Stimulus spending will not decline quickly, he said in an interview. The government and the central bank together have struck a good balancing act, he added.

“At the moment, I am not going to let the fiscal deficit number worry me because there is a need, and a clear need, for me to spend the money,” Sitharaman said.

Sitharaman, who reviews government spending every 15 days, said he will pressure state companies to speed up spending. Prime Minister Narendra Modi last month extended support measures to Rs 30 lakh crore ($ 120 billion), or 15% of the economy, to rescue businesses and save jobs lost due to the coronavirus pandemic, which adds to the global stimulus that has touched $ 12 billion.

Economists see the additional spending, coupled with falling tax revenue, causing India’s budget gap to widen to 8% of gross domestic product in the current financial year, more than double the expected 3.5%. .

Stocks and the rupee rose on the minister’s comments, while sovereign bonds were stable. The BSE sensex added to the initial gains, while the currency strengthened 0.1% against the dollar.

“Regarding next year, we need to do an evaluation,” he said before the budget for the next fiscal year that is due on February 1. “I’m not sure I can cut costs right away. It will have to be a careful balance because the momentum the economy is gaining must be sustained. ”

India’s economic support package consists mainly of corporate loan guarantees, and the actual fiscal cost to the government is seen as much lower, according to economists, including Kanika Pasricha of Standard Chartered Plc, who sees the overall fiscal impact around 1.3% of GDP.

India also raised its borrowing target for the year through March to a record 13.1 crore lakh. S&P Global Ratings and Fitch Ratings previously said that their assessment of India’s sovereign score has not been altered by additional borrowing from the economy.

“Government spending is important to getting the economy on track and, globally, countries are following this path,” said Deven Choksey, strategist at KRChoksey Investment Managers Pvt in Mumbai. “Markets are likely to remain full of liquidity and we can worry about the shortfall later on.”

Countries that turned to stimulus spending of up to 20% of their GDP are now turning to additional taxes, Sitharaman said, adding that the Modi government’s measures were working well for India and helping fuel a recovery in the economy. which is currently in a recession.

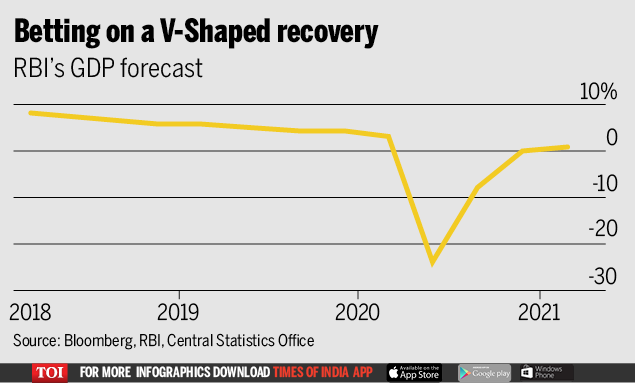

India’s GDP contracted 7.5% less than expected in the three months ending in September, a marked improvement from the record contraction of 24% in the June quarter. A host of high-frequency indicators also suggest a gradual recovery in activity in the manufacturing and service sectors, the key engines of the economy, which is now in recession.

That prompted the Reserve Bank of India this month to revise its annual outlook for the economy to a milder contraction of 7.5% compared to a 9.5% drop seen in October. The RBI, for its part, has cut interest rates by 115 basis points so far this year, in addition to injecting billions in liquidity and ensuring financial stability.

Both the International Monetary Fund and “the central bank have clearly seen that a good recovery is taking place,” Sitharaman said. “A good sustained positive recovery is what I see from the beginning of the next fiscal year.”

Here are other key comments from Sitharaman:

* Rural India and smaller cities will lead demand recovery

* Fiscal measures will always be insufficient, given the severity of the pandemic

* The government will ensure that state-owned companies continue capital expenditures

* Problems facing migrant workers during the peak of the pandemic “somewhat resolved”

.