[ad_1]

The Tax Agency reports new fraud attempts to the detriment of taxpayers. Fake emails are circulating relating to inconsistencies in the “periodic VAT removal” data. In the press release of September 22, 2020 the invitation not to open the attachments and immediately to the trash.

Inconsistencies in the data of “periodic eliminations of VAT”: l ‘Revenue agency Report new scam attempts, through fake email in circulation that aim to steal personal data.

To alert taxpayers is the press release of the Tax Agency published on September 22, 2020, which reports on the new phishing attempt to the detriment of users.

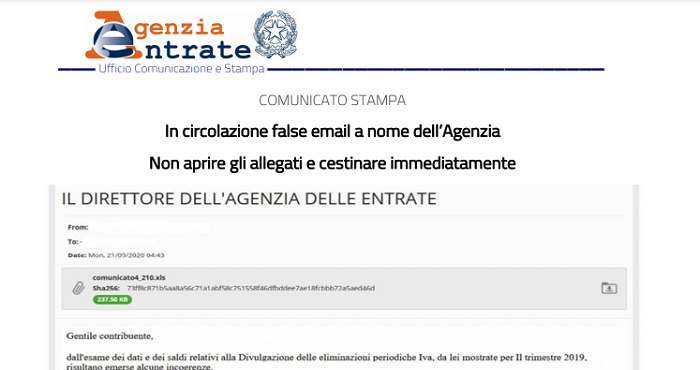

Emails have the wording in the header “The Director of the Agency” the “The Bodies of the Agency”and invite view attachments in a file to verify the inconsistencies found.

This is a fraud, and the invitation is to don’t open attachments and trash right away received emails.

Revenue Agency New Email Scam – Trash Right Away

There is no Director of the Agency or Body of the same to alert by email about some inconsistencies arising from the examination of the data and balances related to the “Disclosure of periodic VAT eliminations”, awkward reference to Lipas.

Just read the contents of the emails circulating in the last hours to understand what a new scam attempt. Reporting it and alerting taxpayers is the Tax Agency itself: it is theanother phishing attempt.

The emails reported in the press release of September 22 invite the taxpayer to consult the documents contained in an attached file. The attempt is to install malware on recipients’ devices as well in order to later acquire confidential information.

To avoid encountering the scam, the Tax Agency invites taxpayers not to open attachments and delete emails immediately.

- Tax agency – press release of September 22, 2020

- Fake emails in circulation on behalf of the agency – don’t open attachments and trash right away

Scam by email, remember the Tax Agency: communications only in the Tax Drawer

In press release September 22, 2020 the Revenue Agency reports two examples of fake emails in circulation, which we report below:

The Agency recommends that taxpayers always carefully review received messages and, if these seem suspicious, especially if the senders are unknown, not to open attachments or follow links in emails (also to avoid damage to their PCs, tablets and smartphone) and throw them away.

In addition, it specifies that communications containing personal data of taxpayers are never sent by email. Personal information can only be consulted in the tax drawer, accessible through the reserved area on the website of the Tax Agency.