Updated: September 21, 2020 7:27:22 am

From the steel industry to the sponsor of IPL, from diamond traders to those under ED, CBI scanner, various Indian individuals and entities have been referred in secret reports by banks to the US Treasury Financial Crimes Enforcement Network. USA

From the steel industry to the sponsor of IPL, from diamond traders to those under ED, CBI scanner, various Indian individuals and entities have been referred in secret reports by banks to the US Treasury Financial Crimes Enforcement Network. USA

What are FinCEN files?

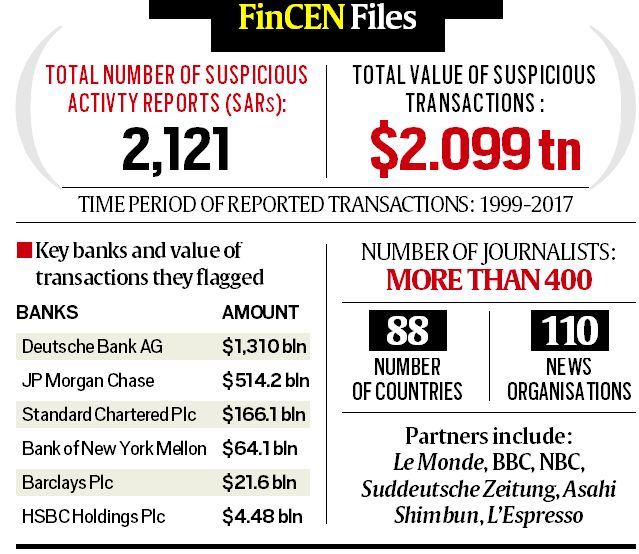

the FinCEN Archives View a set of over 2,100 “Suspicious Activity Reports” (SAR) (see next question) filed by banks with the US Department of the Treasury Financial Crime Control Network, the agency that acts as the primary world regulator in the battle against money. Whitening.

The files identify at least $ 2 trillion in transactions between 1999 and 2017 marked as possible evidence of money laundering or other criminal activity by the compliance officers of banks and financial institutions.

So what is a SAR? When should they appear?

The SAR or Suspicious Activity Report is a document submitted by banks and financial institutions to report suspicious activities to US authorities, in this case, FinCEN. These are confidential, so secret that banks cannot confirm their existence. In fact, even the account holder does not know when a SAR related to a transaction is filed on that account.

SARs are filed with FinCEN in a prescribed format and are intended to be a red flag, within 30 days of the transaction occurring: criminal funds or any form of dirty money; insider trading; potential money laundering; financing of terrorism; any transaction that raises suspicions.

Read | On the US radar: Dawood financier Ibrahim, his laundering, Lashkar financing, Jaish

These include round dollar amounts, for example, $ 100,000, that are sent in multiple transactions; transfers in which there is no apparent economic connection between the parties (a diamond dealer paying a pizzeria for computer parts); transactions in high risk jurisdictions (tax havens, conflict zones); transactions to / by PEPs (politically exposed persons) and, finally, adverse media reports on the parties.

Who can file a SAR?

Banks, of course, but now that list has been expanded to include exchange houses, brokers, casinos. Failure to submit RAS can carry heavy penalties. In recent years, Deustche Bank, HSBC and Standard Chartered Bank, among others, have received huge fines for inadequate supervision. Credit card systems are not required to submit RAS and all taxpayers must maintain RAS records for five years.

Read | Bank reported fraud, UK link of IPL team sponsor

But, is the SAR a test of criminality, illegality? If not, what is its significance?

A SAR is not an accusation, it is a way to alert regulators and law enforcement agencies to possible irregular activities and crimes. SARs are shared by FinCEN with law enforcement authorities, including the US FBI, Immigration and Customs.The SARs are used to detect crimes, but not as direct evidence to prove legal cases. In the world of international finance, where money moves under multiple layers to escape or avoid taxes, SARs are the first red flags.

Read | Revealed: how Jindal Steel sent funds abroad and obtained them in the same period

Is there an equivalent of the SAR in India?

Yes. The Financial Intelligence Unit of India (FIU-IND) performs the same functions as FinCEN in the US Under the Ministry of Finance, it was created in 2004 as the nodal agency to receive, analyze and disseminate information related to suspicious financial transactions.

The agency is authorized to obtain Cash Transaction Reports (CTR) and Suspicious Transaction Reports (STR) and Cross-Border Wire Transfer Reports from public and private sector banks every month under the Prevention of Money Laundering Act ( PMLA). Banks in India are required to provide a monthly CTR to the FIU on all transactions of more than Rs 10 lakh or its equivalent in foreign currency or a series of integrally connected transactions totaling more than Rs 10 lakh or its equivalent in currency foreign. .

ROS and CTRs are analyzed by the FIU and suspicious or doubtful transactions are shared with agencies such as the Compliance Directorate, the Central Investigations Office and the Income Tax in order to launch probes to verify possible cases of money laundering. money, tax evasion and financing of terrorism. . FIU’s 2017-2018 annual report reveals that it had received a record 14 lakh number of RTS after demonetization, which was three times the number of RTS submitted the previous year.

How is FinCEN Files based on the Panama Papers, Paradise Papers, and the offshore leak series?

Countries keep their bank transaction alerts within their borders. FinCEN’s files indicate that after the series of disclosures and leaks of holdings abroad in tax havens, the veil of confidentiality can be lifted even on wire and bank transfers.

One benchmark was the publication of the Panama Papers in 2016 and, as calculated by the ICIJ last year, the total tax collected after the global media investigation was $ 1.2 billion.

In India, the figures provided by the Central Board of Direct Taxes (CBDT) are not for taxes collected but for undeclared taxes collected which as of mid-2019 stood at Rs 1,564 crore.

📣 Express explained is now in Telegram. Click here to join our channel (@ieexplained) and stay up to date with the latest

What clues could the FinCEN archives give researchers in India?

The clear message for agencies in India is that their cases of financial fraud and corruption are being flagged by the world’s most powerful regulator. Because, FinCEN files contain SARs that, in many cases of Indian entities and individuals, mention their financial history of alleged wrongdoing. There are details of the bank transactions that give a clear indication of round trips, money laundering, or dealing with shell-like entities. For the Indian banking sector, FinCEN’s files highlight the dangers posed by correspondent banking and pose the very pertinent question: were the thousands of transactions involving Indian entities and individuals flagged by FinCEN also flagged by banks to the FIU here? Especially since 44 Indian banks have been named in the secret data and, if so, what was the result?

How did these files get to ICIJ and The Indian Express?

These records were collected by Congressional committees investigating Russian interference in the 2016 US presidential election. BuzzFeed News obtained these records and shared them with the International Consortium of Investigative Journalists. ICIJ has partnered with a team of news organizations to investigate the secret world of banking and money laundering. The Indian Express is your partner in India.

BuzzFeed News referenced these SARs in 2018 to reveal secret payments to shell companies controlled by Paul Manafort, who is now serving a federal prison sentence at his home in a case based primarily on these transactions. A former US Treasury Department official, Natalie Mayflower Sours Edwards, has been charged with conspiring to unlawfully disclose documents to Buzzfeed. Buzzfeed has not commented on its source.

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For the latest news explained, download the Indian Express app.

.