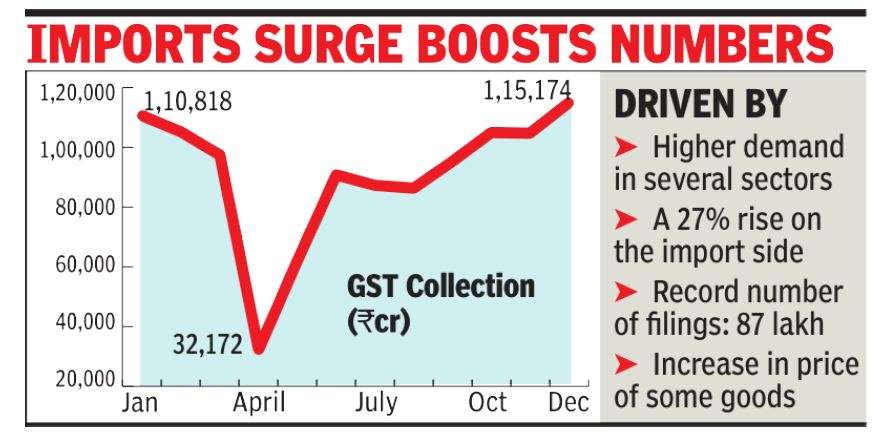

The latest released data showed that collections in December, which were for November sales and transactions, were higher than the previous high of Rs 1.13 lakh crore, recorded in April 2019. It also marks three consecutive months of collections of more than Rs 1 lakh crore. “This is the highest growth in monthly income in the last 21 months. This has been due to a combined effect of the rapid economic recovery after the pandemic and the national campaign against GST evaders,” the Finance Ministry said.

What seems to have helped was the record monthly filing of returns, estimated at 87 lakh, which was 7% higher than in December 2019. The government’s decision to closely monitor tax credits and crackdown on fraudulent transactions has helped.

Although sectors such as automobiles, household appliances, electronics and consumer goods have seen a strong rebound in demand, there are several sectors, such as hospitality and tourism, that have not yet returned to normal. Additionally, collections in December were boosted by a 27% increase in collections from imports, according to data previously released by the commerce department.

“The strong growth of GST collections, even after the holiday season ends, is a clear sign that companies are leaving the specter of COVID behind now … A significant increase in GST in imports could indicate a resurgence in demand for high-end products like cell phones and electronics.

In addition to the economic revival, the reason for this growth could be the tightening of compliance with measures such as electronic invoicing and increased investigations to catch tax evaders, despite the fact that the GST audits for 2017-18 and 2018-19 haven’t started in a big way yet. ”Said Pratik Jain, who leads the indirect tax practice at PwC India consultancy.

.