[ad_1]

For several days theRevenue agency has published online the new 730, which will be presented before September 30, for retirees and employees. The new model takes into account the regulatory changes introduced for the year 2020. They range from the complementary treatment for employment income and similar to the Superbonus 110%, from the deduction of expenses for the reform of the facades of the buildings to the deduction of ‘ ‘Tax on donations in support of measures to combat the Covid-19 emergency, from the vacation voucher to the tax credit for the purchase of electric scooters and electric mobility services.

However, there is an important element that derives from the Budget Law for 2020, which includes a rule on traceability of expenses for tax deductions of 19% that obliges taxpayers to pay with traceable instruments (for example, ATMs or credit cards ) many deductibles. expenses, with the exception of purchases of drugs and medical devices, which will be payable in cash, as well as health services provided by public or private structures accredited to the National Health Service.

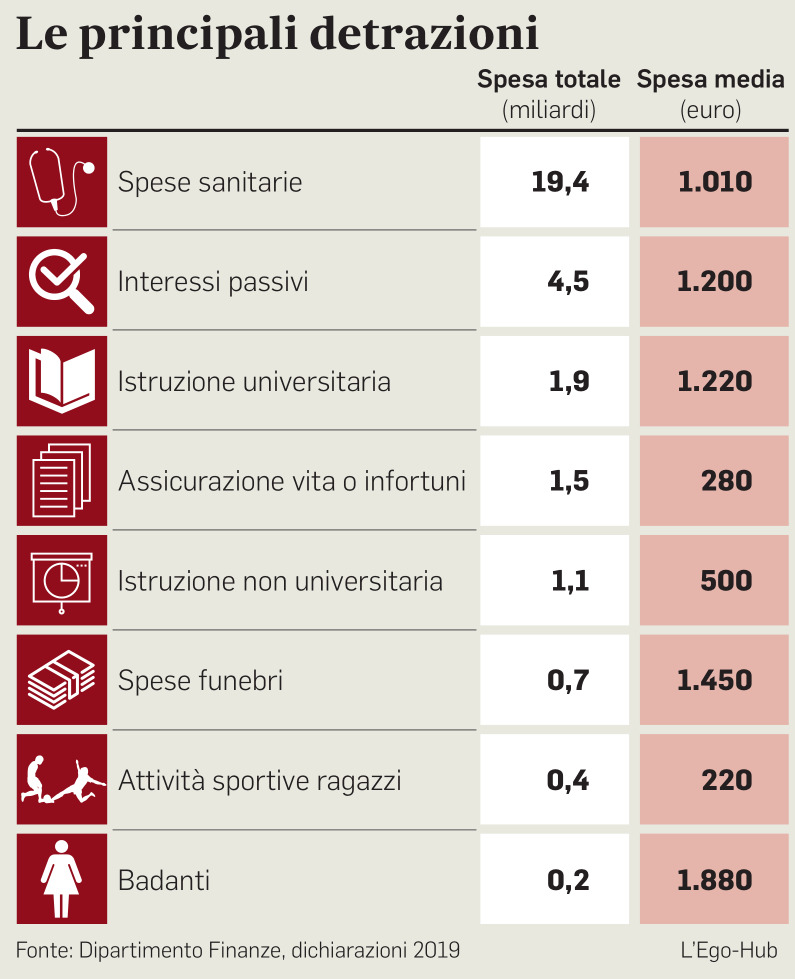

In practice, the deductible expenses in 2020 are always the same, but the form of payment required to benefit from the deduction has changed. The novelty refers to a series of expenses such as education, university or non-university, life insurance, people employed for assistance as caregivers, payments for sports activities for children. Some of these items, if they are of a significant amount, are normally paid for by bank transfer, check or card, but for others cash payment may be normal. The novelty excludes the purchase of drugs and medical devices such as cups, syringes, thermometers and also services in affiliated health services or private establishments: in all these cases the deduction is due even if cash has been used.

ONLY WITHOUT CASH

But there are other health costs, such as medical visits or private professionals, hospitalizations, surgeries, clinical examinations, treatments, ultrasounds, in private establishments not accredited to the Health Service for which the obligation to pay by debit card or credit. ., check, bank transfer or money order. The taxpayer can demonstrate the use of the “traceable” means of payment by means of a paper receipt of the transaction with an ATM receipt, account statement, copy of the postal bulletin or MAV and payments with PagoPA.

In case of absence – it is explained in the instructions – the use of the “traceable” means of payment can be documented by noting the invoice, fiscal receipt or commercial document, by the person who collects the sums, transfers the merchandise or performs the service. Nothing changes with respect to the deductions of 26, 30 and 35% or 90 percent (this last rate applies to the premiums related to seismic risk insurance stipulated at the same time as the transfer to the insurance company of the deduction of 110%) . Among other things, it should be remembered that the professionals required to transmit health expenses will have more time to send the data relative to 2020. In fact, operators, compared to the deadline set for January 31, will have 8 more days to send to the System. Data health card.

Last updated: 22:26

© REPRODUCTION RESERVED

[ad_2]