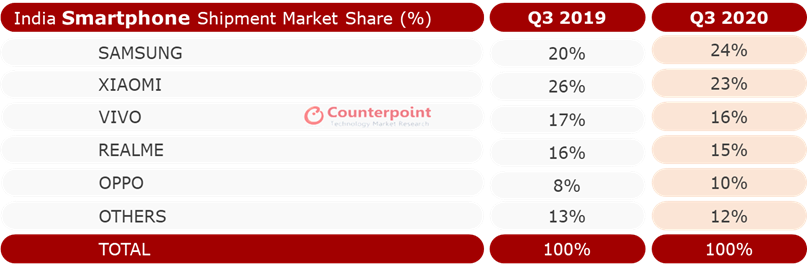

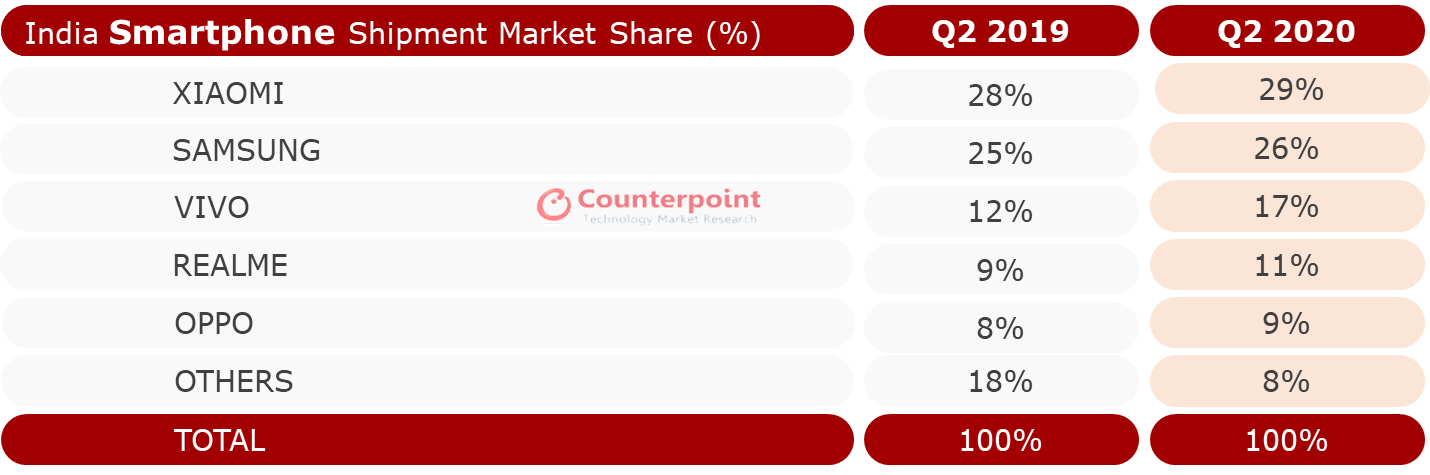

NEW DELHI: Korean phone maker Samsung surpassed China’s Xiaomi to become the leading smartphone company after two years with 32% year-on-year growth in the July-September 2020 quarter, Counterpoint Research said.

NEW DELHI: Korean phone maker Samsung surpassed China’s Xiaomi to become the leading smartphone company after two years with 32% year-on-year growth in the July-September 2020 quarter, Counterpoint Research said.

Samsung’s strong performance was the result of multiple strategies, including effective supply chain and touching various price points through new launches. Samsung’s aggressive push into online channels, with the largest online contribution within its portfolio, also helped it regain its number one spot, the agency said.

Xiaomi fell to the number two position for the first time since the third quarter of 2018 with a year-on-year decline of 4%. Manufacturing constraints due to the COVID-19 situation affected their supply chain, causing a gap between supply and demand.

According to Counterpoint, Apple led the premium segment (Rs 30,000 and up) beating OnePlus even before its flagship launch, driven by strong demand for its 2020 iPhone SE and iPhone 11. Its upcoming flagship iPhone 12 will further strengthen its position in the future. trimester.

Overall smartphone shipments grew 9% year-on-year to reach more than 53 million units in the third quarter of 2020, the highest shipment in a quarter for the Indian smartphone market. Brand momentum coupled with stifled demand due to the lockdown and strong sales on online platforms led to this growth.

“The Indian smartphone market is on the way to recovery as lockdown restrictions have been relaxed. The market has shown steady growth in recent months. It saw strong demand during the Independence Day period in August as the major online platforms hosted massive sales. September has always been a high sales month as brands prepare for the upcoming holiday season and drive stock in channels, ”said senior research analyst Prachir Singh.

In terms of price bands, the mid-tier segment (Rs 10,000 – Rs 20,000) recorded the highest growth and reached its highest share in a quarter. Research analyst Shilpi Jain said that during the beginning of the quarter, there were some anti-China consumer sentiments in the market that affected sales of Chinese origin brands.

“However, these sentiments have diminished as consumers are also considering different parameters during purchase. The brands have been quite aggressive as they started to accumulate inventory long before the holiday season, ”added Jain.

Vivo grew 4% year-on-year and maintained its third position, driven by strong demand for its Y-series models on offline channels.

Realme also grew 4% YoY in the third quarter of 2020, as it was able to manage supply problems with increased production. Oppo ranked fifth and saw its shipments grow 30% year-on-year in the quarter.

.