Updated: September 21, 2020 3:30:38 pm

Wells Fargo’s SBLC unit found that none of the companies named in the application (applicant Aerocom UK, beneficiary KPH Dream Cricket, guarantor NVD Solar) were on the bank’s customer lists.

Wells Fargo’s SBLC unit found that none of the companies named in the application (applicant Aerocom UK, beneficiary KPH Dream Cricket, guarantor NVD Solar) were on the bank’s customer lists.

The Indian Premier League, with its biggest auctions and major sponsors, has also appeared on the radar of the US financial regulator, in a network of transactions involving a leading US bank, a little-known venture. from the UK, a sponsor from Kolkata. an IPL team and allegations of fraud and forgery.

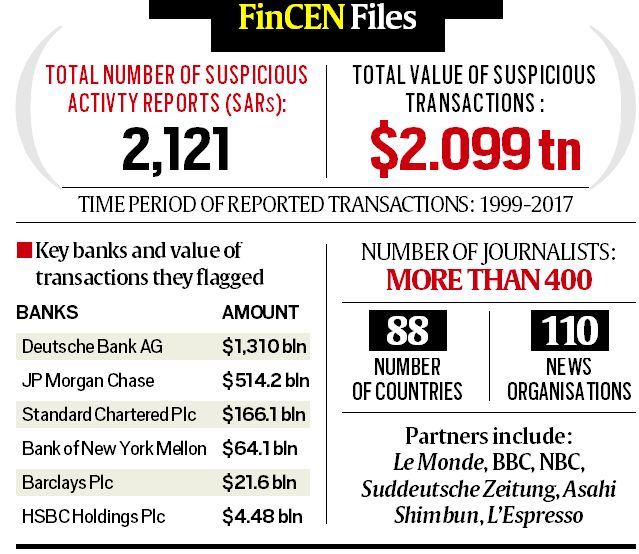

These are the core elements of a Suspicious Activity Report (SAR) filed with the United States Financial Crimes Enforcement Network (FinCEN), according to records investigated by The Indian Express.

Read also | FinCEN Archives – One More Veil Lifted: Suspicious Indian Banking Transactions Red Flagged to US Top Regulator

In 2013, KPH Dream Cricket, which runs Kings XI Punjab, went to court against team sponsor NVD Solar International Ltd for “tricking and misleading” them with $ 3 million in sponsorship fee. The SAR, presented by San Francisco-based Wells Fargo Bank, offers a clue as to what went wrong.

In 2013, the bank had received “a $ 2,975,460 SBLC (Standby Letter of Credit) from Deutsche Bank AG in London” with KPH Dream Cricket as beneficiary. Aerocom UK Ltd, an air tubing manufacturer, applied for the SBLC for nearly $ 3 million, with no apparent ties to the team or sponsor.

The SBLC said that “in the event of default by the obligee, NVD Solar International Ltd of Dhaka, Bangladesh, would have to pay the amount owed under the terms of the contract.”

However, according to the SAR filed by Wells Fargo, the SBLC was found to be “fraudulent” and was “rejected.”

Wells Fargo’s SBLC unit found that none of the companies named in the application (applicant Aerocom UK, beneficiary KPH Dream Cricket, guarantor NVD Solar) were on the bank’s customer lists. It concluded that “SBLC is believed to be false as a search of Wells Fargo’s electronic messaging system does not show the receipt for this transaction,” according to the SAR.

Read also | Fincen Files – On America’s Radar: Dawood Financier Ibrahim, His Wash, Lashkar Financing, Jaish

Meanwhile, an investigation by Wells Fargo’s Trade Finance Investigations unit found that a signature of one of its officials was forged on the electronic copy of the SBLC, according to the SAR.

It also found that an email sent to the bank’s International Wholesale Banking unit, using the internal address of a Wells Fargo employee, was fraudulent and that a business purpose could not be established to support the request, the SAR states.

Aerocom (UK) Ltd owner John Hughes did not respond to multiple calls and emails from The Indian Express seeking comment on its links to NVD Solar. Incorporated in 2000, Aerocom is a pneumatic engineering company dealing with air tube systems and supports. In 2013, the Nottingham-based company reported a net asset of £ 0.6 million.

NVD Solar did not respond to multiple emails from The Indian Express seeking comment. In August 2019, an order from the Calcutta High Court in a case related to the company stated that the directors of NVD Solar “could not be found.”

Read also | FinCEN Archives – Revealed: How Jindal Steel sent funds overseas and obtained them in the same period

Established in Kolkata in 2003, NVD Solar Ltd started operations in Bangladesh in 2012. In 2015, regulator Sebi ordered the seizure of NVD Solar’s bank accounts for the recovery of Rs 1,000 crore after the company failed to meet the deadline for Refund Rs 594 crore supposedly. illegally collected from the public. The company is in liquidation.

KPH Dream Cricket declined to comment. But company sources told The Indian Express that NVD Solar’s fees have yet to be recovered.

Read also | Swiss Leaks, Panama Papers, now SAR: Bank Reports Alerting Law Enforcement

According to a PTI report in October 2013, KXIP co-owner Ness Wadia had alleged that the team received only Rs 42 lakh from the endorsement deal for Rs 14.3 crore and that NVD Solar gave “fake accounts of Deutsche Bank London, Wells Fargo Bank New York, Common Suisse Bank Limited, fake message from Swift, fake names of officials, they even sent us emails from fake IP addresses ”.

When contacted, a Wells Fargo spokesperson said: “Wells Fargo has strong anti-money laundering policies and procedures in place, and we comply with all applicable laws and regulations related to financial crime. We cannot provide further comment. “

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For the latest news exclusive to Express, download the Indian Express app.

.