[ad_1]

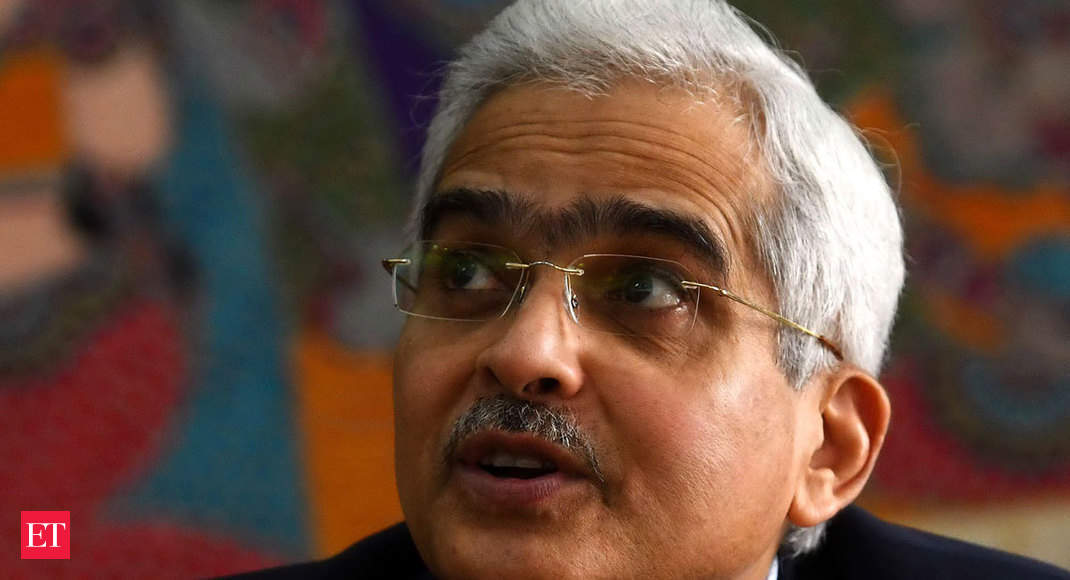

India’s central bank governor Shaktikanta Das underscored the need for fiscal measures to support the economy, saying a slippage in the budget gap target was inevitable amid the coronavirus crisis.

The government is working on an economic package to address the impact of the virus, Das told Cogencis Newswire in an interview the transcript of which was published Monday by the Reserve Bank of India. Meeting the fiscal gap target for the financial year that began April 1 – 3.5% of gross domestic product – was very challenging and expects the government to make a judicious call on deficit management.

“Fiscal measures are important,” said Das, who led the RBI in delivering rate cuts and injecting more than $ 50 billion in liquidity since last month. “Whether it relates to the fiscal deficit or liquidity or any other extraordinary measure, it must be applied on time, and the exit must also be done on time,” he said.

Economic activity in India came to a virtual standstill after Prime Minister Narendra Modi ordered a national shutdown until May 3 to stop the spread of the coronavirus. That is seen pushing Asia’s third-largest economy toward its first year-round contraction since 1980, while the global economy appears to be on its way to its worst recession since the Great Depression.

A protracted slowdown in the economy is likely to hurt tax collection and limit the ability of Finance Minister Nirmala Sitharaman to expand support without resorting to additional loans. She has already outlined a virus relief package of Rs 1.7 lakh crore ($ 22.5 billion) to help the poor through cash grants and free rations of fuel and food.

With more measures planned to rescue the industry, Fitch Solutions believes that the government’s fiscal deficit will rise to 6.2% of GDP in the current year.

Economists, including former central bank officials, have said the RBI would have to directly buy sovereign bonds if the government had to increase spending to combat the coronavirus pandemic. While others have opposed the idea that it would lead to a downgrade and higher borrowing costs, Das seemed to be following a cautious line.

“There is lively public discourse on this topic,” he said. “In the current situation, we have not taken an opinion on it. We will deal with it taking into account operational realities, the need to preserve the strength of the RBI balance sheet and, most importantly, the objective of macroeconomic stability, our mandate In the process, we also evaluated several alternative sources of financing. ”

[ad_2]