ED arrests Deepak Kochhar in ICICI Bank-Videocon case

Deepak Kochhar, the husband of the former CEO and CEO of ICICI Bank Chanda Kochhar, was arrested by the Directorate of Enforcement (ED) in Mumbai. The source confirmed to CNBC-TV18 that Deepak was arrested on September 7 in connection with investigations into alleged financial irregularities between ICICI Bank and Videocon. As reported by PTI, officials said Deepak was arrested by the agency in Mumbai under sections of the Prevention of Money Laundering Act (PMLA). The couple was questioned by the central investigative agency in a case of alleged irregularities and money laundering in the granting of bank loans to the Videocon group. The ED earlier this year also attached assets of Rs 78 million “in possession” of Chanda Kochhar, Deepak Kochhar and the companies they own and control. More here

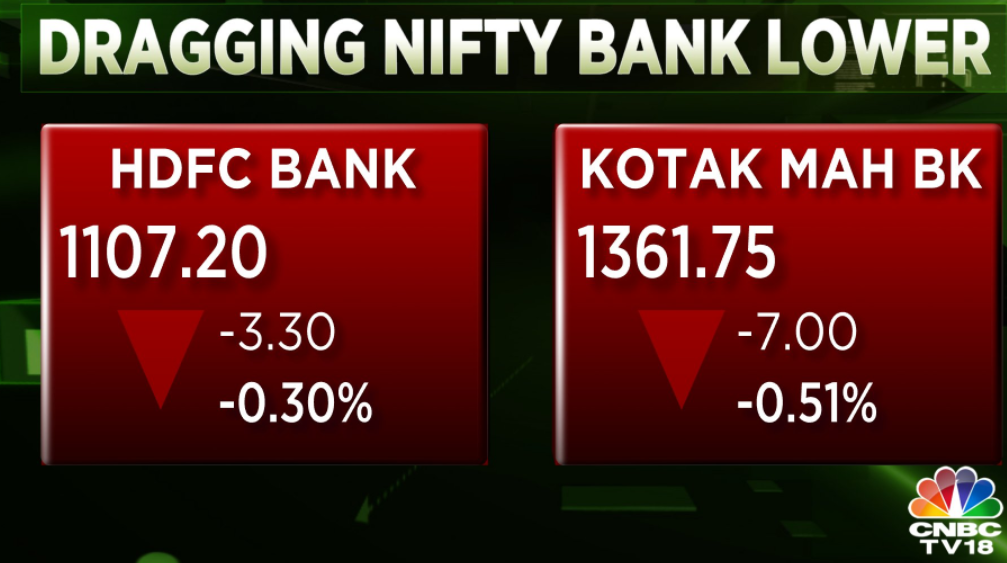

HDFC Bank and Kotak Mahindra contribute more than 40% to Nifty Bank’s losses currently

Opening bell: Sensex, Nifty opens on a muted note; finance drag

Indian indices opened on a subdued note Tuesday as the slide in financial stocks was limited by gains in heavyweights such as RIL, Infosys and ITC. At 9:18 a.m., the Sensex was trading 54 points lower at 38,363 while the Nifty was down 17 points at 11,338. The broader markets were also flat, in line with benchmarks. Across sectors, the banking and fine services indices fell about 0.4 percent in early transactions, while the IT, pharmaceutical and real estate sectors were in the green at the open. In the Nifty50 index, RIL, ITC, L&T, HDFC Life and Axis Bank were the main winners, while Bharti Infratel, Powergrid, Nestle, HDFC and ONGC led the losses.

Oil mixed after falling on demand concerns after US holidays

Oil prices were mixed in early trading Tuesday on looming demand for concerns about a possible spike in COVID-19 cases after the U.S. Labor Day long weekend. Coronavirus cases rose by 22 of the 50 US states, showed a Reuters analysis, on the holiday weekend, traditionally packed with gatherings to mark the end of the summer. At the same time, cases are increasing in India and Great Britain. US West Texas Intermediate (WTI) crude futures fell 64 cents, or 1.6 percent, to $ 39.13 a barrel at 0221 GMT, catching up with a drop in Brent prices overnight. Brent crude futures rose 6 cents, or 0.1 percent, to $ 42.07 a barrel, after falling 1.5 percent on Monday.

Global markets: Stocks stabilize, trying to ignore scare of US tech defeat.

Asian stocks and US equity futures regained some balance on Tuesday after a small rally in European markets as investors looked to see whether high-flying US tech stocks could rebound from their recent slide. Japan’s Nikkei advanced 0.4 percent as revised data confirmed that the nation had slumped into its worst postwar contraction, and business spending was hit harder by the coronavirus than initially estimated. China’s first-class index rose 0.2 percent, while Hong Kong’s Hang Seng gained 0.6 percent, even as President Donald Trump stepped up his anti-China rhetoric on Monday by raising the idea again. decoupling the economies of the United States and China. More here

New fire hits oil supertanker in Sri Lanka

Firefighters are again fighting the flames aboard a fully loaded oil supertanker off Sri Lanka, the island’s navy said on Monday, four days after the New Diamond fire broke out. “New flames have emerged in the funnel section of the MT New Diamond Supertanker and firefighters are fighting the fire using foam to contain the fire,” said Navy spokeswoman Captain Indika de Silva, adding that the fire had not reached the oil load of around 2 million barrels. A fire broke out for the first time last Thursday in the engine room and spread to the bridge of the large crude oil transport ship, chartered by Indian Oil Corp to import oil from Kuwait. That fire went out on Sunday. The tugboats had been spraying water on the ship Monday to keep the metal cool, but strong winds ignited the flames once again, De Silva said. More here

Some global signals this morning

Top CNBC-TV18 Actions to Watch Out For September 8

SBI | The bank plans to hire more than 14,000 people this year.

Dr. Reddy’s Labs | The company has launched Fulvestrant injection in the US market.

Future companies | The company reported a consolidated net loss of Rs 394.77 crore in the fourth quarter of 2020 versus a net profit of Rs 66.58 crore.

Click here for more

Happiest Minds IPO was subscribed 2.87 times on day 1

The initial public offering of IT services firm Happiest Minds Technologies was subscribed 2.87 times on Monday’s first day of bidding. The IPO received offers for 6,67,09,800 shares against a total issue size of 2,32,59,550 shares, according to data available from the NSE. The Qualified Institutional Buyers (QIB) category subscribed to 8%, non-institutional investors 62% and individual retail investors 14.61 times. Happiest Minds Technologies has raised Rs 316 crore from anchor investors. The IPO will close on Wednesday (September 9). The offering price band has been set at Rs 165 to Rs 166 per equity share.

Fitch revises India’s fiscal deficit forecast for fiscal year 21 to 8.2% of GDP from 7.2%

Global credit rating agency Fitch has revised India’s central government’s fiscal deficit forecast for fiscal year 21 to 8.2 percent of GDP from 7.2 percent due to a higher government willingness to spend. than expected amid weak revenue collection. The rating agency also forecasts a total public deficit, including the state deficit for fiscal year 21, at 11.8 percent of GDP. This is due to a faster-than-anticipated divergence in expenses and non-debt income, which caused the deficit to exceed the full-year target in just four months, Fitch said. More here

First, here is a quick update on what happened in the markets on Monday

Indian indices finished slightly higher after a volatile session on Monday led by TI, consumer goods stocks and heavyweights HDFC and RIL. Investors ignored the caution as the country became the second worst hit country by the coronavirus and the Wall Street sell-off. The Sensex finished 60 points higher at 38,417 while the Nifty rose 40 points to 11,374. The broader markets were mixed with Nifty Midcap down 0.7 percent and Nifty Smallcap up 0.2 percent. Most of the sectors turned positive in the last stage of the operation. Nifty FMCG and Nifty IT each increased more than half a percent. Meanwhile, Nifty Realty and Nifty Auto lost 0.8 percent and 0.27 percent. The banking and financial services indices were flat throughout the day.

Welcome to the CNBC-TV18 Market Live blog

Good morning readers! I am Pranati Deva, the market table of CNBC-TV18. Welcome to our market blog, where we provide live news coverage of the latest events in the stock market, business and the economy. We’ll also get instant reactions and guests from our stellar lineup of TV guests and editors, researchers, and internal reporters. If you are an investor, we wish you a great trading day. Good luck!