[ad_1]

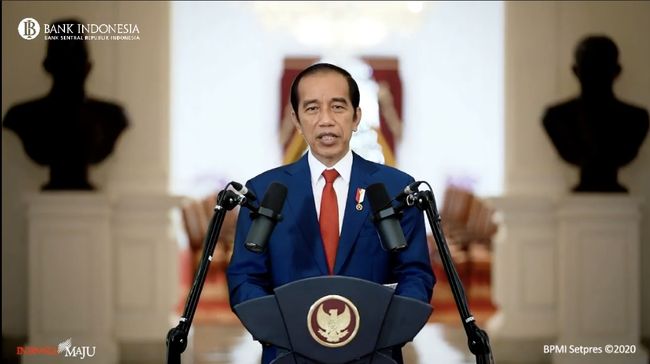

Jakarta, CNBC Indonesia – Credit puzzle For the State Endowment Fund or Sovereign Wealth Fund (SWF) also known as the Investment Management Institution (LPI) formed by the government of President Joko Widodo (Jokowi), it has been revealed that the Indonesian Investment Authority, abbreviated as INA.

Based on documents received by the Ministry of Public Companies CNBC Indonesia, stated that the presence of the Nusantara Investment Authority is important for Indonesia to make a breakthrough in inviting foreign investment.

“This is due to the limited capacity of government financing, both fiscal and through BUMN, to finance investments,” wrote a document from the BUMN Ministry, quoted on Friday (12/18/2020).

“Increasing the number and value of investment will promote economic growth and job creation,” the document states.

The name Nusantara Investment Authority is different from the information above from the Coordinating Minister of Economic Affairs Airlangga Hartarto during the Squawk Box event on CNBC Indonesia TV on Thursday (8/10/2020).

At that time, the General Chairman of the Golkar Party revealed that President Jokowi had already appointed a state endowment fund that the government would establish as mandate of the Cipta Kerja (Ciptaker) Omnibus Law.

The Ciptaker Act was approved by the Plenary Session in the DPR on Monday (10/5/2020) and declared that there would be a government-owned SWF with an initial capital of IDR 15 billion, and it would increase to IDR 75 billion.

“The name proposed by the president is the Indonesian Investment Authority,” Airlangga said.

The government has also recently completed two implementing regulations stemming from the Ciptaker Omnibus Law and a Presidential Decree (Kepres) to oversee the establishment of an endowment fund that will be an alternative financing for the development of infrastructure projects in Indonesia.

A total of two derived regulations, namely, Government Regulation (PP) No. 73 of 2020 on seed capital for investment management institutions and Government Regulation No. 74 of 2020 on Investment Management Institutions (LPI).

Both are implementing regulations of Law Number 11 of 2020 on Job Creation, especially in the investment sector.

The Presidential Decree is Presidential Decree Number 128 / P of 2020 on the Establishment of a Selection Committee for the Selection of Candidates for the Supervisory Board of LPI among Professional Elements.

Airlangga said that the two PPs aimed to respond to structural challenges on the investment side where domestic financing capacity was not sufficient to finance future economic development.

In addition, the Government also needs strong strategic partners from a legal and institutional point of view to attract investment from global investors.

“The LPI will manage investment funds from abroad and from the country as an alternative source of financing and at the same time reduce dependence on short-term funds,” said Airlangga Hartarto, in an official statement.

The LPI functions to manage investment and aims to increase and optimize the value of investments that are managed over the long term to support sustainable development.

He said this PP would help optimize the value of government investment by increasing alternative financing through direct investment, while at the same time fostering improvements in the investment climate.

“The alternative financing provided can also be used to encourage financing for infrastructure projects, in line with future policy directions,” he added.

LPI is an Indonesian legal entity wholly owned by the Indonesian government. Through PP No. 73 In 2020, LPI received initial capital support of 15 trillion IDR, equivalent to around US $ 1 billion.

LPI capital fulfillment will take place gradually until it reaches IDR 75 trillion or the equivalent of US $ 5 billion in 2021, as stated in PP. 74 of 2020.

[Gambas:Video CNBC]

(bag of bag)