/data/photo/2014/03/28/1045234Kredit-Mobil-okeh780x390.jpg)

[ad_1]

YAKARTA, KOMPAS.com – Amid large-scale social restrictions (PSBB), several people experienced financial problems due to declining income.

Not a few of those who have to suspend credit payments to financial companies (leasing) until normal conditions.

The government together with the Financial Services Authority (OJK) also offers credit relaxation solutions for sectors affected by the Covid-19 pandemic.

Also Read: Thousands of Vehicles Forced to Roll Back Due to Daring Mudik

Arista Group officially launched a vehicle buying and selling site

Arista Group officially launched a vehicle buying and selling siteThis condition ultimately forced the lease to select stricter consumers who apply for credit, to minimize consumers who do not pay.

Ali Hanafiah, co-founder and director of the Arista Group, said his group is increasing sales with attractive programs and digital services.

This step is believed to make it easier for consumers to purchase vehicles when PSBB. Still, it doesn’t mean that Arista is loosening the terms and conditions for consumers who apply for credit.

Also read: Discounts on bare bikes and bikes at the beginning of Ramadan Translucent millions of rupees

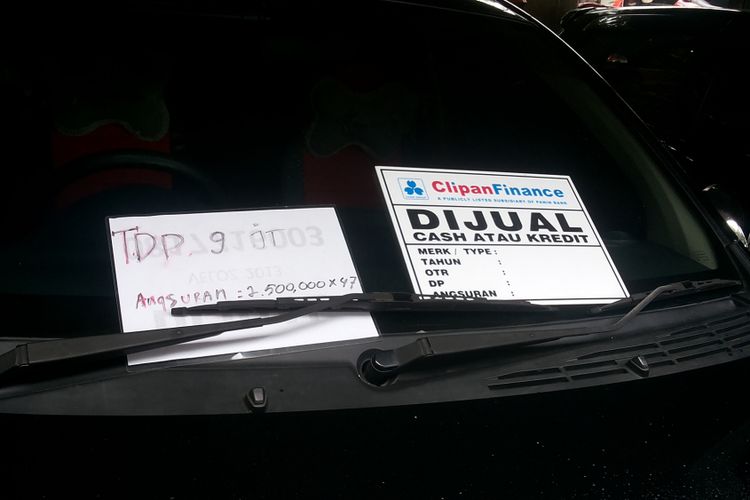

A featured used car unit can be purchased on credit from the Ciliwung Motor dealership, Kelapa Dua, Depok, on Tuesday (2/13/2018).

A featured used car unit can be purchased on credit from the Ciliwung Motor dealership, Kelapa Dua, Depok, on Tuesday (2/13/2018).Ali said his side remained selective in accepting potential clients. According to him, consumers must adjust their credit capabilities when buying a vehicle.

As is known, several distributors have increased the average down payment (DP) by at least 40 percent. Whereas previously there were plenty of low DP deals and light fees for consumers.

“We really maintain the quality of consumers. We work with many large financial companies on vehicle loans. We select their ability to pay with the selected vehicle,” Ali said in a video conference (04/27/2020).

Also read: Knowing the term Tiger Cage, resting place of the AKAP bus driver

Illustration of buying a car

Illustration of buying a carHe added that consumers should adjust the DP with financial capabilities, so as not to overburden credit payments.

“The ideal share is one third of consumer income. If they meet these requirements, we will help them send it to the finance company,” said Ali.