[ad_1]

While the government aims to toughen Recovery plan bring the new draft to the CDM perhaps already on Monday, the contours of what is defined Giuseppe Conte can really grant a Matteo renzi which continues to challenge him on the content of the plan for the use of European funds from the next generation of the EU. There is a fixed point: the public debt. the Stability pact is frozen until at least 2022, but for an indebted country like Italy, putting a pencil on paper that wants to make it rise again means first of all challenging the markets making it widen spread. Especially because in mid-2022 the extraordinary purchasing plan of ECB it will come to an end. Second, therefore, the result would be “having to make cuts“As the Prime Minister warned during the Press conference end of the year. And pay would be the “next generations”.

As is well known, Renzi’s request is that everyone EU loans are used for “additive” projects, rather than for replace financing already foreseen in the budgetary trends – therefore for works that were intended to be carried out – but which without the recovery fund would have had to be requested from the markets at higher costs. The problem is, this means adding to the burden of our debt as well. 120 billion in six years instead of the approx. 55 (more than 65 non-refundable transfers) foreseen in the latest draft of the Palazzo Chigi recovery plan: 65 billion more with respect to the plans of the Treasury. Not to mention that, if the requests from living Italy are accepted, the 36 billion ESM pandemic loans to be used for health, reaching 156 billion. The minister Roberto Gualtieri is not available to revise the figures upwards and Conte is of the same opinion: “There is a limit beyond which to offer a yield curve and sustainability of public debt“, He recalled at the press conference. “If not, we would make fun of our young people. Would be the load that would bury the next generations. “

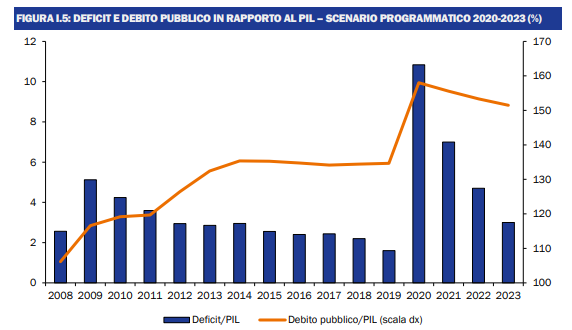

Renzi’s plan would certainly give a greater contribution to GDP growth compared to + 2.3% in 2026 estimated in the Recovery Plan, but it would omit the return route of the debt / GDP curve written in via XX Settembre e approved by Parliament. The last Update note to Def In fact, he estimates that, after reaching a peak of 158% Due to the extraordinary expenses to face the Covid emergency (from 134% in 2019), the debt / GDP should decrease to 155.6% in 2021, 153.4% in 2022 and 151.5% in 2023. To then continue the descent and fall “by 2031” below the 2020 level.

Renzi’s plan would certainly give a greater contribution to GDP growth compared to + 2.3% in 2026 estimated in the Recovery Plan, but it would omit the return route of the debt / GDP curve written in via XX Settembre e approved by Parliament. The last Update note to Def In fact, he estimates that, after reaching a peak of 158% Due to the extraordinary expenses to face the Covid emergency (from 134% in 2019), the debt / GDP should decrease to 155.6% in 2021, 153.4% in 2022 and 151.5% in 2023. To then continue the descent and fall “by 2031” below the 2020 level.

But on the contrary, using all the loans for additional expenses – “nobody in Europe does it,” Gualtieri recalled – would keep the report still in the works. 155% in 2026, last year of disbursement of European financing from the Recovery Fund, instead of about 145% as Nadef envisions. A scenario that would help broaden the yield differential between Italian and German government debt, now very low thanks to the ECB’s purchase plan, which is very favorable for Italy but will end in 2022. And a higher differential, in addition to increasing interest spending, weighs on the pilTherefore, the positive effect of higher additive investments on the denominator would be reduced.

The line decided by Palazzo Chigi and Tesoro is also agreed with the EU Commission: it is no coincidence that the Commissioner for Economic Affairs Paolo Gentiloni A few days ago he recalled precisely that loans “make increase debt and the government is right to propose one prudent use, even substituting expenses already foreseen, provided they are compatible with common European objectives ”. The point is precisely what expenses will be included in the final plan: Gentiloni himself warned of the need to focus “mainly on investments me reforms“Because the incentives, that without being excluded are not a priority “and” expenses that tend to favor fleeting consents“The reference could be to super bonus building that according to the latest draft of the plan would absorb 22 billion – but according to a study cited by Bloomberg would especially favor more families rich – and incentives to companies for plant renovations and green and digital technological innovation, to which the government intends to allocate almost as.

[ad_2]