[ad_1]

Jakarta, CNBC Indonesia – Auto industry players are eager to propose tax incentives for the sale of new cars. Furthermore, consumers will also be spoiled with cheaper car prices, such as the Pajero Sport SUV at Fortuner, only around Rp. 300 million, from the normal price of Rp. 500 million.

The price of cars “on the road” could fall by almost half of the taxable price if the 0% tax were actually applied. For example, for this type of SUV, there may be a price reduction of around 45% from the normal price.

“Roughly 40-45% of a car goes to the government treasury. VAT (value added tax) is 10%, PPnBM (luxury goods sales tax) 10-125%, let’s call it 15%. That’s 25% already in the government treasury (Center) Motor Vehicle Name Transfer Transfer (BBNKB) 12.5% and then PKB (Motor Vehicle Tax) 2.5% means 15% goes to the local government. So a total of 40%, “said Chairman I of the Indonesian Automotive Industries Association (Gaikindo). Jongkie D Sugiarto a CNBC Indonesia.

Photo: Illustration by Toyota Fortuner (screenshot from YouTube channel B) Photo: Illustration by Toyota Fortuner (screenshot from YouTube channel B)Toyota Fortuner illustration astrido-toyota.net |

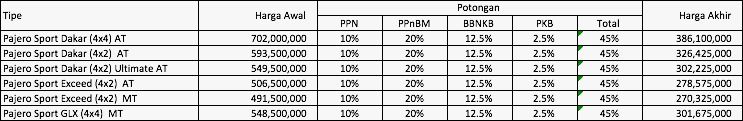

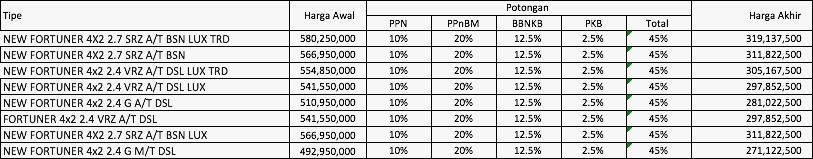

The following is the calculation if the 0% tax is applied to the projected sales price of SUVs such as the Toyota Fortuner and the Mitsubishi Pajero Sport.

1. Price projection for Mitsubishi Pajero Sport if tax is removed.

Photo: Car price Photo: Car priceCar prices |

2. Toyota Fortuner price projection if tax is removed.

Photo: Car price Photo: Car priceCar prices |

(Hello Hello)