[ad_1]

Jakarta, CNBC Indonesia – PT Bahana Sekuritas, a subsidiary PT Bahana Pembinaan Usaha Indonesia (BPUI) or now known as brand, Indonesian Finance Group (IFG) which became tutor or a merger financial advisor, explaining the merger process of three state-owned Islamic banks.

Bahana management confirmed that PT Bank BRISyariah Tbk (BRIS) did not rights problem (issuance of new shares).

“Issuance of new shares for that amount [31,13 miliar saham] “It is the implication of the merger or merger mechanism, but it has nothing to do with the issue of rights because in this transaction there are no rights issued to shareholders,” said Eka Putra Aditya, spokesperson for Bahana Sekuritas, in a letter to CNBC Indonesia. , Thursday (10/22/2020).

“With the word ‘rights issue’ you will cause a public misperception that will harm BRISyariah Bank and may be questioned by regulators,” he said.

This was conveyed in the explanation about the merger plan of the three state-owned sharia banks previously reported using the word “rights issue.”

Based on a brief prospectus for the merger of a state-owned sharia bank, the management of the three banks viz. Bank BRISyariah, PT Bank Syariah Mandiri (BSM) and PT BNI Syariah (BNIS), stated that BRIS will issue up to 31.13 billion new shares as a result of the merger or merger of the Islamic banks BUMN.

The total number of new shares issued is 31,130..700,245 shares, therefore the total number of shares will be 40,846,813,743 shares (40.85 billion shares), compared to the previous 9,716,113,498.

The new shares then will be converted by the new shareholder, PT Bank Mandiri Tbk (BMRI) and PT Bank Negara Indonesia Tbk (BBNI).

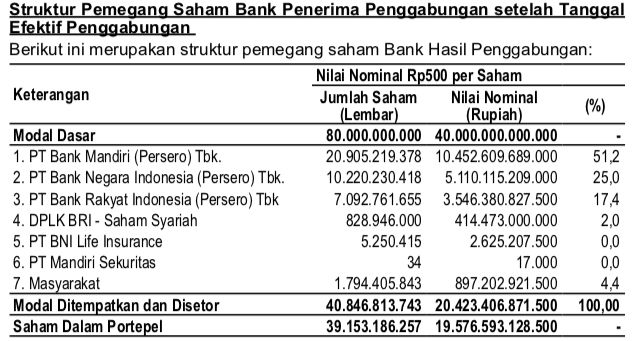

Bank Mandiri will have up to 20.91 billion shares, so that its share will be 51.2% in BRIS (becoming the controller), then BBNI as much as 10.23 billion shares or 25% of BRIS shares.

Another investor, namely PT BNI Life Insurance with 5.25 million shares or 0.00% and PT Mandiri Securities 34 shares or 0.00 with BRIS shares.

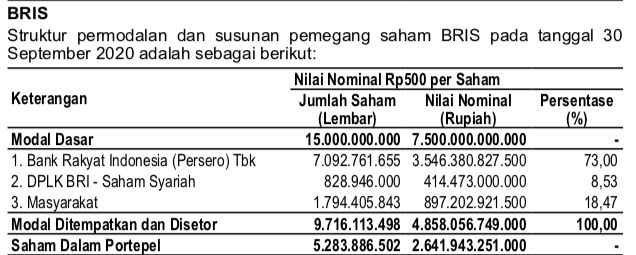

BRIS shareholders before the merger

Photo: BRIS shareholders before the merger, prospectus Photo: BRIS shareholders before the merger, prospectusBRIS shareholders before the merger, prospectus |

Regarding shareholders existing namely PT Bank Rakyat Indonesia Tbk (BBRI) continue to hold 7.09 billion BRIS shares or represent 17.4% of BRIS shares.

Percentage of bank shares BRI in BRIS it declined or diluted from before the merger, which was 73% (with the number of shares set as 7.09 billion shares).

Regarding the number of shares DPLK BRI-Shaiah’s shares also remain the same, that is, 828.95 million shares or portions to 2%, In spite of the percentage diluted before the BRIS merger, which was 8.53%.

Public investors, the number of shares remains the same, that is, 1.79 billion shares or 4.4%, diluted from the previous 18.47% (with the number of shares remaining the same 1.79 billion shares).

BRIS shareholders after the merger

Photo: BRIS shareholders after the merger, prospectus Photo: BRIS shareholders after the merger, prospectusBRIS shareholders after the merger, prospectus |

The prospectus establishes a share conversion plan, each share is owned by one shareholder BSM It is entitled to an additional 34,9700 shares in BRIS (which includes an additional total of 20,910 million shares in BRIS), representing a 51.2% increase in BRIS capital.

Meanwhile, every share owned by shareholders BNIS is entitled to an additional 3,500,2767 shares in BRIS (which includes an additional total of 10,230 million shares in BRIS), representing a 25% increase in BRIS capital.

“Therefore, the number of shares issued by Surviving Bank [BRIS] on the Effective Date of the Merger [1 Februari 2021] for an amount of 40.85 billion shares, of which there will be a new issue of 31.13 billion shares, ”wrote BRIS management.

Based on the evaluation report KJPP Suwendho, Rinaldy and Partners, BRIS’s valuation value is Rs 7.59 trillion.

As of June 30, 2020, the number of BRIS shares outstanding was 9,716,113,498 shares. Therefore, the total valuation per share of BRIS is 781.29 IDR.

Based on the evaluation report KJPP Kusnanto and partners, value valuation BSM is IDR 16.33 trillion. As of June 30, 2020, the number of shares BSM outstanding were 597,804,387 shares. Thus, the total valuation per share BSM is IDR 27,321.67.

Meanwhile, according to the evaluation report KJPP Iwan Bachron and partners, valuation value BNIS is 7.99 trillion IDR. As of June 30, 2020, the number of shares BNIS 2,921,335 shares outstanding. Thus, the total valuation per share BNIS is IDR 2,734,726.87.

“With this addition, then BMRI will be the operator of BRIS as the receiving bank of mergers, “wrote the prospectus.

“Meanwhile, the Government of the Republic of Indonesia indirectly maintains control of BRIS as the Surviving Bank. Therefore, this Merger causes a direct change of control but does not cause an indirect change of control.”

“Furthermore, according to the Rules OJK No. 9 /BOY.04 / 2018 regarding the Acquisition of a Public Limited Company, the changes of control that occur due to a merger of companies are exempt from the provisions for the implementation of the announcement of OPA and OPA and mandatory OPA ”.

[Gambas:Video CNBC](bag of bag)