[ad_1]

India is considering a proposal to guarantee up to Rs 3 trillion ($ 39 billion) of loans to small businesses as part of a plan to restart Asia’s third-largest economy, which is teetering under the impact of a 40-day blockade. , people with knowledge of the said matter.

Under the proposal, small businesses will be eligible to borrow an additional 20% of their credit limit, the people said, asking not to be identified as the discussions are private. The additional debt will be fully backed by Prime Minister Narendra Modi’s administration, the people said. The government will establish a special fund to pay for any default, they said.

India’s government and regulators are slowly rolling out programs as everyone from companies to fund managers struggles under the world’s largest blockade, which halted manufacturing and cut consumption. With the economy poised to contract for the first time in four decades, Modi’s backing is the only way to make it attractive to banks, who are concerned about rising delinquencies, to lend to small businesses.

Bloomberg

“A large part of the tax package in developed countries, such as the United States and the United Kingdom, has involved loan guarantees,” said Teresa John, economist at Nirmal Bang Pvt. “If you set targets for banks and banks in the shadow to resort to refinancing under such a scheme, together with credit guarantees, this will, to some extent, guarantee the flow of credit to MSMEs and ultimately help revive growth, “he said, referring to micro, small and medium enterprises.

A spokesman for the finance ministry was not immediately available for comment.

Earlier on Monday, the country’s central bank offered a Rs 500 billion line of credit to mutual funds to prevent the urgent sale of assets and allay investor concerns after Franklin Templeton closed six of them last week. for lack of liquidity.

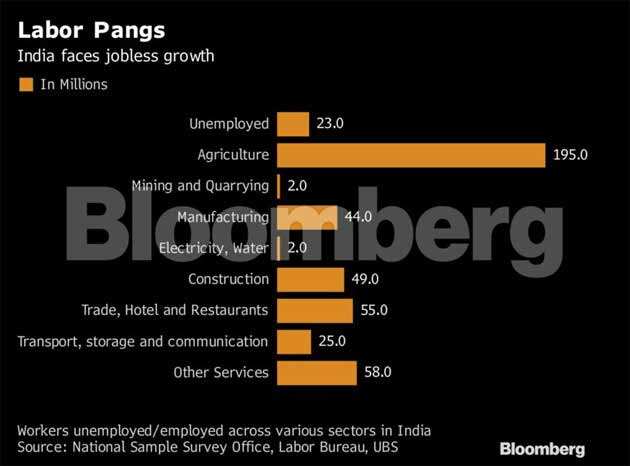

Small businesses, which form the basis of the $ 2.7 trillion economy, have been hit hardest by the blockade with their activity halted. An estimated 100 million workers in the mining, construction, manufacturing and service sectors have been laid off due to the closure, Subhash Chandra Gar, a former top bureaucrat in the finance ministry, wrote in a blog post.

Governments around the world are rushing to help small businesses. Earlier this month, the United States said it would provide $ 320 billion to make new loans under the Paycheck Protection Program, which provides forgivable loans to those companies that keep employees on the payroll for eight weeks, while The Philippines plans to give 35 billion pesos ($ 690 million) to closed small business workers.

[ad_2]