.

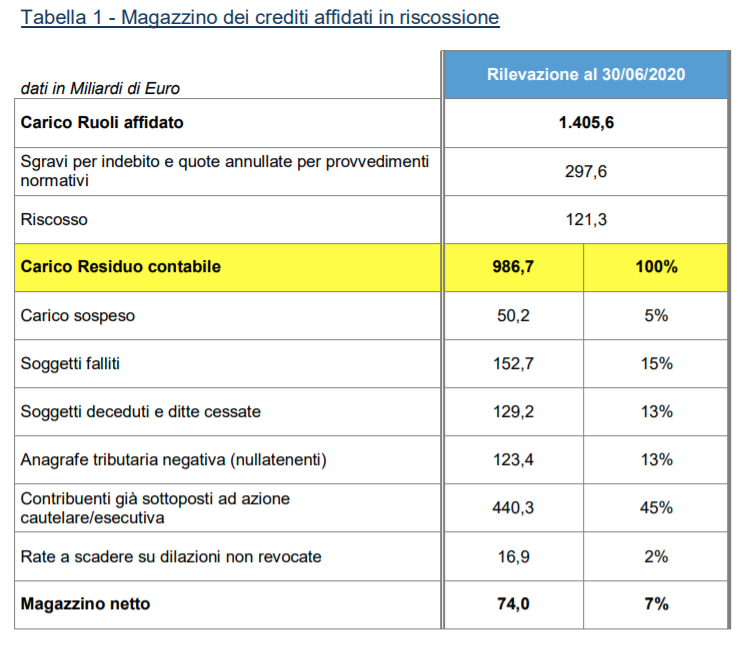

More than 110 million folders remain in stock – Not having selected the really bad folders, as you requested Leu, means that the decree does not solve at all the problem of the 987 billion department stores of the Collection, constituted for the most part (see table below) of sums that the tax authorities will never review. The system, downstream of the amnesty, will in any case remain flooded by more 110 million of folders. Therefore, the other pillar of the operation implemented by the Draghi government will be the reform of the “control and settlement of unclaimed debts“. Today, as the number one in revenue explained in the audience Ernesto Maria RuffiniBefore being able to communicate the irrecoverance to the credit institution, the tax collector is obliged to present “all the compulsory collection actions conceivable in the abstract” regardless of any valuation effectiveness and effective collectibility.

Now the real problem is the tax reform – The first drafts of the decree solved the problem by intervening with the ax: the uncollected shares would have been “Automatic download” on December 31 of the fifth year following to custody. But that would have been an “amnesty permanent“, As noted in ilfattoquotidiano.it former finance minister Vincenzo Visco. On Friday everything was postponed for subsequent decisions of the Ministry of Economy, which within sixty days must transmit to Rooms a report with the criteria to review the cumbersome process. From there it will be seen if the objective is to sharpen the weapons of the collectors or cancel another million credits that the state could recover.

Supports ilfattoquotidiano.it: I never eat right now

we need you.

In these weeks of pandemic, journalists, if we do our work conscientiously, we do a public service. Also for this reason, every day here at ilfattoquotidiano.it we are proud to offer hundreds of new content for free to all citizens: news, exclusive insights, expert interviews, surveys, videos and much more. All this work, however, comes at great financial cost. Advertising, at a time when the economy is stagnant, offers limited income. Not in line with the access boom. That is why I ask those who read these lines to support us. Give us a minimum contribution, equal to the price of a cappuccino per week, which is essential for our work.

Become a support user by clicking here.

Thanks

Peter gomez

THANKS FOR READING NOW XX ITEMS THIS MONTH.

But now we are the ones who need you. Because our work has a cost. We are proud to be able to offer hundreds of new content to all citizens for free every day. But advertising, at a time when the economy is stagnant, offers limited revenue. Not in line with the boom in access to ilfattoquotidiano.it. That is why I ask you to support us, with a minimum contribution, equal to the price of a cappuccino a week. A small but fundamental sum for our work. Give us a hand!

Become a support user!

With gratitude

Peter gomez

Support now

Previous article

Lombardy, Aria’s problems come from afar. When the IT procurement season ended up in the sights of the Regional Court of Auditors

[ad_2]