[ad_1]

At one point, the resourceful had given up much of the profit only to recoup it later. Bank Nifty outperformed Nifty, and most of the gains on the front-line index came from financial stocks.

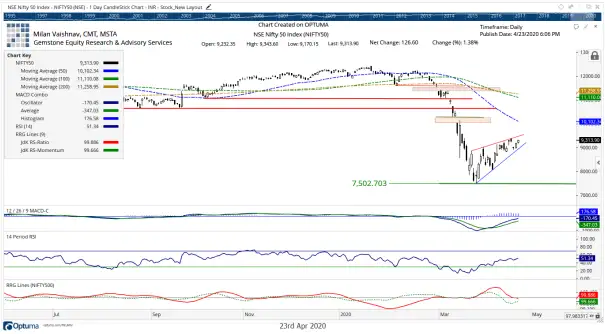

The weekly expiration of options also dominated the procedures. Nifty finally closed with a net advance of 126 points, or 1.38 percent. Nifty is currently trading in the Rising Wedge formation, and is moving towards the upper trend line of this area pattern, which is likely to trigger some resistance. Any higher movement beyond this point is expected to invite profit taking.

INDIA VIX volatility index decreased another 8.39% to 39.2300. Every move higher from the current level will now have to be treated with a high degree of caution.

Nifty is likely to see 9,350 and 9,385 acting as key resistance on Friday, while supports will hit the 9,170 and 9,100 levels. Any corrective move expands the trading range.

ET TAXPAYERS

The PPO price oscillator indicator remains positive on daily charts. The relative strength index (RSI) was 51.34. It has reached a new high of 14 periods, which is a bullish signal. RSI is neutral and shows no divergence against price. The daily MACD remains bullish, and is trading above the signal line.

Pattern analysis continues to show that Nifty is operating in the Rising Wedge formation. Such area patterns often form after strong bear market manifestations and are supposed to be treated with caution.

Given the current technical setup, we recommend using any upward movement, if it occurs, to protect gains in existing positions. Rather than chasing the upward movement with new purchases, it would be prudent to guard your earnings vigilantly. The main reason behind this approach is that the higher the market goes, the closer to the higher the wedge resistance trend line is. This is likely to trigger profit taking at higher levels. While protecting gains at current and higher levels, a cautious approach to the day is recommended.

(Milan Vaishnav, CMT, MSTA is a consulting technical analyst and founder of Gemstone Equity Research & Advisory Services, Vadodara. He can be reached at milan.vaishnav@equityresearch.asia)

[ad_2]