Gold (XAU / USD) broke consolidation mode to the upside, kicking off a great week on the front foot. New geopolitical concerns between Iran and the United States surpassed hopes for the vaccine and lifted the yellow metal.

Politico reported that Iran is reportedly plotting to kill a US ambassador in response to the assassination of Qassim Soleimani. Meanwhile, clinical trials of the AstraZeneca coronavirus vaccine will resume in the UK after a week-long hiatus due to safety concerns.

Gold bulls are struggling to regain control ahead of a big week, with the FOMC’s decision to steal the show. How is gold positioned ahead of key event risks this week?

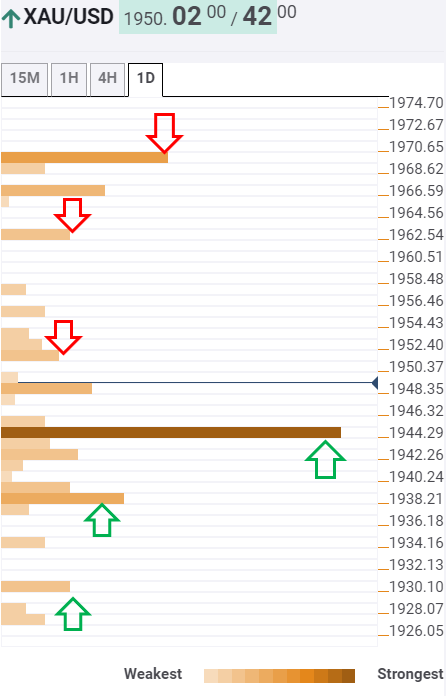

Gold: Key Resistances and Supports

The Technical Confluence tool shows that gold has recaptured the critical barrier at $ 1945, which is the 38.2% Fibonacci convergence in one day, one week, and one month.

Amid the lack of healthy levels of stamina, it appears to be a higher path for bulls.

The next soft limit lines up at $ 1951.50, the Fibonacci 23.6% at one week. Further north, the one-day R2 pivot point at $ 1961 could be tested en route to the previous week’s high of $ 1966.50.

Then the tough $ 1969 hurdle comes into play. That level is the one-day R3 pivot point.

On the other hand, if the bulls give up the aforementioned critical resistance, now supported at $ 1945, sellers could call for a test of the next significant cushion at $ 1938.50 (four-hour SMA50).

The Fibonacci 61.8% one-week support at $ 1930 will be put to the test if the bears take over.

$ 1927 will be the last resort for the bulls, which is the confluence of the one-day R2 pivot point and the four-hour low of the Bollinger Band.

This is how it looks in the tool

About the confluence detector

The TCI (Technical Confluences Indicator) is a tool to locate and indicate those price levels where there is a indicator congestion, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are is very useful for the trader, and can be used as a basis for different strategies.

More information on Technical Confluence

.