The investigation announced Thursday marks the formal beginning of the Communist Party’s crackdown on the jewel in the crown of Ma’s sprawling domain, which spans from e-commerce to logistics to social media. The pressure on Ma is central to a broader effort to control an increasingly influential sphere of the internet: Draft antitrust rules released in November gave the government unusually wide latitude to control businessmen like Ma, who until recently they enjoyed unusual freedom to expand their kingdoms.

Once hailed as drivers of economic prosperity and symbols of the country’s technological prowess, Alibaba and rivals like Tencent Holdings Ltd are facing increasing pressure from regulators after amassing hundreds of millions of users and gaining influence in almost every aspect of daily life in China.

“It is clearly an escalation of coordinated efforts to control Jack Ma’s empire, symbolizing China’s new ‘too big to fail’ entities,” said Dong Ximiao, a researcher at the Zhongguancun Internet Finance Institute. “The Chinese authorities want to see a smaller, less dominant and more compliant company.”

The State Administration for Market Regulation is investigating Alibaba, the main antitrust watchdog said in a statement without further details. Regulators, including the central bank and banking watchdog, will separately convene affiliate Ant for a meeting aimed at pushing for increasingly stringent financial regulations, which now pose a threat to the growth of the online financial services company. biggest in the world. Ant said in a statement on his official WeChat account that he will study and meet all the requirements.

Ma, the flamboyant co-founder of Alibaba and Ant, has all but disappeared from public view since Ant’s initial public offering derailed last month. In early December, the government advised the man most identified with the meteoric rise of China Inc to stay in the country, a person familiar with the matter said.

Mom is not on the brink of a personal downfall, those familiar with the situation have said. His public rebuke is instead a warning that Beijing has lost patience with the enormous power of its tech moguls, increasingly perceived as a threat to the political and financial stability that President Xi Jinping values most.

Alibaba slipped as much as 8.9% in Hong Kong to a five-month intraday low on Thursday. Asia’s largest corporation after Tencent has led losses among China’s internet sector leaders since Ant’s IPO was withdrawn in November, bringing the overall toll to more than $ 100 billion. Tencent fell more than 2% and internet services giant Meituan fell more than 4%, while SoftBank Group Corp, Alibaba’s largest shareholder, sank as much as 2.9% in Tokyo. Alibaba said in a statement that it will cooperate with regulators in their investigation and that its operations remain normal.

Investors remain divided over the extent to which Beijing will go after Alibaba and its compatriots as Beijing prepares to implement the new antitrust regulations. The country’s leaders have said little about how harshly they plan to take drastic action or why they decided to act now.

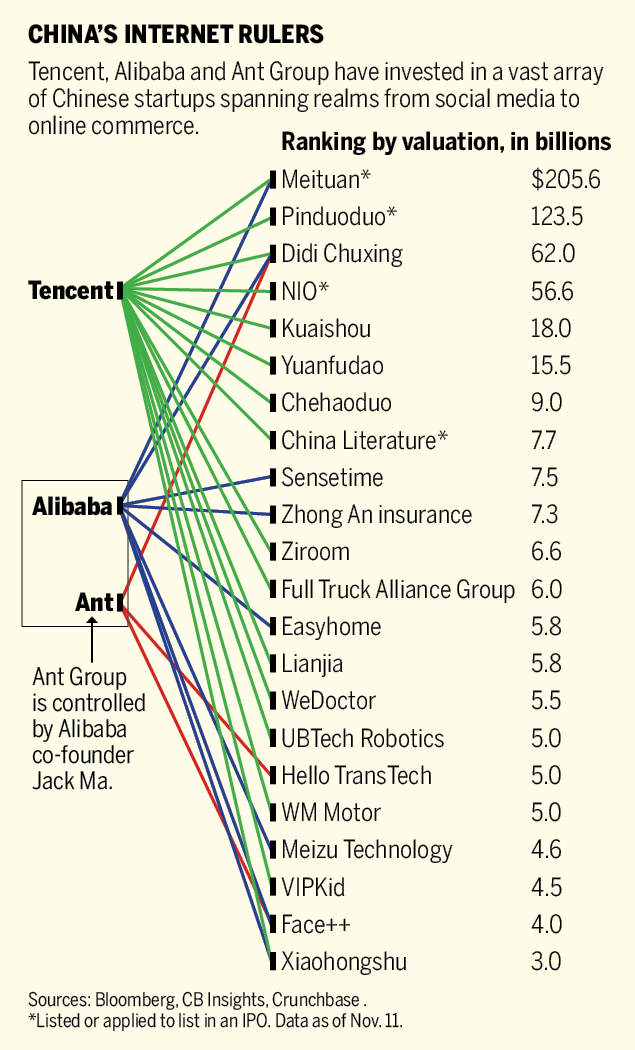

The country’s Internet ecosystem, long protected from competition by companies like Google and Facebook, is dominated by two companies, Alibaba and Tencent, through a labyrinthine investment network that encompasses the vast majority of the country’s startups. in fields from artificial intelligence to digital. Finance. His sponsorship has also groomed a new generation of titans, including travel and food giant Meituan and Didi Chuxing, China’s Uber. Those who thrive outside of his aura, the biggest is the owner of TikTok. ByteDance Ltd, They are rare.

Antitrust rules now threaten to upset that status quo with a variety of possible outcomes, from a benign scenario of fines to the dissolution of industry leaders. The various agencies in Beijing appear to be coordinating their efforts, a bad sign for the Internet sector.

“There is nothing that the Communist Party of China does not control and anything that appears to be spinning out of its orbit will somehow be withdrawn very quickly,” said Alex Capri, a Singapore-based researcher at the Hinrich Foundation.

The campaign against Alibaba and its peers accelerated in November, after Ma attacked Chinese regulators in a public speech for delaying times. Market supervisors subsequently suspended Ant’s IPO, the world’s largest at $ 35 billion, while the antitrust watchdog sent markets plummeting soon after with its bill.

The People’s Daily, a spokesman for the Communist Party, warned on Thursday that fighting alleged monopolies was now a top priority. “Antitrust has become a pressing issue that concerns all matters,” he said in a comment that coincided with the announcement of the investigation. The “wild growth” in the markets must be stopped by law, he added.

The chances that Ant can revive its massive stock listing next year look increasingly slim as China revises the rules governing the fintech industry, which in recent years has exploded as an alternative to financial technology. traditional state-backed loans.

China is said to have separately established a joint task force to oversee Ant, led by the Financial Stability and Development Committee, a regulator of the financial system, along with various departments of the central bank and other regulators. The group is in regular contact with Ant to collect data and other materials, studying its restructuring and drafting other rules for the fintech industry.

“China has simplified much of the bureaucracy, so it is now easier for the different regulatory bodies to work together,” said Mark Tanner, managing director of Shanghai-based consultancy China Skinny. “Of all the regulatory hurdles, this is by far the biggest.”

.