Mukesh Ambani spent much of 2020 convincing Facebook Inc., Google, and a handful of Wall Street heavyweights to buy into his vision for one of the world’s most ambitious corporate transformations. Now filled with $ 27 billion in fresh capital, Asia’s richest man is under pressure to deliver.

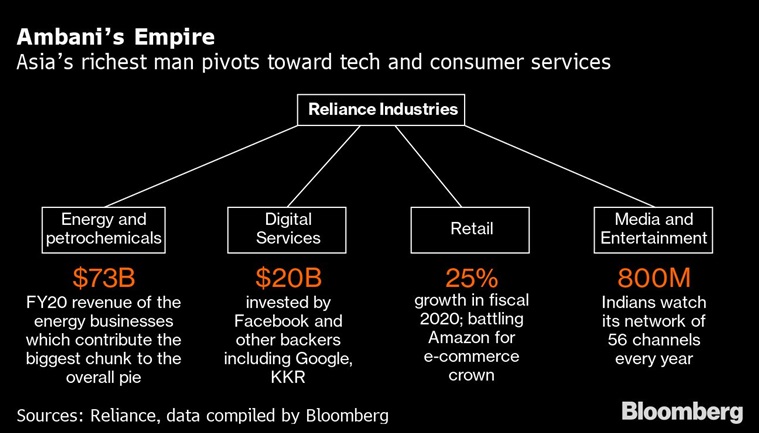

The 63-year-old Indian mogul is focused on a handful of priorities as he tries to turn Reliance Industries Ltd. from an old economy conglomerate into a tech and e-commerce titan, according to recent public statements and people familiar with the company. plans.

These include product development for the anticipated launch next year of a local 5G network; incorporate Facebook’s WhatsApp payment service on Reliance’s digital platform; and integrate the company’s e-commerce offerings with a network of familiar physical stores across the country. Ambani is also moving forward with plans to sell a stake in Reliance’s oil and petrochemical units, a deal that he originally hoped would reduce debt and finance its high-tech pivot earlier this year.

Every move

Investors are watching Ambani’s every move as he reforms his $ 179 billion market value empire amid a pandemic, venturing into highly competitive industries and taking on rivals from Amazon.com Inc. to Walmart Inc.

Shares in Reliance rose as much as 55% this year to an all-time high in September, but have since slashed earnings as stakeholders seek more evidence Ambani can execute.

“The jury is out,” said Nandan Nilekani, who co-founded Infosys Ltd. in 1981 and now serves as president of the Bangalore-based software service provider valued at approximately $ 72 billion. “There is much work to be done”.

A spokesperson for Mumbai-based Reliance Industries declined to comment for this story.

Source: Bloomberg

Source: Bloomberg

While Ambani has publicly accepted his new partnerships with investors, including Facebook (he and Mark Zuckerberg exchanged compliments during a live-streamed conversation on December 15), the Indian mogul’s fundraising spree was initially intended to be more of a Plan. B. His original goal was to sell a 20% stake in Reliance’s oil and petrochemicals division to Saudi Arabian Oil Co., with an enterprise value of $ 75 billion, implying a $ 15 billion valuation for the stake.

The Aramco deal, first announced in August 2019, was supposed to help Ambani deliver on his promise to shed his company’s $ 22 billion in net debt in 18 months. But as talks with the Saudis stalled, Reliance investors became more anxious. The shares fell more than 40% in the three months to March 23.

Hit a wall

Ambani, who had started exploring the sales of stakes in its digital services and retail units months earlier, decided to accelerate those talks after the Aramco deal hit a wall, people familiar with the matter said.

Investor response exceeded the company’s expectations, one of the people said, with big-name backers such as KKR & Co., Silver Lake and Mubadala Investment Co. committing more than $ 20 billion to the digital business and $ 6.4 billion to retail. Trust was declared net debt free in June, nine months before its self-imposed deadline, and Reliance’s stock rose.

At Reliance’s annual shareholders meeting in July, Ambani and his older sons, Isha and Akash, outlined the scope of their high-tech ambitions. Among the new services they promoted was a 5G wireless network starting next year and a video streaming platform that will bring together Netflix, Disney + Hotstar, Amazon Prime Video, and dozens of TV channels under one umbrella.

Reliance’s digital unit, Jio Platforms Ltd., will also develop a portfolio of technology solutions and applications for millions of micro, small and medium-sized companies in India, Ambani said, adding that it plans to eventually expand the platform overseas.

“The time has come for a truly global digital products and services company to emerge in India,” Ambani told shareholders.

The company’s highest priority for 2021 is 5G, people familiar with the matter said. While regulators have yet to auction the rights to India’s next-generation radio waves, Ambani said this month that his company “will pioneer the 5G revolution in India in the second half of 2021.”

$ 54 smartphone

Reliance plans to showcase its 5G product line at next year’s shareholders meeting, which usually takes place between July and September, one of the people said. The company is also working with Google on a $ 54 Android-based smartphone, part of the strategy to get more Indians to use mobile data for services including video streaming, online gaming and shopping.

Reliance sees integration with WhatsApp’s recently approved payment system as a crucial step in the development of its online shopping services, the people said. The companies are working together as Reliance’s e-commerce platforms seek to tap into hundreds of millions of Facebook, WhatsApp and Instagram users.

Ambani’s biggest challenge now is getting a return on these investments, said James Crabtree, author of “The Billionaire Raj: A Journey Through India’s New Gilded Age.”

The industries Ambani targets are constantly evolving, far more so than the refining and petrochemical businesses that still make up the majority of Reliance’s revenue. “He has to get it right over and over again,” Crabtree said.

‘Key man’ risk

There is also the challenge of the “point man” risk. Ambani, the face of Reliance, is not getting any younger. While the company has not publicly disclosed a succession plan, India’s Mint newspaper reported in August that Ambani, whose net worth is about $ 77 billion, is establishing a family council and aims to complete succession planning. by the end of next year.

“Any large single-pillar building has significant inherent risks,” said Kavil Ramachandran, executive director of the Thomas Schmidheiny Center for Family Business at the Indian Business School.

Ambani’s supporters point to his recent history of disruption. Four years ago, it revolutionized the Indian telecommunications industry by offering free calls and cheap data, leading to bankruptcy for some rivals. Its wireless service provider, Reliance Jio Infocomm Ltd., now has more than 400 million subscribers.

“Mukesh has been a big part of this wave of innovation,” said Sundar Pichai, CEO of Alphabet Inc., which owns Google. “His vision and approach to a future where all Indians can benefit from the opportunities that technology creates is really exciting for us and we are excited to be partners in that work.”

Counter China

Ambani has also positioned his empire as a potential asset for an Indian government seeking ways to counter China’s rising technological power, especially after deadly border clashes between rivals long ago this year. Ambani has repeatedly highlighted how Reliance’s goals align with those of Prime Minister Narendra Modi’s government, which has called for local solutions to bridge the country’s huge digital divide.

While Infosys’ Nilekani cautions that it is too early to declare Reliance’s transformation a success, he is optimistic that Ambani will see it through.

“He has a great eye for execution,” said Nilekani. “He looks at the big picture and at the same time goes into every little detail, just like Jeff Bezos. Both are unique. Neither is known to give up. “

.