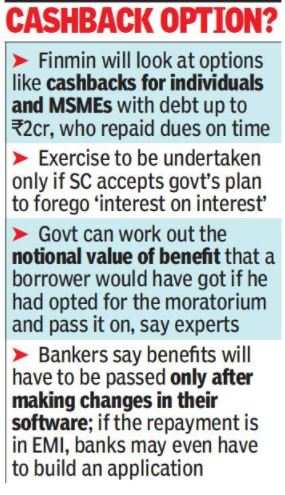

“It is possible to calculate the notional value of the benefit that a borrower would have received if he had opted for the moratorium. The government can pass this on to those who paid their fees. It would be unfair to ignore those who have been paying their fees despite difficulties, “said a government source.

While the details have not yet been worked out, as the numbers are still awaited, a comprehensive exercise will be conducted only if the Supreme Court accepts the ministry’s proposal to renounce “interest on interest.” On Saturday, TOI published an exclusive story detailing the government’s presentation to the Supreme Court.

Farm loan exemptions, announced by states in the past, had been criticized by both the Center and the RBI on the grounds that honest borrowers were being penalized.

‘The cost of relief to the government shall not exceed Rs 5,000-Rs 7,000cr’

According to Anil Gupta, vice president of the ICRA rating agency, the government can provide relief to those who have made payments on time by reducing a Theoretical amount of “interest on interest” of your outstanding principal.

“Assuming that no more than 30-40% of total bank and NBFC loans will be eligible for relief, the cost to the government should not exceed Rs 5,000-7,000 crore. This is assuming that all borrowers receive relief regardless of whether they used the moratorium or not, “he added.

Officials said there were a large number of people availing themselves of the moratorium throughout the six-month period, but there were also some borrowers who used the facility for only a limited period of time, including delaying their EMIs for a few days. .

“It is a complex calculation and the government does not have all the figures at the moment, especially from all the NBFCs and the housing finance companies,” said a source.

In response to questions about whether the government has changed its mind after its initial reluctance in the Supreme Court, a senior official said the Center was not dogmatic and was open to reconsideration. The government has shown interest in addressing the sections affected by the pandemic and the Rs 2 crore exemption and cap reflect this, the official said.

According to the bankers, there will be no discretion to grant relief and the benefits will have to be passed on after making changes to their software.

“In case the refund is in matched monthly fee (EMI), banks may have to create an application to implement the relief. The effect of the moratorium was an extension of the mandate (maintaining the same EMI) or a higher EMI (maintaining the same mandate). Your interest in interest relief will be reflected in a reduced number of installments or a slightly lower EMI for the same period. ” IDBI Bank said MP Dr. Samuel Joesph Jebaraj.

The government’s decision to compensate lenders also addresses RBI concerns that banks and NBFCs will pay what is largely a social benefit in times of Covid-19, where multiple borrowers have to function on lower or lower incomes. , in some cases, even without work.

.