The market falls from highs when the RBI in its first official estimate expects GDP to contract 9.5% in fiscal year 21

In its first official estimate, the RBI expects fiscal year 21 GDP growth to contract by 9.5%.

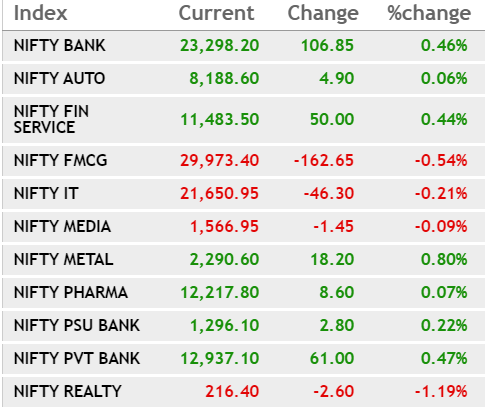

Sectoral trend after the RBI’s political decision

Market update: Sensex and Nifty were trading slightly higher after the RBI kept the buyback rate unchanged. The Sensex rose 95 points to 40,278, while the Nifty climbed 33 points to 11,868.

Vedanta Exclusion: Rs 320 Is Fair Price, Says LIC President

Life Insurance Corporation (LIC) President MR Kumar, in an interview with CNBC-TV18, said that Rs 320 is a fair price for Vedanta’s delisting. LIC has a 6.37 percent stake in Vedanta. Today is the last day of the reverse book construction process in which public shareholders can bid Vedanta shares as the company prepares to be delisted from the Indian stock exchanges. Media reports suggest that the share bidding has been tepid so far. The process of building reverse books for public shareholders to offer their shares began on October 5 and will conclude on October 9.

Opening bell: Sensex opens higher, Nifty above 11,850 ahead of RBI policy decision

Indian indices opened higher on Friday ahead of the RBI’s policy decision to be made later today. Most economists expect a status quo in MPC buyback rates given inflationary pressures. Most of the 10 economists polled by CNBC-TV18 also said that the central bank would have to put a figure on its growth outlook in October policy. Sentiment was also bullish led by a positive trend in its global peers. At 9:18 a.m., the Sensex rose 111 points to 40,294 while the Nifty rose 30 points to 11,864. Hindalco, Tata Steel, Bharti Airtel, ONGC and ICICI Bank were the top winners in the Nifty50 index, while TCS, Tech Mahindra, RIL, IOC and Coal India led the losses. The broader markets were also in the green with the mid-cap and small-cap indices rising 0.3 percent each. Among the sectors, Nifty Metal was the top performer, 1.5 percent, followed by Nifty Pharma, 0.9 percent. Nifty Auto also added 0.8 percent, while Nifty Bank advanced 0.5 percent in early trading. However, Nifty IT and Nifty Realty were in the red.

UTI MF Policy at RBI:

– Don’t expect a rate cut on RBI policy today

– Be attentive to RBI guidance on growth and inflation

– MPC Minutes Plus Imp to understand the thought process of new members

– RBI refuses to act when the market sees some degree of volatility

Here are some more global signals this morning:

No rate cut, but revamped RBI MPC may give fiscal year 21 GDP forecast on Oct 9: CNBC-TV18 survey

The renewed Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) can finally publish a GDP forecast for the fiscal, which the main bank has refrained from giving since the outbreak of the pandemic. Most of the 10 economists polled by CNBC-TV18 said the central bank would have to put a figure on its growth outlook in October policy. “For the year 2020-21 as a whole, real GDP growth is also estimated to be negative,” Governor Shaktikanta Das said during the previous policy announcement on August 6. Fifty percent of those surveyed believe that the RBI will forecast an 8 to 10 percent GDP contraction for fiscal year 21, while 20 percent believe that the central bank may project a more pronounced contraction. More here

China Services Purchasing Managers Index (PMI) for the month of September increases month-over-month

First, here is a quick update on what happened in the markets on Thursday

Indian stocks trimmed some gains but closed higher for a sixth straight session on Thursday as TI shares gained on buyback plans from Tata Consultancy Services (TCS) and Wipro. TCS decided to buy back up to $ 2.2 billion in shares, while its smaller rival, Wipro, said it would also consider the share buyback at the October 13 board meeting. Sentiment also rose after TCS posted better-than-expected earnings for the September quarter. The Sensex finished 304 points higher at 40,183 while the Nifty rose 96 points to 11,834. The Sensex recovered 40,000 for the first time since August 31.

Welcome to the CNBC-TV18 Market Live blog

Good morning readers! I am Pranati Deva, the market table of CNBC-TV18. Welcome to our market blog, where we provide live news coverage of the latest events in the stock market, business and the economy. We’ll also get instant reactions and guests from our stellar lineup of TV guests and editors, researchers, and internal reporters. If you are an investor, we wish you a great trading day. Good luck!