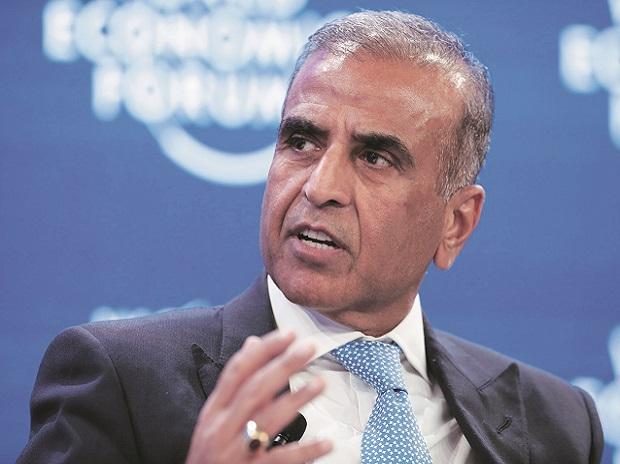

Bharti Airtel Chairman Sunil Mittal believes India will be a major player in cutting-edge 5G technology, but wants prices to be favorable to investors. In a conversation with Commercial standardMittal spoke about the urgent need to increase mobile rates, the industry’s interest in the upcoming 4G spectrum auction, the company’s position on 5G, and the government’s move to ban Chinese equipment providers in telecommunications.

When asked about Airtel’s plans to increase rates, Mittal said: “It will depend on the biggest player.” Today, Reliance Jio, with more than 400 million mobile subscribers, is the largest telecommunications company in the country, having beaten long-time market leader Airtel. Jio’s wireless market share is more than 35 percent versus Airtel’s 28 percent, according to the latest data from the Telecommunications Regulatory Authority of India (Trai).

While asserting that the current low rates in the sector were not sustainable, Mittal said that “someone has to take a call depending on market conditions,” while addressing industry rivals as well as Trai. However, he added that the industry was not considering a major one-time rate increase.

There are signs that Airtel may not take the first step in raising rates, although it was Mittal who took the lead in raising the issue earlier in the year. Mittal had said in August that it was a tragedy that 16GB data came in for 160 rupees a month in India, while arguing that it was time to raise tariffs in an industry that is financially stressed.

Vodafone Idea CEO Ravinder Takkar, in a post-earnings call last month, had said the company would not shy away from taking the first step to increase rates.

According to Takkar, there are strong indications that the competition would follow suit.

Despite the stress in the sector, excessive competition prevented telecommunications companies from raising rates. As for Airtel, it wants the average revenue per user (ARPU) in a month to rise to Rs 200 and then to Rs 300. Airtel’s mobile ARPU is pegged at Rs 162 per month for the September quarter and only an increase of Rates can take the company closer to its goal in an industry that had last increased rates in 2019.

On Airtel’s vision for 5G, Mittal told this newspaper that there was no doubt that India would be a key player once the technology was implemented. “I suppose it will take a couple of years for 5G to reach India in a meaningful way.”

But Mittal raised concerns about the “unreasonably high” 5G reserve price recommended by the regulator. Not only has the industry opposed the reserve price of Rs 492 crore per megahertz for 5G spectrum, but even a task force constituted by the Ministry of Finance suggested in May the rationalization of prices so that next-generation services are affordable for everyone.

“The price of 5G spectrum should be in such a way as to encourage investment in telecommunications networks,” Mittal said. “The price at the current level will serve no one’s purpose.” In fact, the task force had argued that the reserve price of 5G in India was much higher than in most other countries, something the regulator has contested.

At the 4G auction scheduled for the January-March quarter, Mittal said Airtel would participate on a limited basis, to fill the gaps in its network. While Jio is seen as bullish on the 4G auction, Vodafone Idea is expected to stay away for the most part.

In a recent analyst call, Airtel CEO Gopal Vittal had said the company needed to complete the spectrum footprint in the subgigahertz band, which has an advantage in inland areas and deep rural locations. It may also be necessary to add some “capacity spectrum”.

Responding to the Union government considering banning Chinese equipment suppliers in telecommunications services, Mittal said: “We will comply with any decision made by the government in this regard.” He said Airtel has one of the lowest exposures to Chinese suppliers compared to some rivals. “It won’t be a big problem for us,” he said.

The total debt of the top three telcos (Jio, Airtel and Vodafone Idea) was estimated at Rs 3.9 trillion last year. Furthermore, the industry faced quotas linked to adjusted gross income of Rs 1.47 trillion.

Dear reader,

Dear reader,

Business Standard has always strived to provide up-to-date information and comments on developments that are of interest to you and that have broader political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only strengthened our determination and commitment to these ideals. Even during these difficult times arising from Covid-19, we remain committed to keeping you informed and up-to-date with credible news, authoritative opinions, and incisive commentary on relevant current affairs.

However, we have a request.

As we fight the economic impact of the pandemic, we need your support even more so that we can continue to bring you more quality content. Our subscription model has received an encouraging response from many of you, who have subscribed to our content online. Increased subscription to our online content can only help us achieve our goals of bringing you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practice the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital editor

.