[ad_1]

There were several representations received from people who had to extend their stay in the country due to the blockade and suspension of international flights, expressing concern that they will be required to file tax returns as Indian residents.

Coronavirus outbreak – live updates

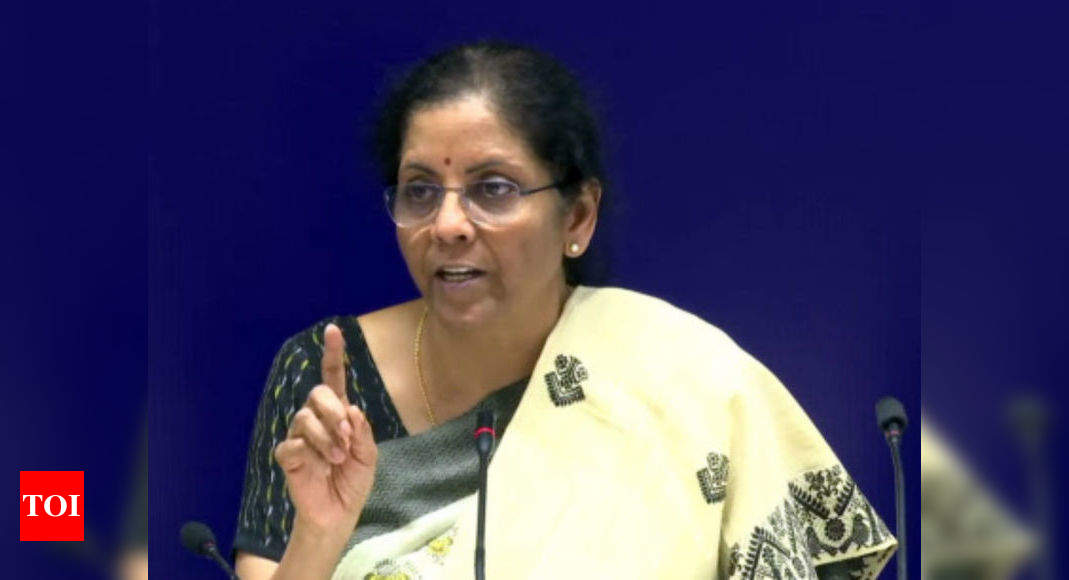

Considering this, the Union Finance Minister Nirmala Sitharaman Friday allowed discounting of the extended stay period in India for the purpose of determining residency status.

More about Covid-19

The finance ministry also said that as the blockade continues during the financial year 2020-21 and it is still unclear when international flight operations will resume, a circular excludes the period of stay of these people until the date of international standardization. Flight operations for residential status determination for financial year 2020-21 will be issued after flight resumes. the Central Board of Direct Taxes (CBDT) issued a circular detailing the relief.

There are a number of people who visited India during the previous year 2019-20 for a specified period of time and intended to leave India before the end of the previous year to maintain their non-resident or habitual non-resident status in the India. India.

.

[ad_2]