The restrictions imposed by the Finance Ministry on more than 80 government departments and ministries at the beginning of the year to preserve cash were relaxed this quarter. Additionally, this year’s budget will be increased from its current Rs 30 lakh crore ($ 407 billion) when new spending plans are announced on February 1, according to people familiar with the discussions, who asked not to be identified because the information did not. it is public and subject to change.

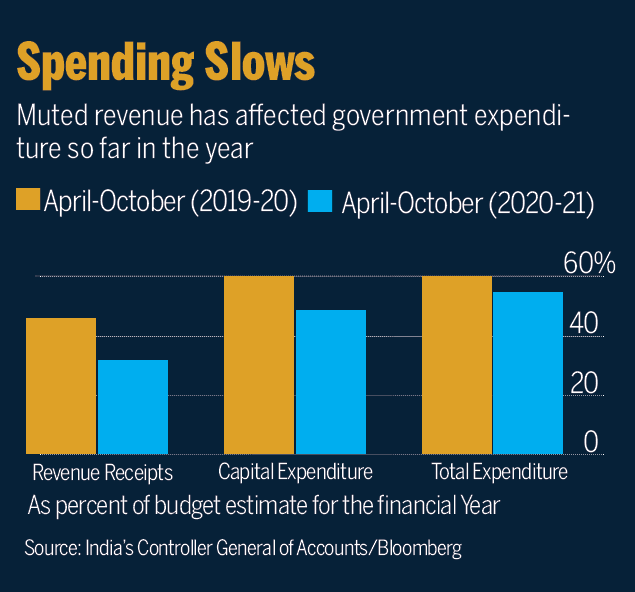

The developments will drive much-needed spending to help weather the impact of the coronavirus pandemic. Government spending has barely reached halfway through the seven-month fiscal year, which began in April.

Government spending is key to avoiding a protracted crisis in the nation that is home to the world’s second-largest coronavirus outbreak. The economy entered an unprecedented recession last quarter after lockdowns brought economic activity to near standstill in the April-June period.

In addition to budget spending, the Modi government has announced measures it said are worth an additional 30 lakh crore rupees, or 15% of gross domestic product, to rescue businesses and jobs.

Disappointing steps

That package, however, disappointed some economists who saw the real fiscal cost of the steps, which were mostly loan guarantees, at less than 2% of gross domestic product. This compares with direct spending of about 3% of GDP on average in other emerging markets, according to S&P Global Ratings. In addition to that, the absence of private investment added to the urgency for the government to increase spending, which was only 55% of the amount budgeted as of October.

The threat of a credit rating downgrade to trash deterred officials from providing a more immediate boost to the economy through direct cash donations to citizens or tax cuts. India’s net government debt will rise to more than 90% of GDP this year from just over 70% last year, according to S&P Global Ratings, and its combined fiscal deficit will be in the double digits this year, factors that have put the nation on track for a rating cut.

Clear need

Finance Minister Nirmala Sitharaman said in an interview this month that she would not let concerns about a fiscal deficit keep her from spending more.

“There is a need, and a clear need, for me to spend the money,” Sitharaman said.

The Finance Ministry declined to comment this week on the possibility of increasing the current budget.

The government budget gap is likely to widen to 8% of GDP this year, according to a Bloomberg survey, as revenue collection suffers from the economic downturn and the need for additional stimulus measures drives borrowing. That will be more than double the 3.5% forecast.

The government expanded its market loan scheme this year to an unprecedented Rs 13.1 lakh crore from its planned Rs 7.8 lakh crore. The increase is necessary to compensate the states for the deficit in the collection of taxes on goods and services.

High-frequency indicators show that a recovery is taking hold, and the central bank is watching the nation emerge from a recession in the current quarter. The Reserve Bank of India also revised its full-year growth outlook this month to a milder contraction of 7.5%, compared with its October estimate of a 9.5% decline.

“More evidence has been presented to show that the Indian economy is emerging from the deep chasm of Covid-19 and is re-inflating at a rate that exceeds most predictions,” the RBI said in its December bulletin, after committing to keeping borrowing costs low for the near future. “Although headwinds are blowing, strong efforts by all stakeholders could put India on a faster growth trajectory.”

.