[ad_1]

Jakarta, CNBC Indonesia – The drama to save PT Asuransi Jiwasraya (Jiwasraya) is not over. The pros and cons began to emerge in the State Capital Participation (PMN) scheme of a Dutch life insurance company called Nederlandsch Indiesche Levensverzekering in Liffrente Maatschappij van 1859.

The government, through the Ministry of BUMN, finally chose the scheme rescue in or a capital injection of Rs 22 trillion to save Jiwasraya.

This fund will be delivered in two stages, IDR 12 trillion next year, the remaining IDR 10 trillion in 2022.

These funds will then be injected into IFG Life, a new life insurance company that will be formed by the government under PT Bahana Indonesian Business Development (BPUI) or Bahana as an insurance and guarantee company.

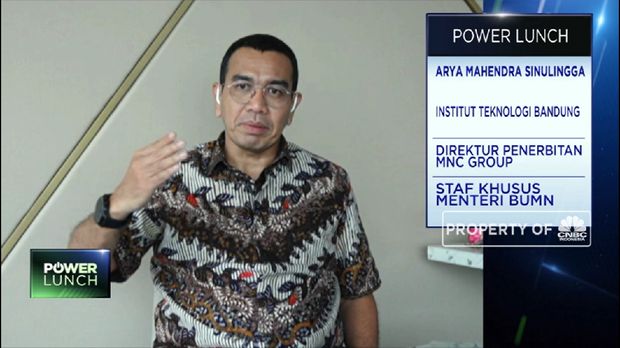

Photo: Arya Sinulingga: Pharmaceutical Sub-holding, Efforts to Boost RI’s Health Security (CNBC Indonesia TV) Photo: Arya Sinulingga: Pharmaceutical Sub-holding, Efforts to Boost RI’s Health Security (CNBC Indonesia TV)Arya Sinulingga: Pharmaceutical Sub-holding, Efforts to Boost RI’s Health Security (CNBC Indonesia TV) |

Special staff of BUMN Minister Arya Sinulingga detailed, there are several reasons why the government and BUMN, as shareholders, injected this PMN.

First, Jiwasraya is a state-owned company whose shares are owned by the government.

“This concerns the government’s credibility towards BUMN, so it is quite natural that as a shareholder the government should be responsible to its own company,” Arya said at an online press conference Sunday night (10/4 / 2020).

Second, The Ministry of BUMN ensures that it will comply with the obligations of the insured in installments for all insured.

As of August 31, 2020, the number of insured reached 2.63 million people, of which more than 90% of the clients were policyholders of pension programs and the lower middle class.

Third, policyholders can still receive most of their rights, this option is better than settlement.

“For AJS [Jiwasraya] The settlement will be less, this is better even if it does not comply with all the obligations of the rights of the insured, ”he said while emphasizing that this rescue will maintain public confidence in BUMN, the government and the insurance industry.

Fourth, avoid further losses for Jiwasraya. “We don’t want to be like that,” said the former high-ranking MNC Group official.

Earlier, DPR RI Commission XI member Ecky Awal Mucharam strongly rejected the government’s plan to inject state money for the Jiwasraya rescue in 2021 via PMN to Bahana. The government should have sought the assets of the defendants to compensate investors for their losses.

“The Jiwasraya scandal is clearly a ‘robbery’, or a structured and systematic corruption scandal. Therefore, it is not appropriate to rescue with state money, public money,” he said on Thursday (9/17/2020).

Currently, legal cases, in addition to saving PMN, are still ongoing.

The Supreme Audit Agency (BPK) calculates potential state losses due to negligent losses and investments in Jiwasraya to reach Rs 16.8 trillion.

This value consists of investment losses placed in shares of 4.65 trillion rupees and mutual funds of 12.16 trillion rupees.

This case began to burn when Jiwasraya announced a breach of the JS Saving Plan product in October 2018.