Analysts believe so, although there are still those who feel that the company’s inability to generate healthy cash flows may limit its march to a credible and rapid recovery.

Vodafone Idea, which was formed after the merger of Vodafone and Cellular Idea of Birla after the disruptive launch of Trust Jio, has never managed to show synergy benefits, even as it runs out of cash and loses coveted customers to rivals Jio and traditional competitor Airtel. “For the company to turn around, it urgently needs a strong inflow of funds, global partnerships and a healthy cash register,” said a senior analyst, who requested anonymity.

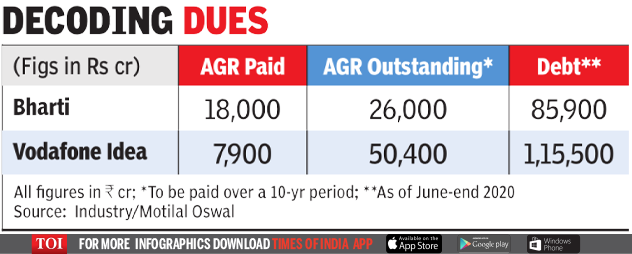

Vodafone Idea shares took a hit as it closed the day at Rs 8.9 on BSE, down 13%. Airtel grew 6% and Dependency industries (Jio’s father) by 0.5%. “Even though this (AGR payment judgment) is a kind of relief, it would still be extremely difficult for Vodafone Idea to manage its finances due to the large amount of interest and payments from AGR,” said Hemang Jani, equity strategist at Motilal Oswal. TOI. “It is doubtful how they would run their business, unless new funds come into the company.”

Prashant Singhal, Ernst & Young India’s main telecom partner, said “the worst seems to be over” for the company, as the uncertainty about its payment tenure and its fees is behind it. “The company will now base its business parameters on this reality. Not everything is lost. They can survive, ”Singhal said.

Legal eagle Mukul Rohatgi, who represented Vodafone Idea in the high court, also said that the difficult period is behind us for the company. “They will survive.”

.