The significant development occurred on a day when National Payments Corporation of India (NPCI), which manages UPI, also said it will implement a 30% cap on total payment volumes through a single third-party payment application starting January 1, 2021. For existing third-party applications in UPI They will have two years to comply until January 2023. For WhatsApp and other future applications in UPI, this will apply from next January.

WhatsApp, which has 400 million monthly active users in India, was expected to grab a significant share of users on UPI given its popularity.

One senior banker said that the payout volume limit is to ensure that no player ends up with “the majority of the market share.” “Based on how WhatsApp Pay does over the next two to three months, it would be decided whether its user base can expand further,” added this person. Hereinafter, Google payment and owned by Walmart PhonePe it is UPI leaders who each control almost 40% stake in UPI, as of October. WhatsApp’s entry has long been feared by rivals like Google Pay, PhonePe, Paytm and others, as it can change the dynamics of the industry.

Both announcements came just after UPI recorded 2 billion transactions in a single month for the first time last month. NPCI said WhatsApp can launch on UPI in the multi-bank model, while its 30% payment volume limit will help address risks and protect the UPI ecosystem as it further expands. Industry players have been reluctant to this idea. In fact, PhonePe co-founder and CEO Sameer Nigam told TOI in September that the idea was not a good one and why would someone invest if his leadership is ‘punished’.

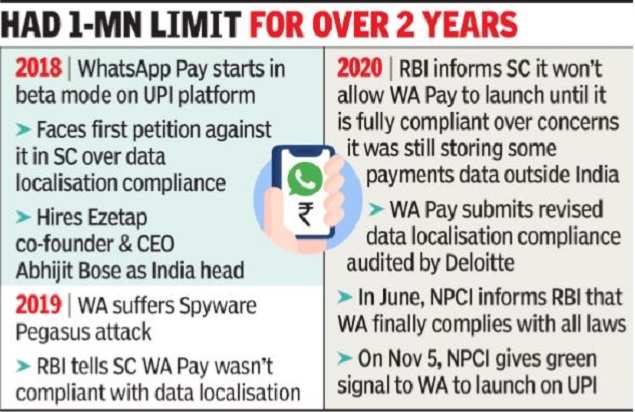

For Facebook-owned WhatsApp, getting the final go-ahead has not been easy. While regulators were unhappy with his compliance with data localization initially, he also faced at least two legal challenges in the Supreme Court where petitions sought his blocked entry into digital payments. In July, TOI reported, citing a letter from NPCI to RBI that was sent in June, which confirmed compliance with the WhatsApp data tracing to the banking regulator. But then no approval was given.

“The only player who can be hit immediately with this market share cap is WhatsApp because they are the new player. One fear was that WhatsApp would go with the whole market and this is a middle ground to pave the way for its launch, ”said Deepak Abbot, a payments industry veteran and co-founder of fintech startup Indiagold.

He also added that implementing a market share cap for businesses will be another challenge as they may have to implement a user level or hourly cap on transactions, which will affect the customer experience. “But how will players know if they have reached the 30% limit will be the questions, since they do not know exactly how many transactions their rivals are making at any given time,” he added.

The banker quoted above said NPCI is expected to issue more guidance over the next 30 to 45 days on implementation so that the consumer experience is not affected. “The 30% limit will be calculated based on the total volume of transactions processed in UPI during the previous three months (continuously),” added the NPCI circular.

A WhatsApp spokesperson did not immediately comment on the regulatory go-ahead. Spokespersons for Google Pay, PhonePe and Paytm also did not offer comment on the market share cap.

.