[ad_1]

Median home prices rose 7.6% in the year to March 2021, according to the latest Daft.ie home price report.

The average price during January, February and March 2020 was € 256,000 – this has increased to € 275 751 this quarter, an increase of almost € 20,000.

This marks the second consecutive quarter in which prices are almost 8% higher than the previous year, roughly double the inflation rate observed during 2018 and 2019.

The median sale price of a home nationwide in the first quarter of 2021 was up to 68% from the lowest point in early 2013, but still below the Celtic Tiger peak.

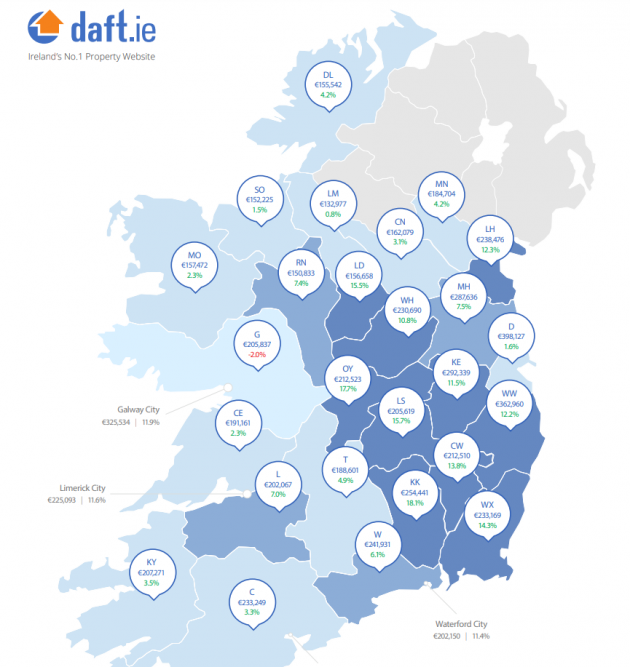

In Dublin, prices increased by 6.9% in the year to March 2021, but the largest increases were seen in the counties surrounding Dublin and in the other cities.

Average House Prices and Year-on-Year Changes: First Quarter 2020 – First Quarter 2021.

Source: Daft Report

In the cities of Cork, Galway, Limerick and Waterford, listing prices were 11-12% higher in the first quarter of 2021 than a year earlier, while in Leinster (outside of Dublin), they were a 12.4% higher on average.

In contrast, in Munster, Connacht and Ulster (outside the city areas), there was more moderate price growth, with annual increases of about 4% in Munster and all three Ulster counties and only 1% in Connacht.

Average list price and year-over-year change through Q1 2021:

- Dublin City: € 398,127 – 6.9% more

- Cork City: € 309,681 – up to 11%

- Galway City: € 325,534 – up to 11.9%

- Limerick City: € 225,093 – up to 11.6%

- City of Waterford: € 202,150 – 11.4% more.

The total number of properties available to buy on March 1 was just under 12,000, the lowest number on record since the rise in advertising properties for sale online.

This represents a 40% year-on-year drop nationally, although stock available for sale in Dublin has fallen less than the national average, while stock for sale in Leinster (outside the capital) is down by almost half.

Commenting on the report, its author Ronan Lyons, an economist at Trinity College Dublin, said: “The figures in this latest Daft.ie report confirm that the impact of Covid-19 on the retail market was a massive shock to the supply, apparently far less impact on demand.

The total number of homes listed for sale in the twelve months through February across the country was just 45,700, a third less than in the previous 12-month period. This sudden collapse in supply, at a time when demand has held up remarkably well, has turned into strong upward pressure on prices.

“It highlights the importance of supply in determining market outcomes and is a reminder that even as the pandemic subsides, there will continue to be a need to build a substantial volume of new homes each year.”

No news is bad news

Support the magazine

You contributions help us continue to deliver the stories that are important to you

Support us now

Reaction

Pat Davitt, CEO of IPAV, said that many agents are not listing new properties on the market on real estate portals due to the severity of Covid-19 restrictions on listing properties.

“We have sought an easement from the government in one respect: allowing agents to show properties, under strict health and safety protocols, of course, to potential buyers who can confirm that they have the necessary funds to buy,” he said.

He said auctioneers across the country are seeing extremely strong demand for homes that they cannot meet.

IPAV’s own Residential Property Price Barometer, which records the actual prices achieved by auctioneers, rather than asking for prices, found price increases for the second half of 2020 during the first six months of the year in the vast majority of the country. , and the largest increases were recorded in placing in four-bedroom homes.

“The housing market is like any other market, it is driven by supply and demand. Builders must safely return to building more homes. “

Daft.ie’s full report can be found here.

Note: Journal Media Ltd has shareholders in common with the publisher of Daft.ie Distilled Media Group.

[ad_2]