Since agriculture is the only sector that is expected to grow during the current fiscal year, the RBI has decided to increase the flow of credit to this segment and those prescribed targets for small and marginal farmers and the weaker sections will be increased from gradually. Banks can now lend up to Rs 5 crore to Agricultural Producer Organizations (FPO) and individual households can borrow up to Rs 10 lakh for renewable energy generation.

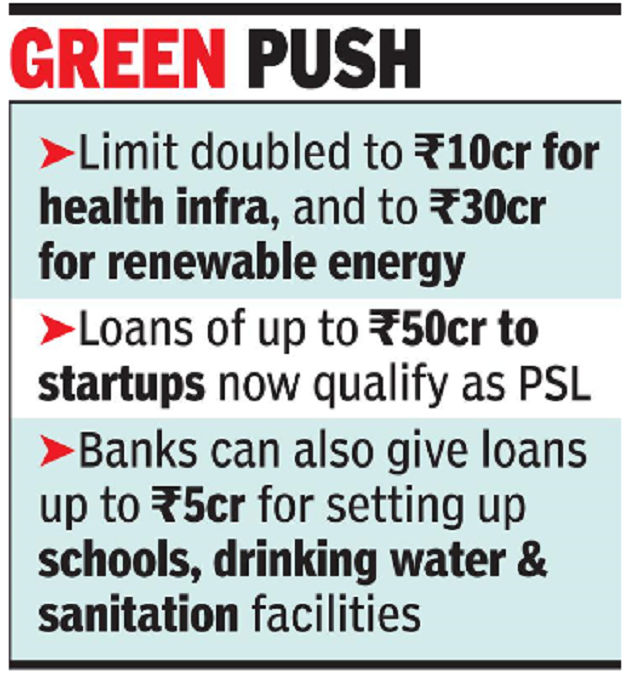

Banks can also make loans of up to Rs 5 million for the installation of schools, drinking water facilities and sanitation facilities. After Covid-19, healthcare, sanitation, and startups have emerged as focus areas and the government is keen to support these sectors. Clean energy is another key area that has received attention in recent years.

“The inclusion of startups in PSL will reduce their cost of capital by allowing them better access to bank credit. In the future, capital injection will not be the only route to take when startups need funding for working capital requirements, and this will greatly alleviate the risk of ordinary shareholders being eliminated due to ‘downstream rounds. ‘ “, said. OSE Chief Economist Soumya Kanti Ghosh. However, to boost lending to new companies, it is also imperative to establish an institutional mechanism, since they do not have a matrix of performance evaluation mechanisms and guarantees, he added. The RBI last revised the PSL standards in 2015.

The new rules will benefit microlenders serving the priority sector defined by the RBI. This is because banks have been allowed to buy those loans or invest in securitized assets, which represent loans to various categories of priority sectors, except for the “other” category, and these will qualify for the priority sector.

“The revision of the guidelines will incentivize the flow of credit to specific segments such as clean energy, weaker sections, health infrastructure and credit deficient geographies. These measures are also aligned with development focus areas according to the existing political environment and will support funding requirements in these specific sectors, ”said Crisil Ratings Senior Director Krishnan Sitaraman.

New categories eligible for funding in the priority sector include loans to farmers for the installation of solar power plants for the solarization of agricultural pumps connected to the grid and loans for the installation of compressed biogas (CBG) plants. According to the RBI, the revised guidelines will correct regional disparities in the flow of credit from the priority sector. This has been done by giving more weight to new loans in “identified districts where the flow of credit from the priority sector is comparatively low.”

Priority sector standards were last revised in 2015 and new segments were included, including midsize companies, social infrastructure, and renewables. In recent years, home loans have dominated priority sector loans, as banks considered them the safest in this category. About 40% of bank loans will be obligatorily made in the priority sector. Lenders who fail to do so are penalized by being forced to invest in underperforming government investments.

.