[ad_1]

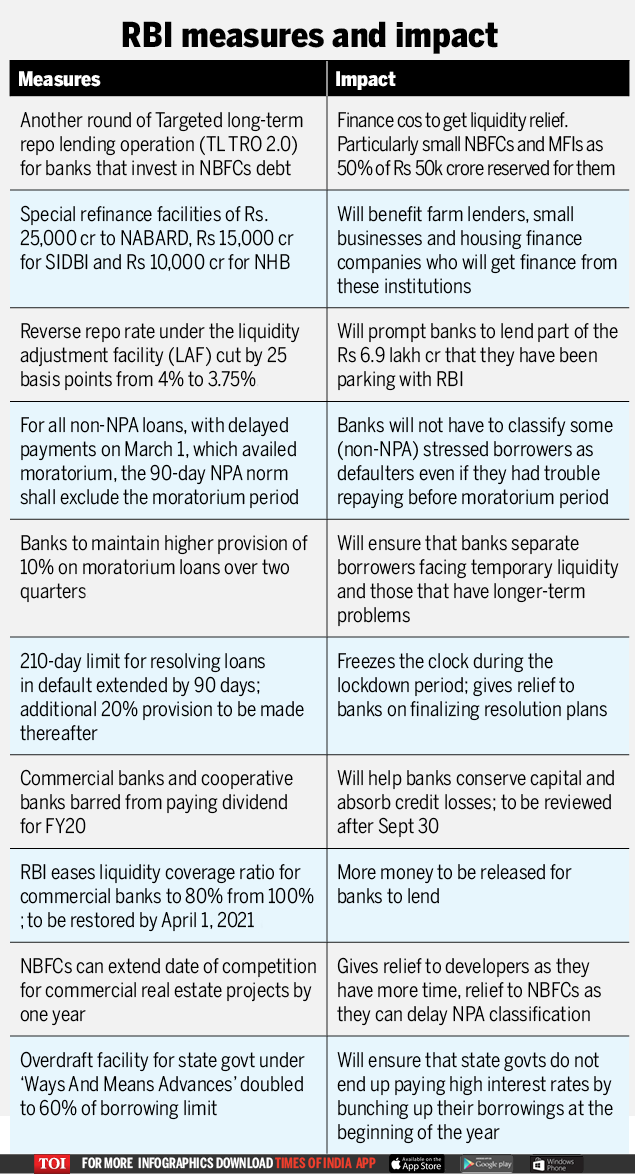

Highlights of the measures on Friday are: a Rs 50 billion refinancing facility to banks for loans to NBFCs through a new long-term loan operation (TLTRO 2), a financing support of Rs 50,000 for refinancing institutions and the reduction of the rates of bank funds stationed with RBI.

RBI Governor Shaktikanta Das noted that previous TLTRO funds were used to invest in bonds issued by public sector entities and large corporations. In addition to Rs 50 billion to finance companies, RBI set aside another Rs 50 billion for agricultural loans, SME loans and home financing.

These lenders will obtain a special refinancing facility to refinance up to Rs 25,000 crore from NABARD, Rs 15,000 crore from SIDBI and Rs 10,000 crore from the National Housing Bank (NHB).

Das acknowledged that banks were avoiding loans by parking close to Rs 6.9 lakh crore with the Reserve Bank of India under its reverse repos program, where banks can park surplus funds. To discourage banks from doing so, RBI has reduced the reverse repo rate by 25 basis points to 4.75% from 4%.

Finance companies said the measures have yet to address the key problem of making banks lend to the top-rated borrowers by noting the Rs 6.9 lakh crores parked with RBI as an example of banks’ risk aversion. While the RBI cannot compel banks to lend, the measures have created the basis for allowing lenders to start lending if the government presents an economic package that will facilitate loans through credit guarantees for small businesses.

In announcing the measures, Das said in India, the mission is to do whatever it takes to prevent the epidemiological curve from escalating further. The governor said that due to the epidemic and measures to contain it, the macroeconomic and financial outlook has deteriorated precipitously in some areas; but the light still shines bravely on some others. He said these were not the latest measures and that the central bank would take more steps as the situation evolved.

According to HDFC Vice President and CEO Keki Mistry, the measures announced by the RBI greatly alleviate the liquidity situation in the markets. He said that while the direction towards the banks asking them to skip the dividend would result in Rs 1 crore of the dividend, the overall impact would be offset in a consolidated balance sheet.