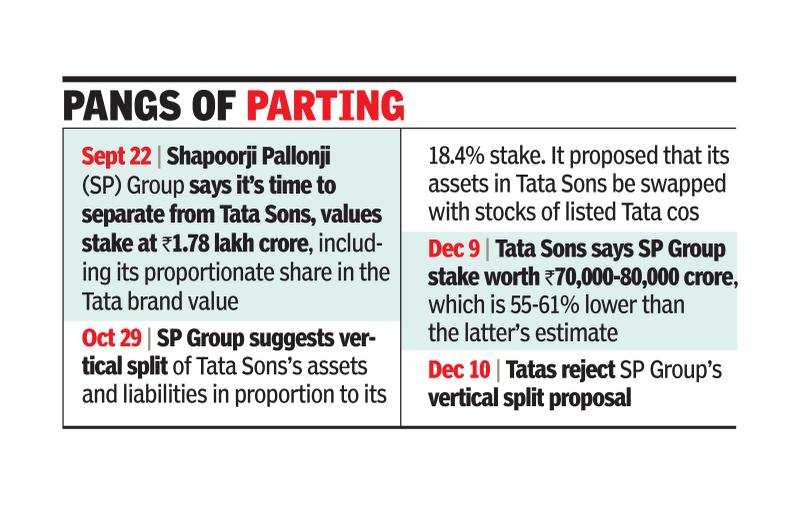

When asked if SP’s proposal is sustainable at this stage, Tata Sons said: “No. In the best case, if (SP) wins the case, the court can ask the majority shareholder to buy his stake at fair market value. “On Tuesday, Tata Sons had told the SC that he had valued SP’s stake. at Rs 70,000-80,000 crore, which is 55-61% lower than the minority shareholder’s estimate of Rs 1.78 lakh crore. SP’s estimate included its proportional share in the value of the Tata brand, with a value of Rs 1.46 lakh crore, based on Brand Finance’s 2020 ranking.

“SP is also seeking an 18.4% stake in the value of the Tata brand. How can they be rewarded for damaging the Tata brand? “Argued Tata Sons, and stated that the proposal is” similar to the dissolution of Tata Sons. ” Interestingly, the minority shareholder, weeping over the oppression, wants to compound his problems by seeking pro-rated shares in Tata’s listed companies instead of his 18.4% stake in Tata Sons, the holding company said.

“Accepting his proposal could spread the problem from Tata Sons to its listed downstream companies, where SP would have minority stakes.” Tata Sons said: “The only way to resolve the deadlock is for one of the two sides to withdraw. And you can only ask the minority to withdraw. ”

SP argued that a for-profit company is not a criterion for deciding whether there is oppression or mismanagement. “Unfair treatment of a minority shareholder is also an act of oppression,” he said. The question is “whether the affairs of a company are managed in a way that harms the members or the public interest.” “All the conduct by which Tata Sons became a limited liability company showed that SP was being marginalized.”

SP further stated that Tata Sons does not do any business on its own, but nonetheless its directors make decisions for subsequent companies. Tata Sons had told the SC that certain matters require the consent of the majority of the directors nominated by the Tata Trusts. Tata Trusts owns more than 65% of the holding company and was the driving force behind the removal of SP Scion Cyrus Mistry from the position of president.

The minority stakeholder told the SC that everything came to a head because Mistry was going to file a corporate governance document to regulate the Tata Trusts’ opinion on the holding company so that two nominated directors don’t decide everything for subsequent entities. He also argued that elsewhere, decisions are generally made by the respective company boards, but in Tata’s operating companies, Tata Sons has a role to play in these decisions.

.