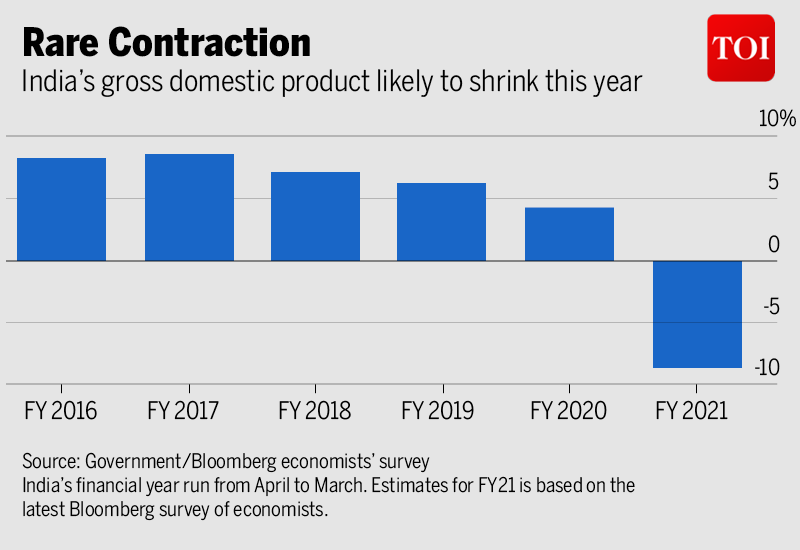

Gross domestic product contracted 8.6% in the quarter ending September, the Reserve Bank of India showed in its first published ‘immediate report’, which is an estimate based on high-frequency data. The economy had plummeted about 24% between April and June.

“India entered a technical recession in the first half of 2020-21 for the first time in its history,” the authors wrote. The government is due to publish official statistics on November 27. The median forecast in a Bloomberg survey of economists foresees a 10.4% contraction in the July-September quarter.

Rare contraction

The Reserve Bank’s figure is bolstered by cost cuts at companies, which boosted operating profit even as sales fell. The team of authors also used a series of indicators, from vehicle sales to bank liquidity, to point out prospects for improvement for October. If this recovery continues, the Indian economy will grow again in the October-December quarter, earlier than was projected by Governor Shaktikanta Das last month, when he promised to maintain accommodative monetary policy.

However, “there is a serious risk of generalization of price pressures, de-anchoring of inflation expectations fueling a loss of credibility in policy interventions,” wrote the team of economists in the Reserve Bank bulletin. They also highlighted the risks to the global growth of a second wave of coronavirus infections.

‘Challenging times’

“Lurking around the corner is the third major risk: stress is intensifying among households and businesses, which has been delayed but not mitigated and could spread to the financial sector,” the economists concluded. “We live in challenging times.”

Consumers cut back on spending as millions lost their jobs and preferred to save cash instead. Preliminary estimates presented in the central bank bulletin showed a jump in household financial savings to 21.4% of GDP in April-June, compared to 7.9% in the same period a year ago and 10% in January March. Most of these savings are bank deposits.

“The trend of higher-than-usual household financial savings may persist for some time until the pandemic recedes and consumption levels normalize,” wrote RBI’s Sanjay Kumar Hansda, Anupam Prakash and Anand Prakash Ekka, adding that this could decrease as the virus curve flattens and reactivates economic activity.

.