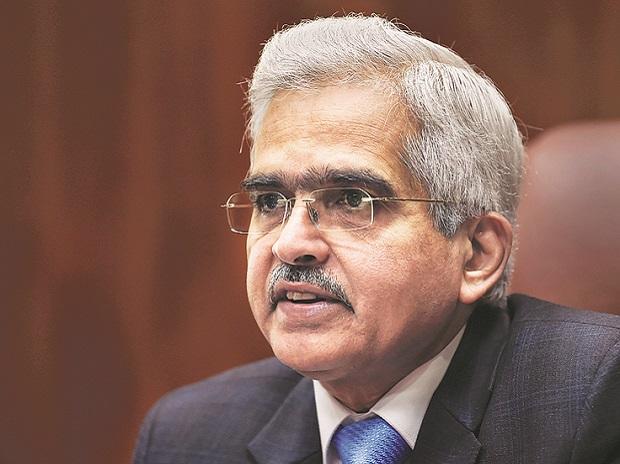

The Reserve Bank of India had to ask HDFC Bank to suspend the launch of digital businesses or the issuance of new credit cards due to the “overwhelming presence” of the lender, Governor Shaktikanta Das said on Friday.

“You see, we cannot put together hundreds of thousands of customers who use digital banking in any kind of difficulty for hours, and especially when we ourselves are placing so much emphasis on our digital banking, it is important that the public trust Digital banking. as it stands today, “Das said, referring to Thursday’s central bank order.

“In the case of HDFC Bank there were also previous episodes and HDFC Bank has an overwhelming presence in the digital payments segment in the Internet banking segment. We have some concerns about certain deficiencies (in the bank). And therefore we are sorry That HDFC Bank is required and necessary to strengthen its security and IT systems before expanding further.

“So therefore this trade restriction has been imposed on them,” he said, adding that he was “quite confident and optimistic that the management of HDFC Bank will abide by our direction.”

The RBI is verifying why the YONO application from the State Bank of India was canceled, but it is too early to specify whether action will be taken against the state lender. HDFC Bank was asked on Thursday to stop expanding its digital products until it introduced a strong information technology (IT) infrastructure, which would affect its reputation as India’s leading digitally focused lender.

ALSO READ: RBI Asks Banks To Withhold Profits, Do Not Make Any Dividend Payments For Fiscal Year 2020

Das, however, declined to specify whether unprecedented measures would form the rule book for dealing with such disruptions as a penalty. Until now, the central bank has imposed a monetary fine on banks, but it is unheard of to stop some operations of a leading bank.

“If it would be the same monetary sanction or if it is a supervisory action. I mean, that depends from case to case, and it will not be appropriate for me to discuss individual cases, “he said in an online media briefing after the central bank announced that it would keep interest rates stable.

“If you want to stay competitive for years to come, technology is key, robustness of your IT system is key. Therefore, banks, NBFCs and other financial entities need to invest more in their IT systems, they need to invest more in technology and strengthen all their systems so that the trust of the public is maintained ”.

ALSO READ: RBI proposes liquidity improvement measures for RRBs, addresses will come soon

RBI works with banks and NBFCs to improve technology. “We will continue to do that. But certain types of actions are fulfilled in certain situations or certain actions become unavoidable and unavoidable. As regulator and custodian of the digital payments segment in the country. I think the central bank also has to act. And that is precisely what we have done, ”said the RBI governor.

Dear reader,

Dear reader,

Business Standard has always strived to provide up-to-date information and feedback on developments that are of interest to you and that have broader political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only strengthened our determination and commitment to these ideals. Even during these difficult times arising from Covid-19, we remain committed to keeping you informed and up-to-date with credible news, authoritative opinions, and incisive commentary on relevant current affairs.

However, we have a request.

As we fight the economic impact of the pandemic, we need your support even more so that we can continue to bring you more quality content. Our subscription model has received an encouraging response from many of you, who have subscribed to our content online. More subscription to our content online can only help us achieve the goals of bringing you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practice the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital editor

.