Finance Minister Nirmala Sitharaman has sounded bad banks do more for employees who retired earlier so they are not discriminated against in terms of pension. The government has also asked banks to review the family pension scheme so that the spouse’s pension is the same as the government’s.

The family pension plan is likely to be announced on Wednesday when the Indian Banking Association (IBA) unveils the 11th bipartisan salary agreement. This expired from November 2017 and, although the MOU was signed in July, the agreement was slow to materialize. Banks currently have a family pension plan, but it is a truncated version of what is available to other government employees (see chart).

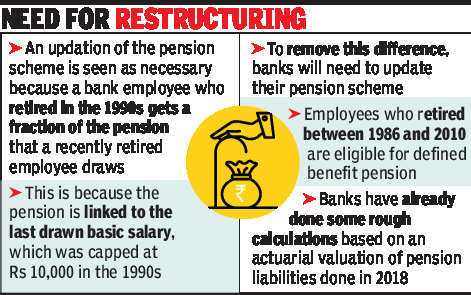

An update of the pension plan is considered necessary because Bank The employee who retired in the 1990s receives a fraction of the pension that a recently retired employee receives. This is because the pension is tied to the last basic salary collected, which was limited to Rs 10,000 in the 1990s. To eliminate this difference, banks will need to update their pension plan. Employees who retired between 1986 and 2010 are eligible for a defined benefit pension. Banks have made some rough calculations based on an actuarial valuation of pension liabilities carried out in 2018.

Although the annual expense is not very high, there will be an initial cost to renew the family pension plan. Banks are obliged to hold funds to cover future pension liabilities and this provision requirement continues to increase as interest rates fall and life expectancy increases without any change in the pension plan. Therefore, an increase in future liabilities could result in a strong one-time increase in provisions.

Sitharaman spoke outside the banks about the need to treat retirees fairly during his interaction with them at the 73rd annual general meeting of the IBA on Tuesday. The annual meeting was attended by heads of banks, including IBA President Rajkiran Rai. Bankers It is understood that they have said that the health of the industry was better than expected. . At the meeting, Sitharaman appreciated the work done by bankers during the Covid pandemic and recognized the role of every banker and business correspondent.

He called on banks to ensure that no Indian is left behind and that all disadvantaged citizens have a bank account linked to Aadhaar where they can receive benefits from the government. The finance minister also urged banks to make digital banking services available to all Indians and urged lenders to issue RuPay cards and try to get all Indians to have one. Addressing the merged banks, Sitharaman said the country needs six to seven large banks the size of the State Bank of India to meet the needs of large borrowers.

At the same time, there was room for small and medium banks and non-bank finance companies and it was the responsibility of lenders to differentiate their products, he said.

.