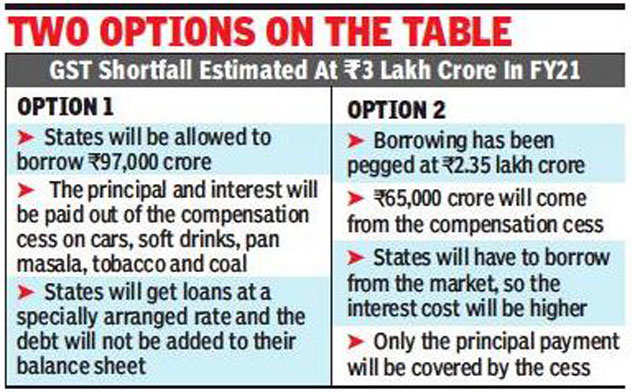

In keeping with the deliberations of the GST Council Meeting earlier this week, the ministry of finance has proposed that states be allowed to borrow Rs 97,000 crore against an estimated deficit of Rs 3 lakh crore between April 2020 and January 2021. The shortfall is due to problems related to implementation.

Under this option, the entire principal and interest will be paid out of the compensation fee for automobiles, soft drinks, masala bread, tobacco and charcoal, which will extend beyond the current deadline of June 2022. States that opt for this will obtain loans at a specially set rate and the debt will not be added to their balance, giving them room to borrow more in the years to come.

Under the second option, where the total loan has been set at Rs 2.35 lakh crore (with Rs 65,000 crore flowing from the tax this year), states will have to borrow from the market, which means that the cost will be higher. More importantly, those who choose this route will have to bear the entire interest burden, since only the principal payment will be covered by the tax and they will leave the debt margin.

“Neither state should have a problem, we are honoring the commitment made by former Finance Minister Arun Jaitley. The first option will allow states to obtain the benefits of cess when the loan is repaid ”, a Union government official he told TOI.

Some of the states governed by the BJP indicated their willingness to support the first option. “We are studying the proposal, but prima facie the first option is beneficial for the states. We must also bear in mind that not only state finances have been affected by Covid-19, even the Center has to endure stress. There are also other requirements, such as higher defense spending ”. Bihar Chief Deputy Minister Sushil Modi said by phone from Patna.

The opposition-run states want the Center to take over the debt burden, arguing that they have much less leeway to borrow or service it. In addition, they argue that the Center can raise funds at a cheaper rate.

“I am not in favor of states having to borrow. The Center is lobbying states to apply for loans. We will get a call on Monday, ”Chattisgarh Minister TS Singh Deo, who represents the state on the GST Council, told TOI.

Given the differences, the issue is expected to return to the GST Council soon for a final decision.

“The position of the central government is that any compensation to the states will only come through a compensation cut unless the GST Council decides otherwise. However, if the states opt for the Rs 2.35 lakh crore option, only the principal will come out of the compensation payment. Given this, states may decide the option depending on their situation and income projection. It is not clear what the GST Board will decide if a few states opt for Option 1 and others for Option 2, ”said Pratik Jain, who leads the indirect tax practice at consulting firm PwC.

On video: Rs 3-lakh-crore deficit in GST: Panel considers loans to compensate states

.