At a press conference, he set the value of the package at Rs 2.65 lakh crore, including production linked incentives (PLI) of nearly Rs 1.5 lakh crore for 10 sectors which was approved by the Union Cabinet on Wednesday. The PLI scheme spans five years, while several of the announcements made on Thursday, such as the improved allocation for the fertilizer subsidy and PM Aawas Yojana in urban areas, will see spending during the current financial year.

This is also a departure from the past, when the government was accused of providing little budget support and instead piggybacking banks and other intermediaries to deliver goods during the pandemic. The government is ready to support the recent recovery, as is evident from a series of economic data.

The economy has endured the brunt of the Covid-19-induced lockdown and contracted a record 23.9% in the June quarter.

Including the steps announced by the Reserve Bank of India since the closure at the end of March, Sitharaman said, the government and central bank together have provided a stimulus of around Rs 29.9 lakh crore, which is almost 50 % higher than the budgeted income for the year. The size of the stimulus now amounts to 15% of GDP, the minister estimated.

Today’s Aatmanirbhar Bharat Package continues our efforts to help all sectors of society. These initiatives will help create jobs, alleviate stressed sectors, ensure liquidity, boost manufacturing, energize real estate and support farmers, “Prime Minister Narendra Modi said on the microblogging site Twitter.

Barclays He said the fiscal deficit could exceed 7% of GDP this year, compared to the 3.5% budgeted, but the government seemed willing to support steps to revive the economy. Market indebtedness has already increased to help keep the economy healthy.

The last group of measures came amid an improvement in several indicators, which Sitharaman listed. On Wednesday, RBI warned that with growth expected to contract during the September quarter as well, India is headed for a recession as it would turn it into two consecutive quarters of falling economic output. The FM was based on RBI’s assessment that economic recovery can take place from the third quarter, which is earlier than previously projected.

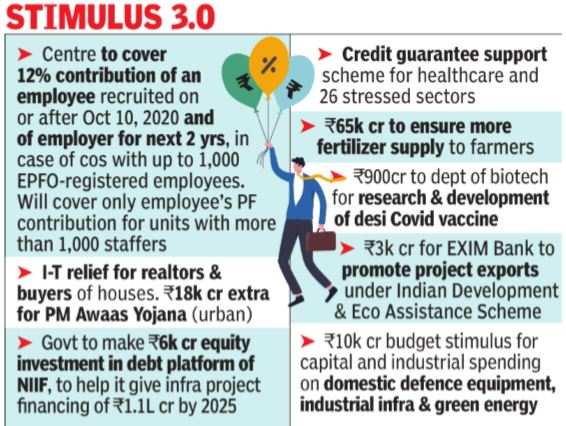

To support the recovery and encourage recruitment especially in the organized sector, said the Center, it will provide 24% of salaries as a contribution to the provident fund of employees who earn up to 15,000 rupees a month in entities that have fewer than 1,000 employees, exercise that will cover more than 99% of the employers registered in the Organization of the Provident Fund for Employees (EPFO). For entities with more than 1,000 employees, 12% of the salary will be given as a subsidy to cover the employee’s contribution. The benefit will be available to those who were previously not part of the EPFO network or who lost their jobs between March and September. Rs 10 billion was also provided for rural jobs.

The movement it is an extension of a previous benefit, which has had an outlet to support employee employment of Rs 1.2 crore.

There were also measures such as support to allow loan restructuring in various sectors based on the government guarantee if the outstanding credit was between Rs 50 million and Rs 500 million, a long pending demand from the industry. However, the benefit will be limited to companies that had 30-day late payments at the end of February. The move is part of the Rs 3 lakh crore package that was previously limited to MSMEs, which has also been extended until the end of March.

Furthermore, the government has tried to provide support to the real estate sector to offset the inventory of apartments that cost up to Rs 2 crore and are sold below the circle rate for the locality.

There were also subsidies for contractors engaged in infrastructure construction and an increase in the allocation of subsidies for fertilizers to help farmers.

.