A five-member committee headed by KV Kamath, set up by the RBI to examine the parameters within which restructuring may be allowed, has submitted its recommendation to the central bank and the lenders will come to your meetings once the report is released.

Bankers said that companies that have been lax on repayments before March 2020 will not qualify for restructuring even if they are not assets in default (NPA). Bankers expect that only 2-3% of total bank loans will be eligible for restructuring.

India Ratings has said that 7.7% of bank loans (Rs 8.4 million lakh crore) would need restructuring, of which non-corporate would be only 1.9%. The rating agency also said that loans of more than Rs 5 lakh crore would come into NPA if they are not restructured.

The RBI circular notifying the Covid resolution framework and appointing the expert committee had said that only those borrower accounts, which were classified as standard and not in arrears for more than 30 days with the lender on March 1, 2020 , will be eligible for resolution in this framework.

Bankers said that much of the stress on the banking system has been addressed through the bankruptcy and insolvency code (IBC). Borrowers who were facing stress even before the pandemic have been excluded due to the 30-day maturity clause. Bankers said stressed companies often delay payments and make use of available margin even when avoiding the NPA label.

This means that only those companies that were doing well before the shutdown but are facing problems due to Covid will be entertained. These include hospitality and retail real estate, as the shopping centers have had no revenue during closing. It also includes construction-operation-transfer projects such as highways, where revenues disappeared in the initial months.

Some well-performing power projects were also affected due to the state government’s ability to pay for power on time. Those affected by the global shocks include the gem and jewelry segment and the textile sector, which were affected by the global shocks.

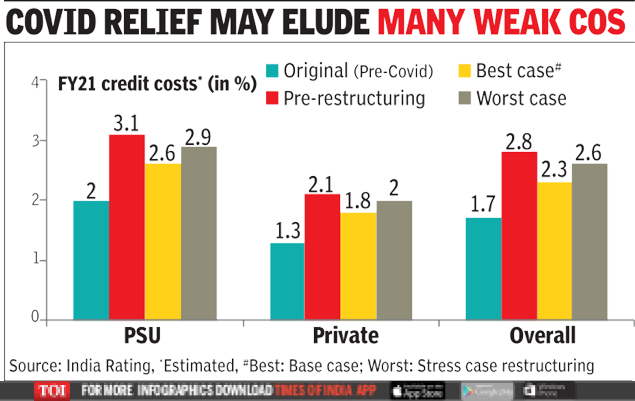

According to India Ratings analysis of companies in 35 sectors, the amount of corporate sector restructuring in fiscal year 21 could range from 3% to 5.8% of bank credit worth 3.3 to 6.3 million rupees.

“Even stressed assets that may not slip in the short term could be restructured as Covid would have compounded the stress. Almost 53% of this group has a high probability of restructuring / slippage. The remaining 47% have a moderate risk of restructuring, and the progress of these accounts will depend on the progress of the Covid situation, ”said the rating agency.

While a high proportion of debt from real estate, airlines, hotels and other consumer discretionary sectors is likely to be restructured, the biggest contribution would be from infrastructure, energy and construction, India Ratings said.

.